- United States

- /

- Hospitality

- /

- NYSE:LTH

Has Life Time’s Recent Club Expansion Put Its Stock at a Fair Value for 2025?

Reviewed by Bailey Pemberton

- If you have ever wondered whether Life Time Group Holdings is really worth its current price, you are not alone. We are about to break down what the market might be getting right or missing entirely.

- The stock has climbed 12.4% over the past week and is up a solid 24.6% year-to-date, suggesting investors are warming up to its growth story or seeing reduced risks on the horizon.

- Recently, the company's inclusion in new fitness industry partnerships and media coverage of expanding club openings have fueled optimism, as investors see momentum growing in both brand awareness and membership trends. These headlines offer helpful context for the impressive moves in the share price this year.

- On our simple valuation check, Life Time Group Holdings earns a 3 out of 6. There is more nuance to valuation than any one score can capture, so next we will dig deeper into the main valuation methods and later highlight an even more comprehensive approach you should not miss.

Approach 1: Life Time Group Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used approach for estimating a company's intrinsic value by projecting its future cash flows and discounting them back to today’s value. This method aims to capture the company’s expected cash generation potential over time, adjusted for the time value of money.

For Life Time Group Holdings, the current Free Cash Flow (FCF) stands at $26.7 million. Analysts provide estimates for the next several years, with 2026 FCF projected to climb to $99.3 million. Beyond these periods, Simply Wall St extrapolates further growth, projecting FCF could reach as high as $613.6 million by 2035. These jumps reflect expectations for continued business expansion and improved profitability in the health and fitness space.

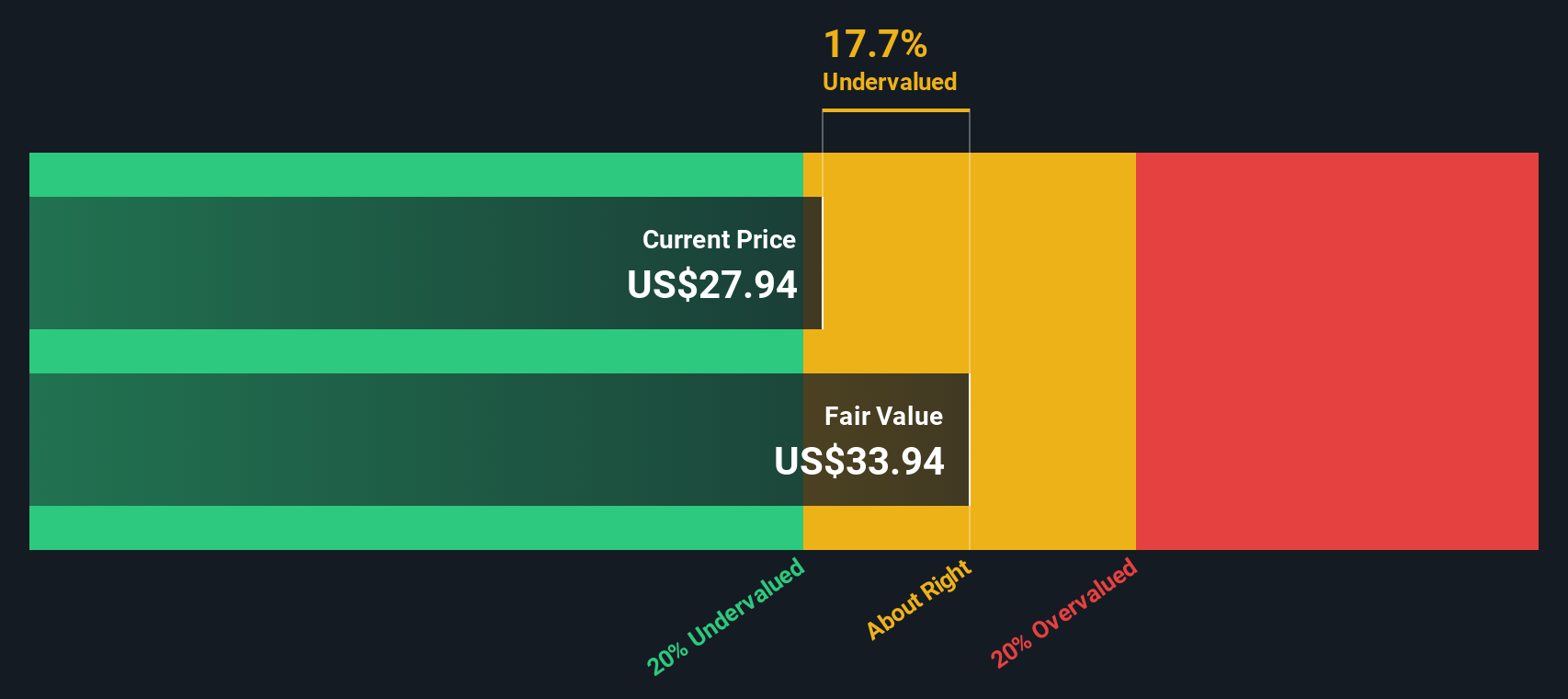

Based on these two-stage FCF projections, the DCF model arrives at a fair value estimate of $25.58 per share for Life Time Group Holdings. With the current share price roughly 9.1% above this figure, the DCF assessment suggests the stock is trading just slightly above its intrinsic value, so it looks mostly fairly valued at this time.

Result: ABOUT RIGHT

Life Time Group Holdings is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Life Time Group Holdings Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely recognized metric for valuing profitable businesses like Life Time Group Holdings, as it directly connects the company’s share price to its underlying earnings. For companies generating consistent profits, the PE ratio provides a quick snapshot of how much investors are willing to pay for each dollar of earnings. This makes it a useful tool for comparison against industry norms and competitors.

Of course, what counts as a “reasonable” PE ratio depends on expected earnings growth and business risks. Higher growth prospects or a more stable business model often justify a higher PE, while slow growth or elevated risks indicate that a lower multiple is more appropriate.

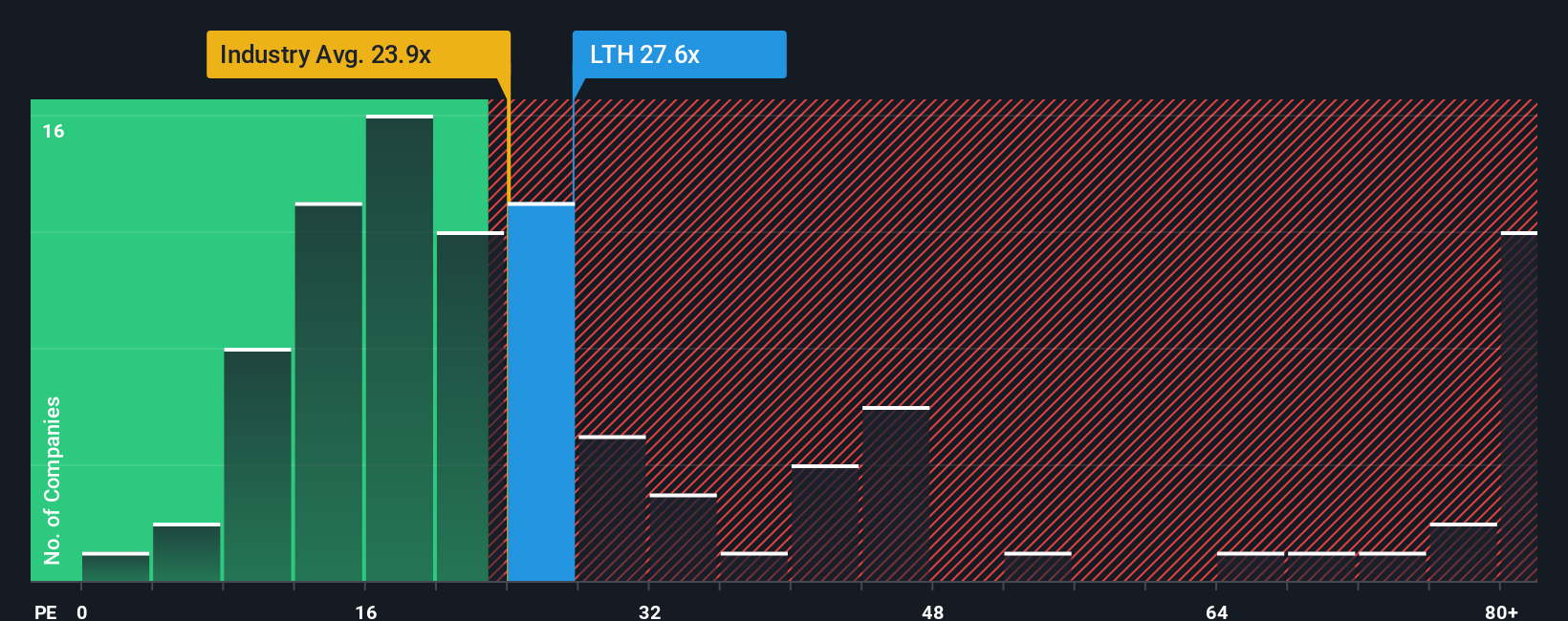

Currently, Life Time Group Holdings trades at a PE ratio of 21.4x. This figure is right in line with the broader hospitality industry average of 21.4x, but noticeably lower than the peer group average of 33.9x. Simply Wall St offers another key benchmark: a proprietary “Fair Ratio” of 22.4x for Life Time. This Fair Ratio incorporates not just industry trends or peer comparisons, but also factors in Life Time’s unique growth outlook, risks, profit margins and market capitalization.

The advantage of using the Fair Ratio over a standard industry or peer comparison is that it tailors the assessment to the company’s actual situation. This offers a more nuanced perspective that reflects both opportunities and vulnerabilities. Compared to its Fair Ratio, Life Time’s actual PE ratio is nearly identical, indicating the market’s current price for the stock is quite well calibrated.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Life Time Group Holdings Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is more than just numbers; it's your personal story and perspective about a business, combining your view of a company’s future with the key financial forecasts such as estimated revenue, profit margins, and what you believe is fair value.

Narratives allow investors to connect a company’s story, such as exciting new club openings, technology innovation, or expansion into premium services, to updated financial models and fair value calculations. With Simply Wall St’s Community page, you can easily build your own Narrative or see how others think, making this powerful tool accessible to millions of investors.

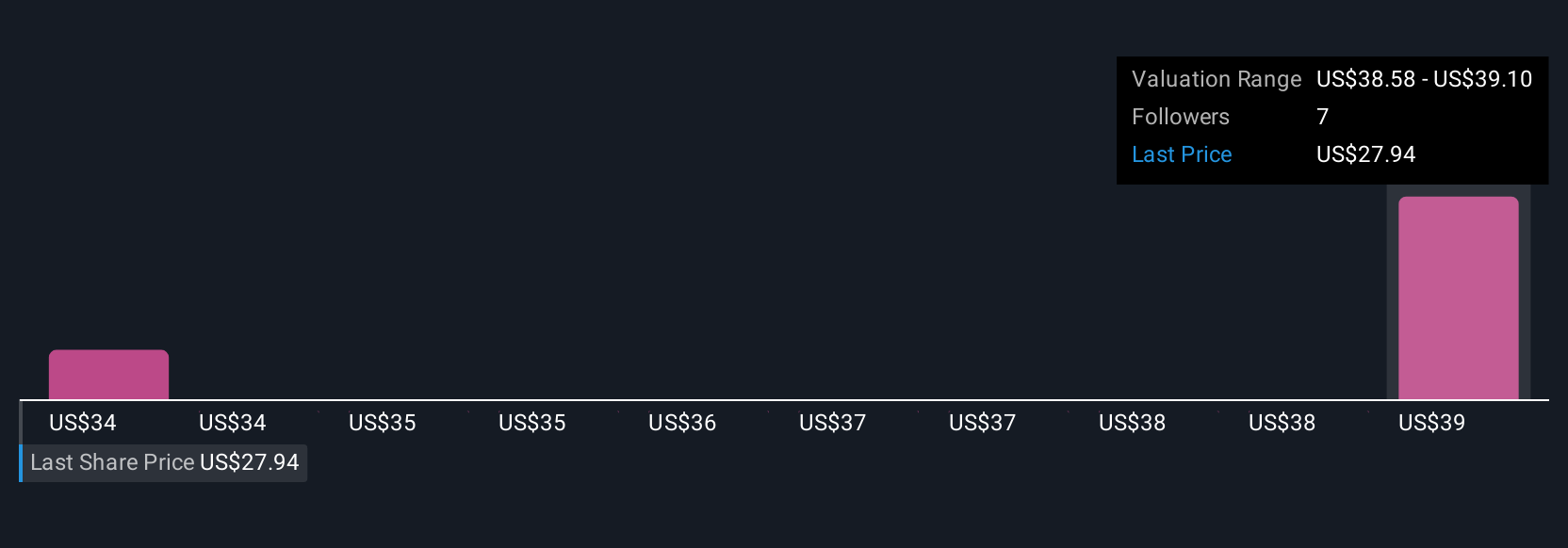

By comparing your fair value estimate to today’s price, Narratives help you decide whether to buy, hold, or sell. They update automatically as news, earnings, or fresh data become available, so your analysis always stays relevant. For example, one investor might have a bullish Narrative for Life Time Group Holdings, assuming a price target of $45.0, based on strong digital growth and club expansion. Another investor might be more cautious, targeting $32.0 due to competition and strategic risks. This demonstrates how Narratives turn outlooks and evidence into actionable decisions.

Do you think there's more to the story for Life Time Group Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LTH

Life Time Group Holdings

Provides health, fitness, and wellness experiences to a community of individual members in the United States and Canada.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success