- United States

- /

- Hospitality

- /

- NYSE:LVS

Las Vegas Sands (LVS): Fresh JPMorgan Upgrade Puts Spotlight on Valuation and Singapore Resort Growth Prospects

Reviewed by Kshitija Bhandaru

JPMorgan’s recent upgrade of Las Vegas Sands (LVS) is getting attention, as the firm called out strong growth prospects for its Singapore resorts, particularly at Marina Bay Sands following record-high quarterly EBITDA. This upgrade could influence how investors view the company’s current valuation.

See our latest analysis for Las Vegas Sands.

Las Vegas Sands has seen its share price struggle recently, sliding about 8% over the past month as investors digested mixed regional performances and awaited the upcoming quarterly results. Despite short-term volatility, the company’s three-year total shareholder return of nearly 30% highlights how momentum can quickly rebuild when investor confidence returns, whether due to stronger fundamentals or positive news cycles.

If you’re weighing what other opportunities are on investors’ radar as travel and leisure trends evolve, it’s a great moment to discover fast growing stocks with high insider ownership

With analysts highlighting potential upside and a recent dip in the share price, investors are left asking whether Las Vegas Sands is trading at a discount or if the market has already accounted for its future growth story.

Most Popular Narrative: 20% Undervalued

Compared to Las Vegas Sands’ last close price of $48.54, the most popular narrative sees fair value much higher. This creates a sharp disconnect between the consensus-derived target price and where shares are trading now.

The full opening and ramp-up of The Londoner in Macao, with its 2,405 rooms and suites, is expected to boost revenues and cash flows significantly as the property leverages its scale and quality in a competitive market. Marina Bay Sands (MBS) in Singapore reported record EBITDA from high-value tourism and is expected to continue its growth trajectory supported by increased visitor capacity post-renovations, directly impacting revenue and EBITDA growth.

Want to know what bold forecasts underpin this valuation? The narrative features ambitious financial outcomes and a future profit multiple that stands out versus peers. Curious which numbers give the analysts so much conviction in this fair value? Only a full read reveals the complex calculations and assumptions supporting the price target.

Result: Fair Value of $60.68 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, disappointing Macau revenues and ongoing challenges in high-spending visitor recovery could quickly shift market sentiment, even with the optimism around Las Vegas Sands' growth.

Find out about the key risks to this Las Vegas Sands narrative.

Another View: Looking at Market Comparisons

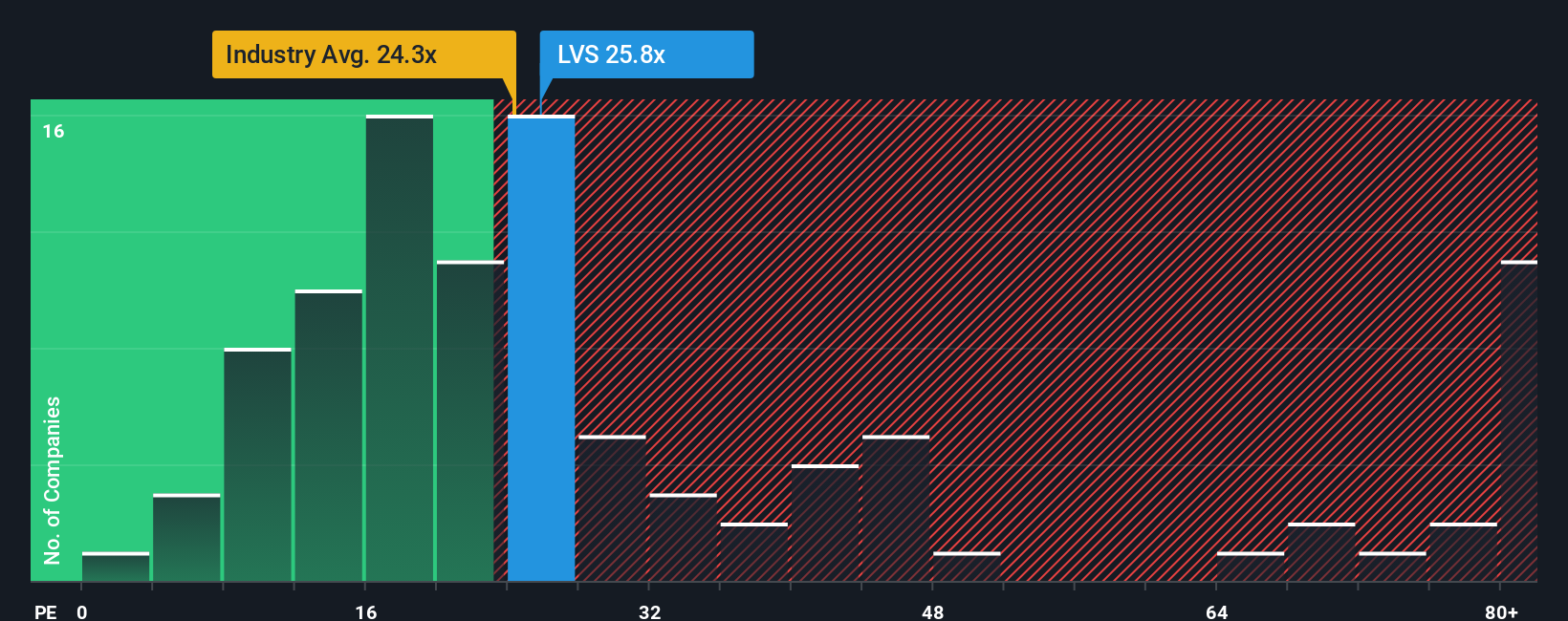

While analysts see Las Vegas Sands as undervalued based on future earnings growth, a glance at the company's price-to-earnings ratio tells a different story. Currently at 23.6x, it sits just above the US Hospitality industry average of 23.5x. This suggests shares are more expensive than sector peers.

The gap becomes more noticeable when compared to the estimated fair ratio of 29.9x, which signals that the market might adjust upward if sentiment shifts. Does this premium mean investors are overlooking risks, or could improving fundamentals justify even higher multiples in the future?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Las Vegas Sands Narrative

If this analysis doesn't align with your perspective or you’d rather investigate the numbers yourself, you can build a personalized view of Las Vegas Sands in just a few minutes, Do it your way.

A great starting point for your Las Vegas Sands research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why limit yourself to one opportunity when other smart investing angles are just a click away? These handpicked screens could open the door to your next winning move:

- Boost your yield by checking out these 18 dividend stocks with yields > 3% featuring companies with attractive dividend payouts and stable cash flows.

- Start your search for untapped potential in emerging technology by uncovering these 26 quantum computing stocks positioned at the forefront of quantum innovation.

- Grow your portfolio with forward-thinking healthcare leaders by tapping into these 33 healthcare AI stocks focused on AI advancements in medical science.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LVS

Las Vegas Sands

Owns, develops, and operates integrated resorts in Macao and Singapore.

Undervalued with low risk.

Similar Companies

Market Insights

Community Narratives