- United States

- /

- Hospitality

- /

- NYSE:LVS

Hosting NBA China Games in Macau Might Change The Case For Investing In Las Vegas Sands (LVS)

Reviewed by Sasha Jovanovic

- Las Vegas Sands recently deepened its collaboration with the NBA, as Sands China hosted the NBA China Games 2025 at The Venetian Arena in Macau, aiming to support Macau's evolution into a sports and entertainment destination.

- This partnership leverages not only Sands China's resort infrastructure but also the Adelson family's ties to the Dallas Mavericks, strengthening the company's influence in global entertainment circles.

- We'll explore how hosting premier NBA events in Macau could complement Las Vegas Sands' core resort operations and enhance its long-term investment outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Las Vegas Sands Investment Narrative Recap

To be a shareholder in Las Vegas Sands, you need confidence in Macau’s transformation into a true sports and entertainment hub, supporting consistent growth in premium tourism and related revenues. While hosting the NBA China Games 2025 showcases the brand and complements its Macao resorts, it does not alter the most critical short-term issue: the pace of recovery in Macau visitor numbers and pressures on margins. The biggest risk remains weaker-than-anticipated revenue and limited growth if high-spending segments do not return in force.

Among recent company moves, the continued ramp-up of The Londoner in Macau remains particularly important. This property’s scale and luxury profile give it the potential to significantly improve group revenues and cash flows, tying directly into the anticipated benefits from increased resort visitation and larger, higher-profile events like the NBA games.

Yet, in contrast to new event partnerships, investors should also consider that Macau's revenue recovery is still below earlier expectations and...

Read the full narrative on Las Vegas Sands (it's free!)

Las Vegas Sands' outlook anticipates $14.1 billion in revenue and $2.5 billion in earnings by 2028. This assumes a 6.8% annual revenue growth rate and a $1.1 billion increase in earnings from $1.4 billion currently.

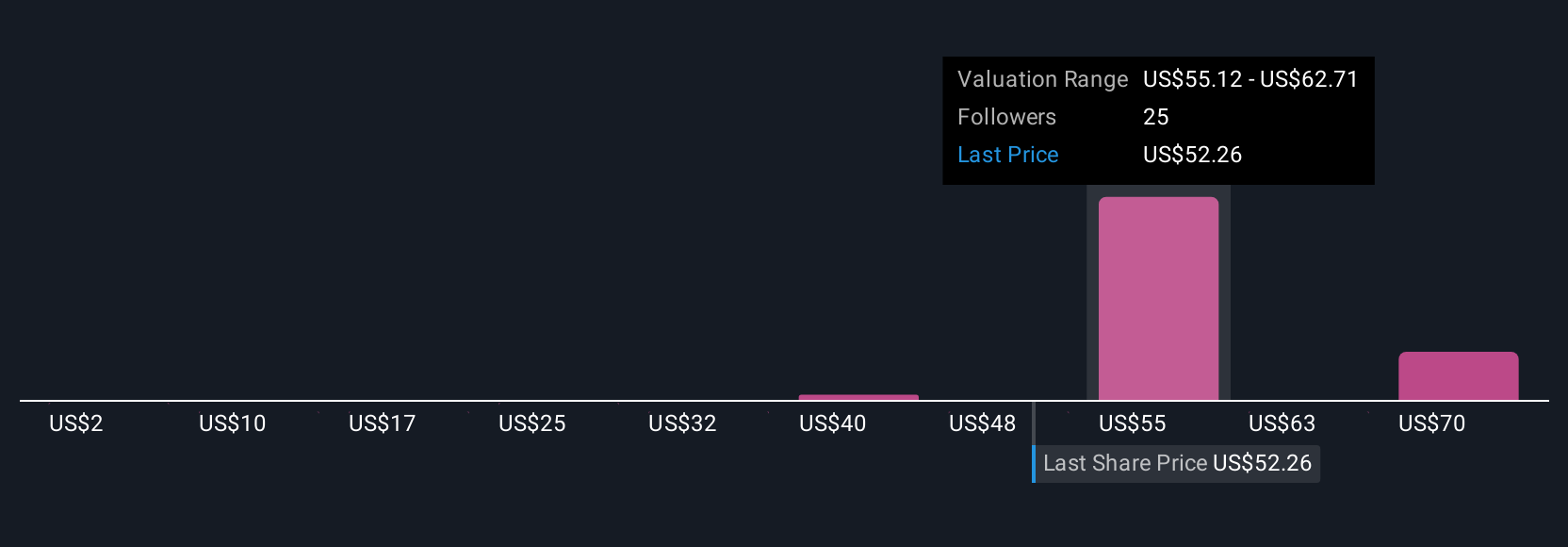

Uncover how Las Vegas Sands' forecasts yield a $60.68 fair value, a 22% upside to its current price.

Exploring Other Perspectives

Seven individual fair value estimates from the Simply Wall St Community range widely, from as low as US$2 to as high as US$77.89 per share. Some see major upside, but the ongoing risk that Macau premium customer volumes may not rebound quickly enough remains a focal point for your research.

Explore 7 other fair value estimates on Las Vegas Sands - why the stock might be worth as much as 57% more than the current price!

Build Your Own Las Vegas Sands Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Las Vegas Sands research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Las Vegas Sands research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Las Vegas Sands' overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LVS

Las Vegas Sands

Owns, develops, and operates integrated resorts in Macao and Singapore.

Undervalued with low risk.

Similar Companies

Market Insights

Community Narratives