- United States

- /

- Hospitality

- /

- NYSE:LVS

The Bull Case For Las Vegas Sands (LVS) Could Change Following Executive Share Sales And Rising Short Interest - Learn Why

Reviewed by Sasha Jovanovic

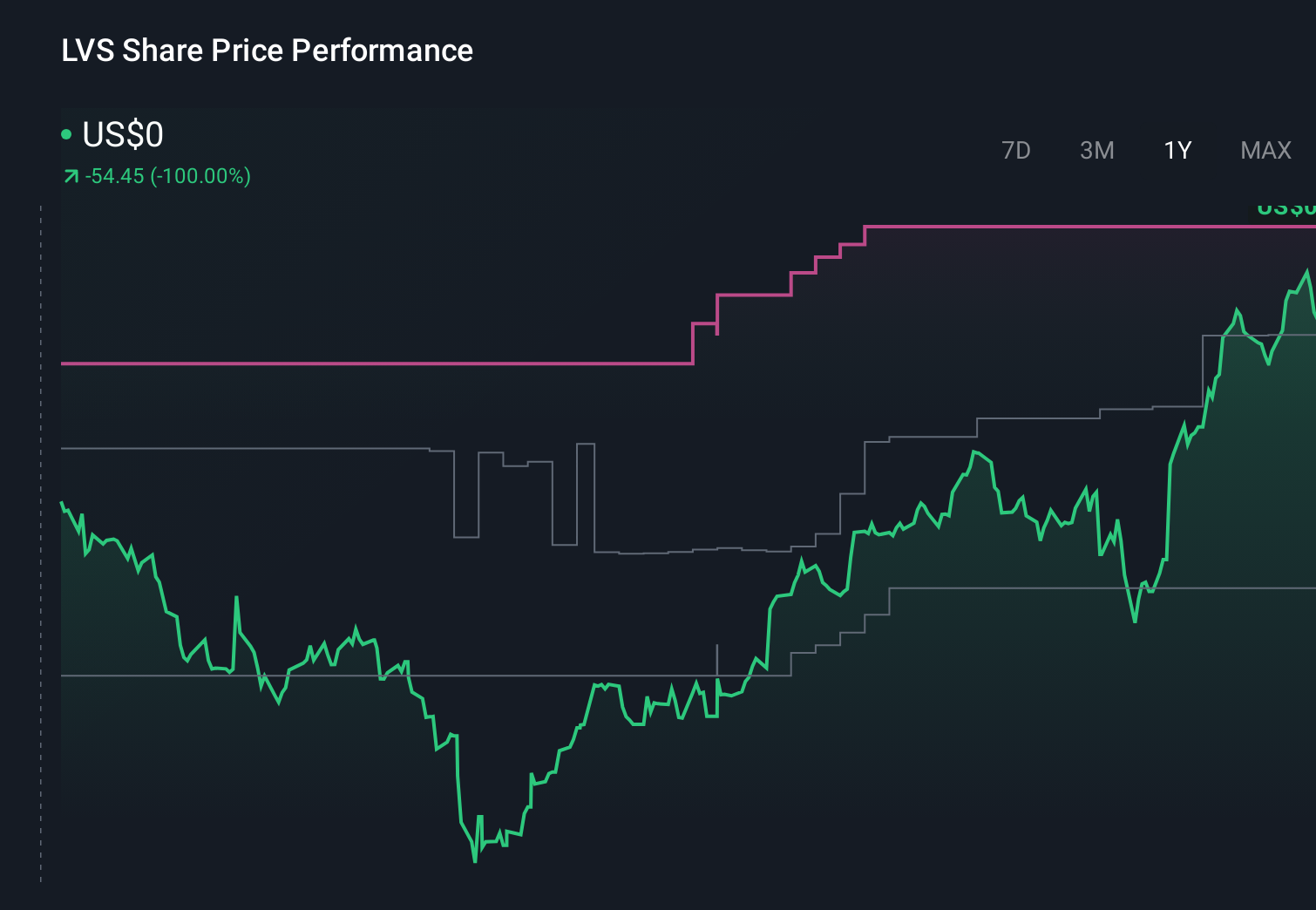

- In recent days, Las Vegas Sands has attracted attention as its President & COO Patrick Dumont sold 135,603 shares, short interest increased, and the company presented at Macquarie’s Asia Conference 2025 in New York after refocusing its portfolio on Asian integrated resorts.

- These developments, combined with mixed analyst views and stronger October casino revenue data from Macau, highlight how investor sentiment is being pulled between concern over executive selling and short positioning on one side and improving Asian gaming fundamentals on the other.

- Against this backdrop of rising short interest, we’ll examine how these signals from bearish traders could reshape Las Vegas Sands’ investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Las Vegas Sands Investment Narrative Recap

To own Las Vegas Sands, you need to believe in the long term appeal of Asian integrated resorts, particularly Macao and Singapore, as the core earnings engine. The key near term catalyst remains execution and margin recovery in Macao, while the biggest risk is that Macao demand and profitability lag expectations. The recent insider sale, rising short interest and conference appearance do not materially change those fundamental drivers in the short run.

Among the recent developments, the Macquarie Asia Conference 2025 appearance ties in most directly, reinforcing Las Vegas Sands’ shift to an Asia focused portfolio after selling its Las Vegas assets in 2022. For investors, that context matters more than trading activity because it connects directly to the medium term catalysts in Macao and at Marina Bay Sands, where reinvestment and capacity expansion are central to the company’s investment case.

Yet investors should be aware that Macao market growth and margins may not recover as quickly as some expect, especially if...

Read the full narrative on Las Vegas Sands (it's free!)

Las Vegas Sands' narrative projects $14.1 billion revenue and $2.5 billion earnings by 2028. This requires 6.8% yearly revenue growth and about a $1.1 billion earnings increase from $1.4 billion today.

Uncover how Las Vegas Sands' forecasts yield a $65.85 fair value, in line with its current price.

Exploring Other Perspectives

Seven fair value estimates from the Simply Wall St Community span roughly US$2 to about US$132 per share, showing very different views on Las Vegas Sands. Against that backdrop, Macao’s slower than hoped for market growth and margin pressure could be a key swing factor for how the company’s performance ultimately lines up with these expectations.

Explore 7 other fair value estimates on Las Vegas Sands - why the stock might be worth less than half the current price!

Build Your Own Las Vegas Sands Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Las Vegas Sands research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Las Vegas Sands research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Las Vegas Sands' overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LVS

Las Vegas Sands

Owns, develops, and operates integrated resorts in Macao and Singapore.

Good value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026