Even after the solid earnings results,McDonald's(NYSE:MCD) stock remained somewhat flat. While the company did well, supply chain issues and wage inflation remain a concern.

Today, we will examine the company’s return on capital (ROCE) and a scenario on mitigating inflationary pressures.

Today, New York City starts imposing a vaccination requirement on restaurants, fitness clubs, and performances held indoors. After a short grace period, enforcement will begin on September 13. Although this is the first major city in the US to implement such a policy, this approach is gaining traction and putting an additional strain on the restaurant industry.

Restaurants currently have one of the highest unemployment rates at 8.4% for July. Many employers are offering pay hikes, dropping educational requirements, or even going on hiring tours.

Understanding Return On Capital Employed (ROCE)

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. Analysts use this formula to calculate it for McDonald's:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.19 = US$9.1b ÷ (US$52b - US$3.9b) (Based on the trailing twelve months to June 2021).

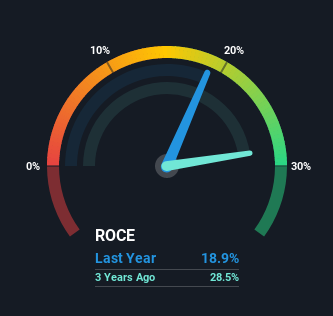

Thus, McDonald's has a ROCE of 19%. On its own, that's a standard return; however, it's much better than the 8.1% generated by the Hospitality industry.

See our latest analysis for McDonald's

In the above chart, we have measured McDonald's' prior ROCE against its last performance, but the future is arguably more important. If you'd like to see what analysts are forecasting in the future, you should check out our free report for McDonald's.

What The Trend Of ROCE Can Tell Us

In terms of McDonald's' historical ROCE movements, the trend isn't fantastic. Over the last five years, returns on capital have decreased to 19% from 25% five years ago. Although both revenue and the number of assets employed in the business have increased, it could suggest the company is investing in growth, and the extra capital has led to a short-term reduction in ROCE. And if the increased capital generates additional returns, the business, and thus shareholders, will benefit in the long run.

A Hedge Against Inflation

McDonald's business model provides for a possible hedge against inflation. The company operates through location ownership and/or long-term leases (about 25% of long-term liabilities); those expenses come at fixed costs.

Meanwhile, it profits through the sales of food, a high turnover inventory. The ability to quickly adjust the prices through the system will lead to higher profit margins if most costs lag behind.

Furthermore, international revenues will result in higher sales when denoted in US dollars with a globally diversified operation, as global operations currently bring most revenues.

The Bottom Line On McDonald's' ROCE

In summary, despite lower returns in the short term, we're encouraged to see that McDonald's is reinvesting for growth and has higher sales as a result. And long term investors must be optimistic going forward because the stock has returned a massive 136% to shareholders in the last five years. So while investors seem to be recognizing these promising trends, we would look further into this stock to make sure the other metrics justify the optimistic view.

Like most companies, McDonald's does come with some risks, and we've found 2 warning signs that you should be aware of.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:MCD

McDonald's

Owns, operates, and franchises restaurants under the McDonald’s brand in the United States and internationally.

Established dividend payer with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026