- United States

- /

- Hospitality

- /

- NYSE:LVS

A Look at Las Vegas Sands (LVS) Valuation Following Recent Share Price Momentum

Reviewed by Simply Wall St

See our latest analysis for Las Vegas Sands.

After a strong run-up this past month, Las Vegas Sands is starting to look like a stock with momentum on its side. The company’s 30-day share price return of 16.1% and year-to-date gain of 36.8% have outpaced many in the gaming and hospitality sector. A 1-year total shareholder return of 31.4% signals that both recent enthusiasm and long-term performance are turning heads among investors.

If recent momentum in the gaming space has you interested in new ideas, now’s the perfect time to discover fast growing stocks with high insider ownership

With such strong performance numbers on display, some investors are asking whether Las Vegas Sands shares still have room to run or if current prices already account for all that future growth. Could this be a genuine buying opportunity, or has the market already priced it in?

Most Popular Narrative: 4% Overvalued

With Las Vegas Sands closing at $68.25, the most widely tracked narrative fair value estimate comes in slightly lower at $65.38. This suggests minor overvaluation attributed to high recent performance. This context provides an opportunity to examine the rationale behind the narrative’s calculations and future projections.

The full opening and ramp-up of The Londoner in Macao, with its 2,405 rooms and suites, is expected to boost revenues and cash flows significantly as the property leverages its scale and quality in a competitive market. Marina Bay Sands in Singapore reported record EBITDA from high-value tourism and is expected to continue its growth trajectory supported by increased visitor capacity post-renovations, directly impacting revenue and EBITDA growth.

The real story focuses on bold expansion and profit forecasts that are uncommon in this sector. Do you know which financial pillars support this premium price? Explore the strategic bets and analyst assumptions that underpin the fair value, as these factors are shaping market sentiment.

Result: Fair Value of $65.38 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing volatility in Macau’s visitation figures and intensifying competition in the region could quickly change the outlook for Las Vegas Sands.

Find out about the key risks to this Las Vegas Sands narrative.

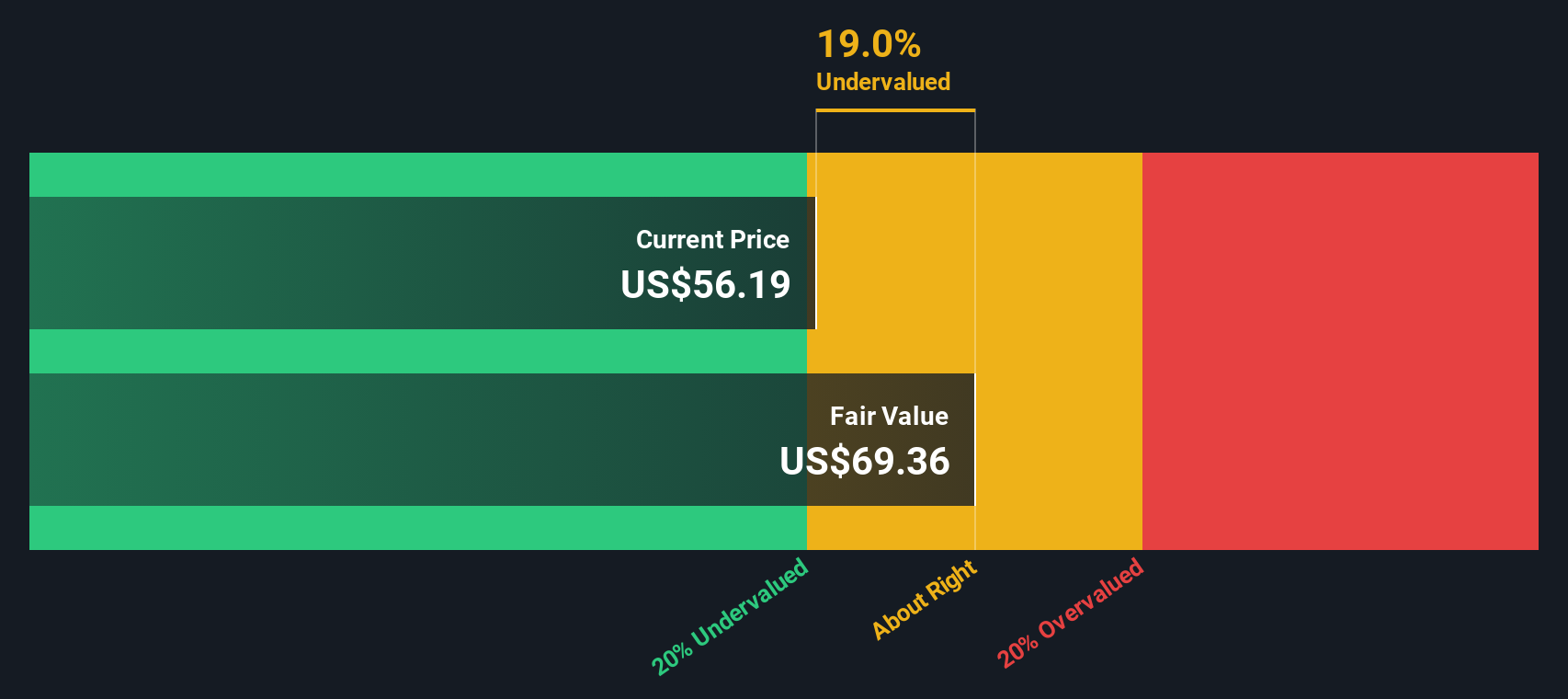

Another View: DCF Model Points to Undervaluation

Looking beyond recent multiple-based valuations, our SWS DCF model presents a very different perspective. It estimates Las Vegas Sands’ fair value at $134.08 per share, which is nearly double the current market price. This suggests the stock may be significantly undervalued based on projected future cash flows. Could this model be highlighting an overlooked opportunity, or is it overly optimistic about future performance?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Las Vegas Sands Narrative

If you see the numbers differently or want to take a hands-on approach, you can easily craft your own narrative in just a few minutes. Do it your way

A great starting point for your Las Vegas Sands research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t wait on the sidelines while smart investors jump on new trends. Let the Simply Wall Street Screener point you toward dynamic opportunities beyond the obvious picks.

- Jumpstart your search for undervalued gems and see how these 932 undervalued stocks based on cash flows are capitalizing on strong fundamentals today.

- Tap into the explosive growth of artificial intelligence by viewing these 25 AI penny stocks set to transform entire industries with rapid innovation.

- Unlock the potential of stable passive income by checking out these 15 dividend stocks with yields > 3% offering attractive dividend yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LVS

Las Vegas Sands

Owns, develops, and operates integrated resorts in Macao and Singapore.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.