- United States

- /

- Hospitality

- /

- NYSE:MGM

Did Rebranding NoMad Las Vegas Into The Reserve Just Shift MGM Resorts International's (MGM) Investment Narrative?

Reviewed by Sasha Jovanovic

- MGM Resorts International has already rebranded NoMad Las Vegas as The Reserve at Park MGM and plans to integrate the property into Marriott Bonvoy’s Autograph Collection in early 2026, expanding its presence within a major global hotel loyalty ecosystem.

- This move deepens MGM’s collaboration with Marriott International and may enhance customer acquisition by linking a boutique-style Las Vegas experience to a broad base of high-frequency travelers.

- Next, we’ll explore how integrating The Reserve at Park MGM into Marriott Bonvoy could influence MGM’s broader investment narrative and growth priorities.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

MGM Resorts International Investment Narrative Recap

To own MGM Resorts International, you need to believe in its ability to convert large, capital-intensive resorts and growing digital gaming operations into consistent cash generation while managing debt and cost pressures. The Reserve at Park MGM rebrand and Marriott Bonvoy integration look directionally supportive of the near term focus on improving Strip monetization, while the biggest current risk remains weaker Las Vegas visitation and pricing power, which could limit the payoff from these upgrades.

The most relevant recent announcement here is MGM’s decision to roll NoMad Las Vegas into The Reserve at Park MGM and connect it to Marriott Bonvoy’s Autograph Collection by early 2026. This fits with the broader catalyst of using branded, higher end room product and global loyalty partnerships to support RevPAR and non gaming spend, even as the company is adjusting Strip pricing after customer pushback on high fees.

Yet while these branding moves may help, investors should also be aware of the risk that persistent softness in Las Vegas visitation could...

Read the full narrative on MGM Resorts International (it's free!)

MGM Resorts International's narrative projects $18.4 billion revenue and $906.1 million earnings by 2028. This requires 2.3% yearly revenue growth and a $369.7 million earnings increase from $536.4 million.

Uncover how MGM Resorts International's forecasts yield a $42.50 fair value, a 20% upside to its current price.

Exploring Other Perspectives

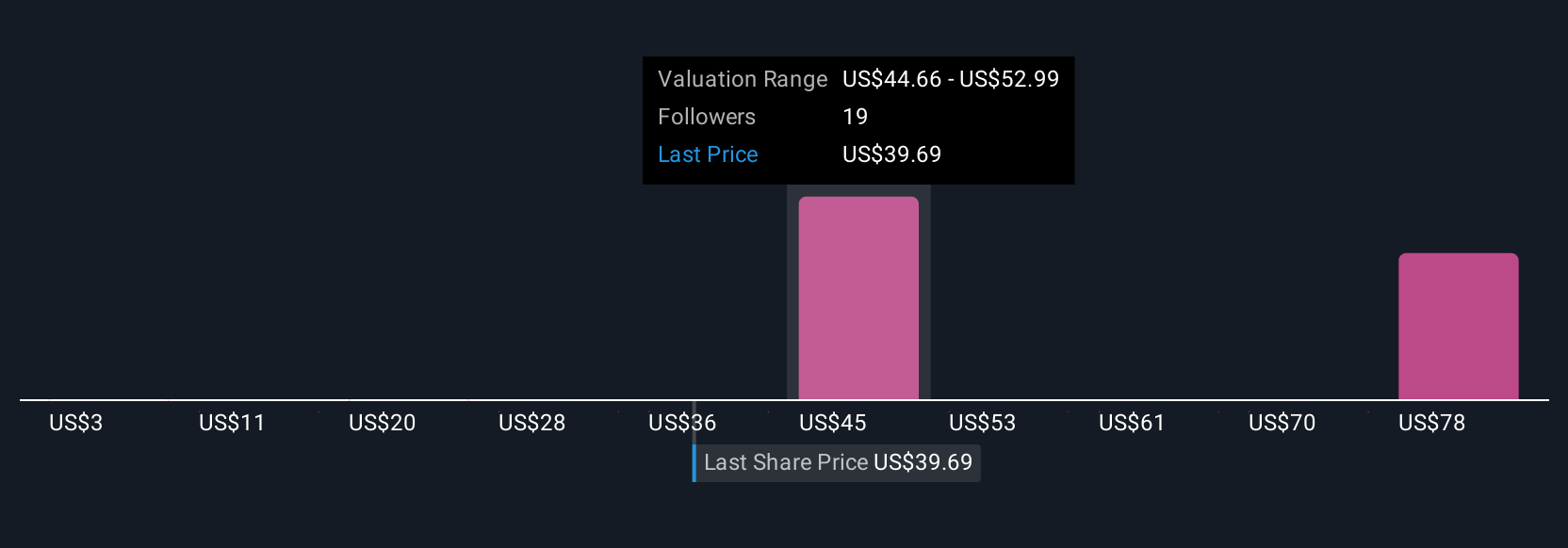

Seven members of the Simply Wall St Community currently estimate MGM’s fair value between US$26.92 and US$86.31, reflecting very different expectations for the stock. Against that wide range, the key risk of structurally weaker brick and mortar demand on the Las Vegas Strip could heavily influence which of these views ends up closer to reality, so it is worth comparing several perspectives before forming your own.

Explore 7 other fair value estimates on MGM Resorts International - why the stock might be worth over 2x more than the current price!

Build Your Own MGM Resorts International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MGM Resorts International research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free MGM Resorts International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MGM Resorts International's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MGM

MGM Resorts International

Through its subsidiaries, operates as a gaming and entertainment company in the United States, China, and internationally.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026