- United States

- /

- Hospitality

- /

- NYSE:MCD

McDonald's (NYSE:MCD) Growth Remains Suppressed by Debt and Profit Margin Concerns

After a promising start to the quarter, when the stock surged over 6%, McDonald's Corporation NYSE:MCD )is back to the starting line.

Regardless of an earnings beat, few issues hinder the market's optimism. Today we will examine those, as well as the company's rising debt-to-equity ratio.

McDonald's does use debt in its business.But the real question is whether this debt is making the company risky.

A Pullback After an Earnings Beat

Despite an earnings beat , McDonald's stock has been falling for 4 consecutive sessions. The company quoted supply chain issues and wage inflation as the deciding factors for Q3 2021.

- U.S same-store sales increased 25.9% in the quarter

- Global comparable sales increased 6.9% on a 2-year basis (beating the pre-pandemic levels)

- International Operated Markets segment increased 2.6% on a 2-year basis

- Consolidated revenues at US$ 5.88b

The market reaction doesn't come as a surprise since the restaurant industry is rather margin-sensitive. A potential federal minimum wage hike to US$ 15 would undoubtedly make a huge impact , changing the sector that heavily relies on cheap labor.

The current federal minimum wage is US$7.25, and it has not been raised in over 10 years. Some competitors like Chipotle have already adjusted , increasing the wage to an average of US$15 per hour.

Meanwhile, McDonald's remains oriented toward marketing, partnering up with a K-pop band BTS to launch the BTS Meal , their first global celebrity collaboration.

Elevated Debt Remains a Concern

Debt assists a business until it has trouble paying it off, either with new capital or with free cash flow.Part and parcel of capitalism is the process of "creative destruction" where their bankers mercilessly liquidate failed businesses.However, a more common (but still painful) scenario is raising new equity capital at a low price, thus permanently diluting shareholders.Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return.When considering how much debt a business uses, the first thing to do is to look at its cash and debt together.

View our latest analysis for McDonald's

What Is McDonald's Net Debt?

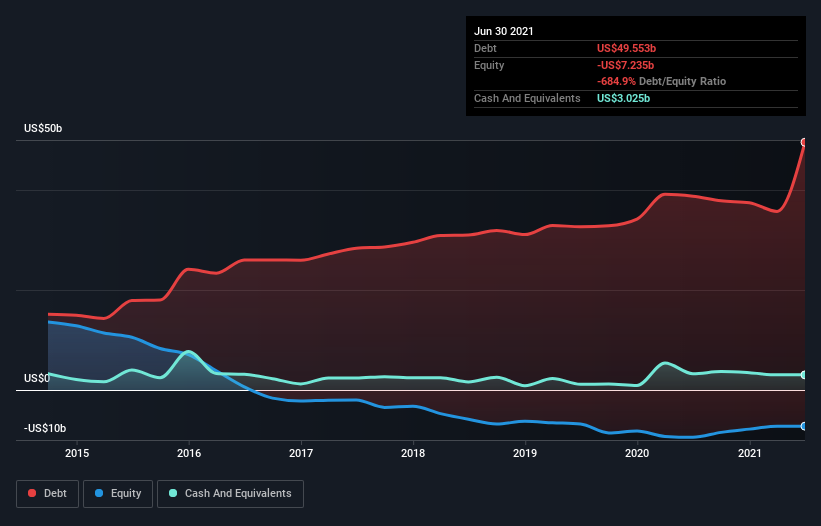

As you can see below, McDonald's had US$35.7b of debt in March 2021, down from US$38.8b a year prior. However, it does have US$3.03b in cash, offsetting this, leading to net debt of about US$32.7b.

The debt-to-equity ratio at 0.68 is above average from the industry average of 0.56.

How Healthy Is McDonald's' Balance Sheet?

In the latest balance sheet data, we can see that McDonald's had liabilities of US$4.58b due within 12 months and liabilities of US$53.8b due beyond that. Offsetting this, it had US$3.03b in cash and US$1.73b in receivables that were due within 12 months.So its liabilities outweigh the sum of its cash and (near-term) receivables by US$53.6b.

While this might seem like a lot, it is not so bad since McDonald's has a huge market capitalization of US$175.2b, and so it could probably strengthen its balance sheet by raising capital if it needed to.However, it is still worthwhile taking a close look at its ability to pay off debt.

To size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover).The advantage of this approach is that we consider both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

With a net debt to EBITDA of 2.9, McDonald's has a fairly noticeable amount of debt.But the high-interest coverage of 7.9 suggests it can efficiently service that debt.It is well worth noting McDonald's EBIT gaining 30% in the last twelve months. The company quoted 70% of McDonald's U.S dining space reopening as the key to this success; however, Delta variant and new potential quarantine remain a looming threat.

While the balance sheet is the area to focus on when you are analyzing debt, ultimately, the business's future profitability will decide if McDonald's can strengthen it over time. So if you're focused on the future, you can check out this free report showing analyst profit forecasts .

Although accounting profits may look good, lenders only accept cold hard cash.So we need to look at whether that EBIT is leading to corresponding free cash flow.During the last three years, McDonald's produced sturdy free cash flow equating to 55% of its EBIT, about what we'd expect.This free cash flow puts the company in a good position to pay down debt when appropriate.

Our View

McDonald's EBIT growth rate suggests it can handle its debt.But truth be told, we feel its net debt to EBITDA does undermine this impression a bit.Looking at all the factors mentioned above together, it strikes us that McDonald's can handle its debt comfortably.On the plus side, this leverage can boost shareholder returns, but the potential downside is more risk of loss, so it's worth monitoring the balance sheet.The balance sheet is the area to focus on when you are analyzing debt.But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that McDonald's shows 2 warning signs in our investment analysis , and 1 of those is a bit unpleasant.

If, after all that, you're more interested in a fast-growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:MCD

McDonald's

Owns, operates, and franchises restaurants under the McDonald’s brand in the United States and internationally.

Established dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives