- United States

- /

- Hospitality

- /

- NYSE:LTH

Will Life Time’s New Paradise Valley Luxury Project Shape LTH’s Integrated Wellness Living Narrative?

Reviewed by Sasha Jovanovic

- Life Time Group Holdings and RED Development recently broke ground on Life Time Living Paradise Valley, an 11-story, 327-unit luxury residential project adjacent to a 92,000-square-foot athletic country club in Phoenix, with completion targeted for 2027.

- This project extends Life Time’s wellness-focused living concept and highlights its commitment to integrating wellness, fitness, and community experiences within large-scale mixed-use developments.

- We'll explore how Life Time’s Paradise Valley luxury residential expansion could influence its investment narrative and growth prospects.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

Life Time Group Holdings Investment Narrative Recap

To be a shareholder in Life Time Group Holdings, you need to believe in the long-term demand for premium, health-focused living experiences and the company's ability to deliver sustained club and ancillary revenue growth. The new Paradise Valley luxury residential project reinforces Life Time’s community-centric, luxury wellness positioning, but given its multi-year timeline, it is unlikely to materially influence the near-term catalyst of successfully delivering growth from ongoing club expansions or shift the biggest risk, which remains access to affordable real estate capital and exposure to rising interest rates.

Among recent announcements, the opening of Life Time Prudential Center in Boston is especially relevant, as it reflects the company's focus on expanding into affluent urban environments. Together with the new Paradise Valley project, these developments underscore Life Time’s reliance on scaling up premium large-format locations to support revenue growth, while also amplifying exposure to higher construction costs and capital intensity as a key operational risk.

In contrast, investors should be aware that Life Time’s ambitious expansion could be challenged by tighter real estate capital markets and the potential for...

Read the full narrative on Life Time Group Holdings (it's free!)

Life Time Group Holdings is projected to reach $3.8 billion in revenue and $457.9 million in earnings by 2028. This outlook depends on achieving a 10.7% annual revenue growth rate and an earnings increase of $231.1 million from the current earnings of $226.8 million.

Uncover how Life Time Group Holdings' forecasts yield a $39.91 fair value, a 59% upside to its current price.

Exploring Other Perspectives

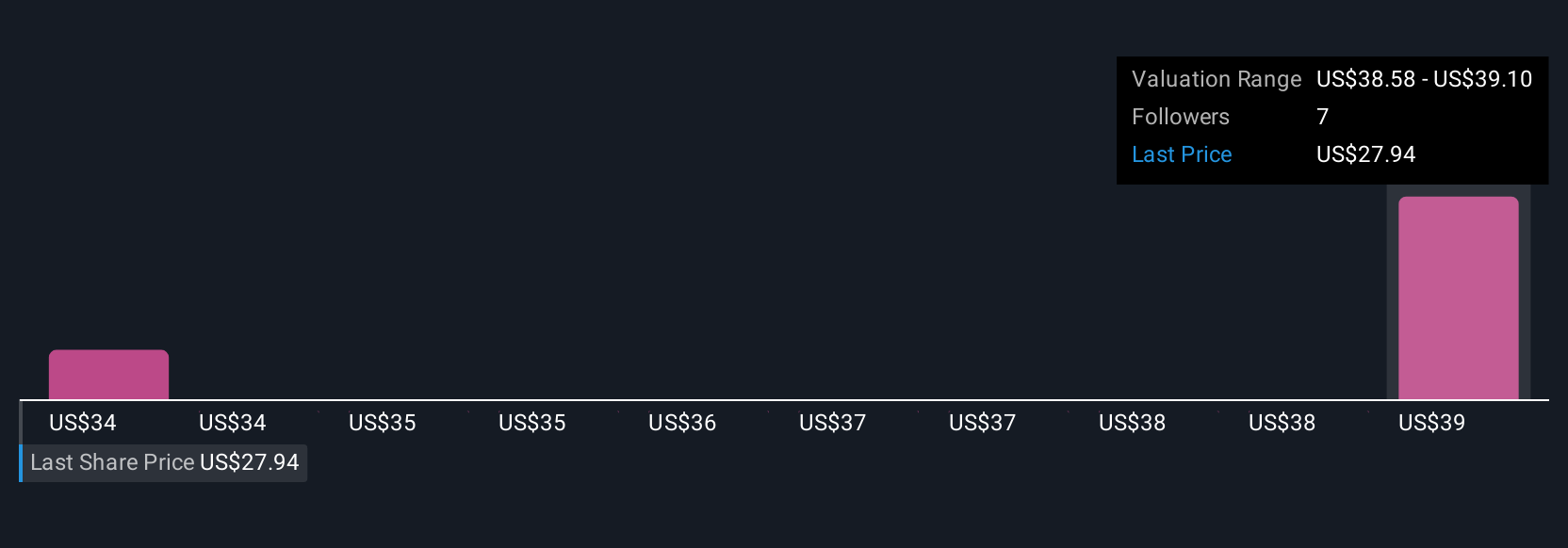

Two fair value estimates from the Simply Wall St Community put Life Time Group Holdings’ worth between US$34.25 and US$39.91. As members weigh these views, keep in mind that ongoing capital-intensive club expansions could have broad effects on future returns and support for premium positioning.

Explore 2 other fair value estimates on Life Time Group Holdings - why the stock might be worth as much as 59% more than the current price!

Build Your Own Life Time Group Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Life Time Group Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Life Time Group Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Life Time Group Holdings' overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LTH

Life Time Group Holdings

Provides health, fitness, and wellness experiences to a community of individual members in the United States and Canada.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives