- United States

- /

- Hospitality

- /

- NYSE:LTH

A Look at Life Time Group Holdings’s Valuation Following Upbeat Q3 Results and Raised Earnings Guidance

Reviewed by Simply Wall St

Life Time Group Holdings (LTH) reported impressive third-quarter results this week, with both revenue and net income rising sharply year-over-year. Management also raised full-year earnings forecasts, reflecting ongoing growth and strong demand.

See our latest analysis for Life Time Group Holdings.

Life Time Group Holdings' latest business updates, including expansion of its CTR workout program and raised full-year earnings guidance, have kept momentum building. Despite a dip in share price over the past three months, the bigger story is strong underlying growth. This is reflected in a share price that is up 13.7% this year and a three-year total shareholder return of 109.6%.

If you’re interested in discovering more high-potential companies riding industry tailwinds, now is the perfect time to explore fast growing stocks with high insider ownership.

Given this recent momentum and analyst optimism, the pressing question for investors is whether Life Time Group Holdings is undervalued at its current price or if the market has already factored in its future growth prospects.

Most Popular Narrative: 36.2% Undervalued

Based on the most widely followed narrative, the current fair value sits well above where Life Time Group Holdings last closed. This suggests room for upside if the assumptions behind this narrative prove accurate.

The expanding pipeline of new and larger club openings in affluent and high-density markets positions Life Time for sustained membership and top-line revenue growth. The company may benefit from the growing consumer demand for premium health, wellness, and lifestyle experiences. Accelerating growth in ancillary, higher-margin services—including personal training, Life Time Digital offerings, nutritional supplements, and health and wellness programs—supports increased average revenue per member and improved net margins as consumer expectations shift toward holistic wellness.

What is driving such a bullish take? It hinges on growth in core revenue streams, an aggressive push into digital, and the assumptions analysts are making about future margins. The full narrative reveals the bold forecasts underpinning this 36% upside. Want to see what is fueling the optimism? Dive in to get the details.

Result: Fair Value of $39.91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustaining high growth depends on successful club expansion and steady demand for premium fitness, as economic shifts or rising costs could test the bullish narrative.

Find out about the key risks to this Life Time Group Holdings narrative.

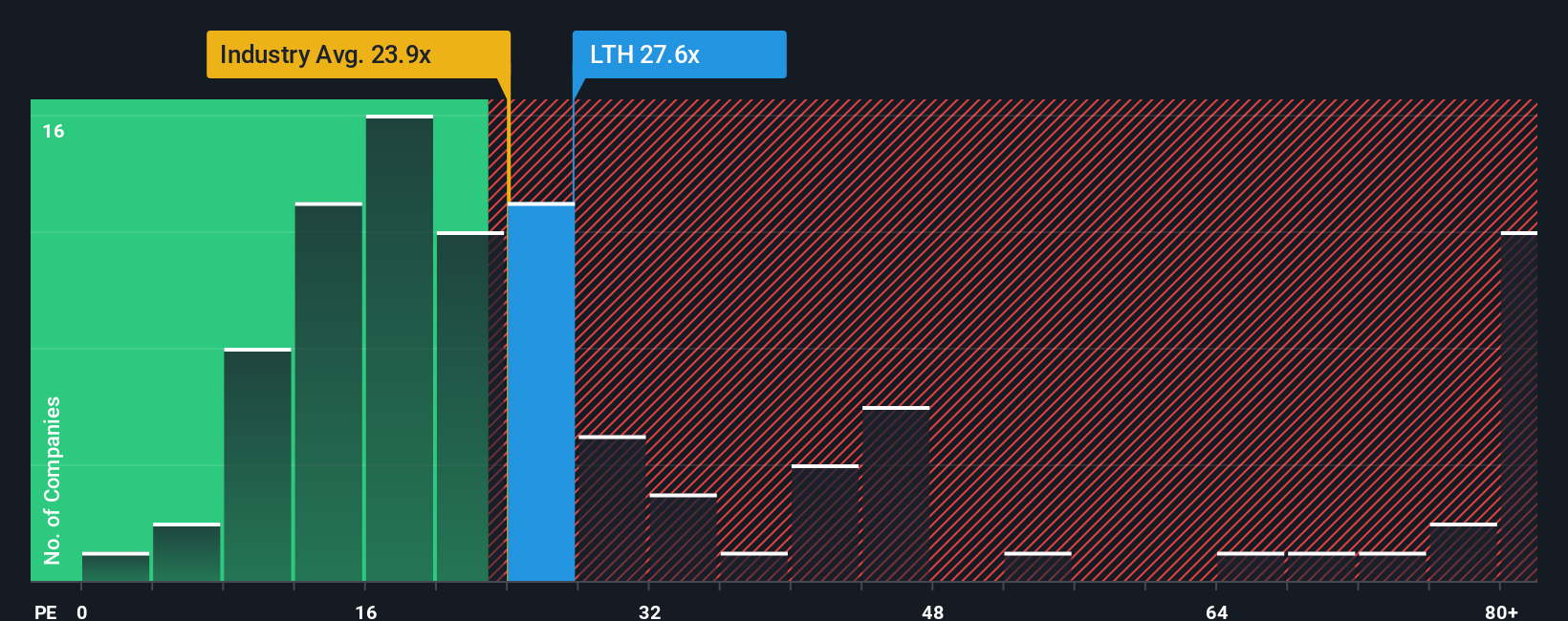

Another View: Multiples Comparison Tells a Similar Story

Looking beyond fair value estimates, the price-to-earnings ratio offers further perspective. Life Time Group Holdings trades at 19.5 times earnings, which is lower than both the industry average of 21.1x and peer average of 30.4x. Compared to the fair ratio of 22.2x, this suggests shares might be attractively valued. However, if the market adjusts, is there even more upside? Or does a gap hint at risks market-watchers might be missing?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Life Time Group Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 885 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Life Time Group Holdings Narrative

If you see things differently or want to dig into the numbers yourself, you can shape your own perspective in just a few minutes. Do it your way

A great starting point for your Life Time Group Holdings research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you want to stay ahead and uncover standout opportunities, don’t let these hand-picked stock ideas pass you by. Move quickly to position yourself for potential gains.

- Supercharge your income with proven high-yield options by checking out these 16 dividend stocks with yields > 3%, which offer solid payouts and strong fundamentals.

- Ride the next technological wave by exploring these 24 AI penny stocks featuring innovators who use artificial intelligence to transform entire industries.

- Boost your returns by targeting value opportunities. Focus on these 885 undervalued stocks based on cash flows, which are trading below their intrinsic worth and offer chances to get ahead of the broader market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LTH

Life Time Group Holdings

Provides health, fitness, and wellness experiences to a community of individual members in the United States and Canada.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives