- United States

- /

- Hospitality

- /

- NYSE:MCD

Assessing McDonald’s (MCD) Valuation After Recent Share Price Drift

Reviewed by Kshitija Bhandaru

McDonald's (MCD) shares are tracking near $301 after a modest gain today. This extends a trend shaped by company fundamentals and recent trading sentiment. Over the past month, the stock has retraced by 4%, even as one-year returns stay positive.

See our latest analysis for McDonald's.

Momentum for McDonald's shares has leveled off lately, with the 30-day share price return reflecting a minor pullback. Still, long-term investors have enjoyed a total shareholder return of 14% over the past year, driven by the company's solid performance and steady growth story.

If you’re weighing what else the market has to offer right now, it could be the perfect moment to broaden your sights and discover fast growing stocks with high insider ownership

With shares drifting sideways and growth metrics holding steady, the key question emerges: is McDonald’s trading below its potential value, or is the market already factoring in the company’s future prospects?

Most Popular Narrative: 10.3% Undervalued

With McDonald's shares last closing at $300.98, the most widely followed narrative sees fair value nearly $34 higher, suggesting room to run. This disconnect between market price and fair value estimate comes down to big assumptions about growth drivers and profitability levers. This sets the stage for a debate over just how much upside exists.

Robust investment and traction in digital commerce, including loyalty program expansion, app-based ordering, geofencing-enabled pickup, and a targeted goal of 250 million active loyalty users by 2027, are expected to increase customer frequency, improve retention, and lift average ticket size. These factors support both revenue and higher net margins over time.

What’s fueling such a bullish take on McDonald’s? There is a sharp narrative around growth, margins, and a future profit multiple reminiscent of the world’s most valuable brands. Curious about the critical assumptions behind this price target? Dive in to uncover the numbers and momentum behind this valuation call.

Result: Fair Value of $335.41 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant declines in low-income traffic or intensifying competition in the U.S. could quickly challenge the bullish case for McDonald's shares.

Find out about the key risks to this McDonald's narrative.

Another View: Looking at Market Multiples

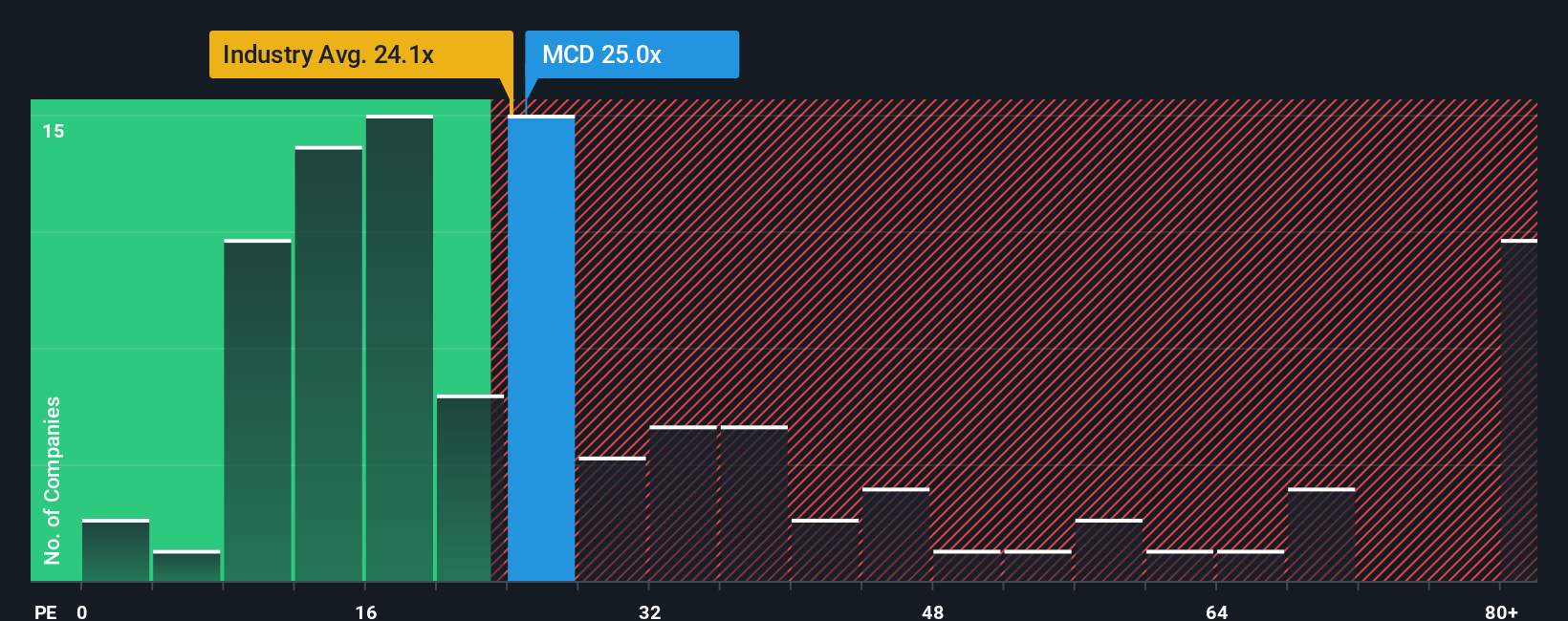

While the previous section made the case for McDonald’s being undervalued based on future earnings, a look at how the market is pricing the company tells a different story. McDonald’s currently trades on a price-to-earnings ratio of 25.6x, which is higher than the US Hospitality industry average of 24.4x and well below the peer group’s average of 62.8x. However, our fair ratio model suggests a level of 31.3x, hinting at both possible opportunity and valuation risk if market sentiment shifts. Could the market be overlooking future growth or holding back for a reason?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out McDonald's for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own McDonald's Narrative

If you're inclined to challenge the consensus or want to dig into the data on your own terms, there’s an easy way to shape your own story in just minutes, and you can Do it your way.

A great starting point for your McDonald's research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t wait for the next big headline. Now is the time to upgrade your watchlist and make moves with stocks primed for tomorrow’s growth stories.

- Grow your passive income and spot top-yield opportunities by checking out these 19 dividend stocks with yields > 3% with attractive returns above 3%.

- Capture the upside in technology’s hottest frontier by following these 24 AI penny stocks making breakthroughs in real-world artificial intelligence applications.

- Diversify your portfolio with these 3567 penny stocks with strong financials that have strong balance sheets and the financials to support long-term success.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MCD

McDonald's

Owns, operates, and franchises restaurants under the McDonald’s brand in the United States and internationally.

Established dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success