- United States

- /

- Hospitality

- /

- NYSE:MCD

Even Though it Didn't Meet the Expectations, McDonald's (NYSE:MCD) Still Posted Solid Results

Between supply chain and inflation, there were plenty of challenges in 2021. Thus, even traditionally resilient business models have suffered, like McDonald's (NYSE: MCD), as it just missed earnings expectations.

Click here for our latest analysis for McDonald's

Q4 Earnings Results

- Non-GAAP EPS: US$2.23 (miss by US$0.11)

- Revenue: US$6b (miss by US$30m)

- Revenue growth: +13% Y/Y

Other highlights

- FY 2021 revenue: US$23.22b (+22% Y/Y)

- CAPEX 2022: US$2.2b – US$2.4b

- 40% for U.S. restaurant modernization

- 50% for opening over 1,400 new restaurants

While the results missed the analyst's expectations, we have to admit that they're reasonably good for the situation.

Consider the following:

- U.S. comparable sales increased 13.4% - on the 2-year basis

- Global comparable sales increased 12.3%

- Comparable sales increased for the 7th consecutive year

- FY operating income increased 41%

- Only 1% of domestic locations impacted by Omicron

CFO Kevin Ozan noted that digital growth remains the key driver of success in the domestic market. Overall we see that digital sales accounted for over 25% of total sales in the top six markets. Furthermore, McDonald's loyalty program now stands at 21 million active members.

What is Mcdonald's Return On Capital Employed (ROCE)?

For those who don't know, ROCE measures a company's yearly pre-tax profit (its return) relative to the capital employed in the business. Analysts use this formula to calculate it for McDonald's:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.20 = US$9.4b ÷ (US$53b - US$5.1b) (Based on the trailing twelve months to September 2021).

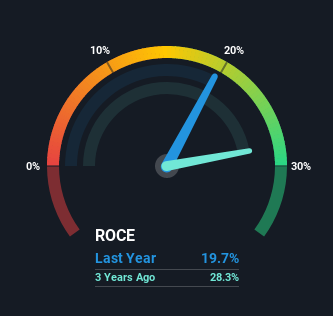

Thus, McDonald's has a ROCE of 20%. In absolute terms, that's a satisfactory return, but compared to the Hospitality industry average of 9.0%, it's much better.

Above you can see how the current ROCE for McDonald's compares to its prior returns on capital, but there's only so much you can tell from the past.

If you'd like to see what analysts are forecasting in the future, you should check out our free report for McDonald's.

So How Is McDonald's' ROCE Trending?

The trend isn't fantastic in McDonald's' historical ROCE movements. Specifically, ROCE has fallen from 28% over the last five years. Although both revenue and the number of assets employed in the business have increased, it could suggest the company is investing in growth, and the extra capital has led to a short-term reduction in ROCE. And if the increased capital generates additional returns, the business, and thus shareholders, will benefit in the long run.

The Key Takeaway

While returns have fallen for McDonald's in recent times, the correction of 7% has primarily followed the overall market decline. Although the company didn't meet the expectations, it looks like it posted a good full-year result for a mature company - especially when it comes to growth.

However, McDonald's debt still seems like the elephant in the room. Even though the business model allows for higher leverage than many others, we still believe it is high. While it has declined from the peak in March 2020, we are still convinced that the company should take more decisive action.

One more thing, we've spotted 1 warning sign facing McDonald's that you might find interesting.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

If you're looking to trade McDonald's, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:MCD

McDonald's

Owns, operates, and franchises restaurants under the McDonald’s brand in the United States and internationally.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives