- United States

- /

- Consumer Services

- /

- NYSE:LRN

Stride (LRN): Evaluating Valuation After Blowout Q4 Results and Raised Outlook

Reviewed by Simply Wall St

Stride (LRN) just grabbed investors' attention after a standout fourth quarter, where management delivered far more than what Wall Street expected. The company exceeded earnings projections and then raised its forward guidance for the next year. Add in an eye-catching 20% surge in total enrollments, particularly the 33% jump in its Career Learning segment, and it is clear why Stride is making waves as digital education gains momentum, AI becomes integral to learning, and remote schooling solidifies its place in the education landscape.

That strong finish to the year sent Stride’s shares to new highs in August, reflecting growing confidence in its ability to execute and adapt. In a broader view, the stock is up over 51% for 2025 so far, with a triple-digit total return in the past year, which indicates shifting sentiment as investors recognize its scale and agility. Recent product initiatives, including investments in tutoring and tech-enhanced learning, further enhance the company’s perception as a leader in the education space. Momentum is building, turning a once-steady stock into a sought-after name for growth watchers.

The real question, though, is whether Stride’s current price truly reflects all of this growth or if there is still value for investors to unlock. Is the opportunity as good as it looks, or is the market already one step ahead?

Most Popular Narrative: 1.8% Undervalued

The most widely followed narrative currently suggests that Stride remains valued just below its calculated fair value, offering a slim margin of discount for investors under current market assumptions and consensus forecasts.

Persistent double-digit enrollment growth and robust application volumes signal accelerating demand for flexible, digital, and alternative education offerings. This implies sustainable revenue growth as families seek personalized, remote learning options.

Expansion of tutoring and career-focused learning solutions, both internally and as externally monetizable offerings, positions Stride to capture additional revenue streams amid rising emphasis on lifelong learning and workforce reskilling.

Curious what numbers are powering this narrative? The bullish outlook is not just about top-line growth or digital momentum. There is a surprising blend of optimistic analyst estimates and ambitious earnings forecasts baked into this valuation. Ready to discover which future milestones analysts expect Stride to hit? These numbers might reshape expectations for the entire sector.

Result: Fair Value of $163.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, Stride’s growth could be tempered by state-level funding volatility and stricter enrollment limits. Both factors would threaten its future revenue pace.

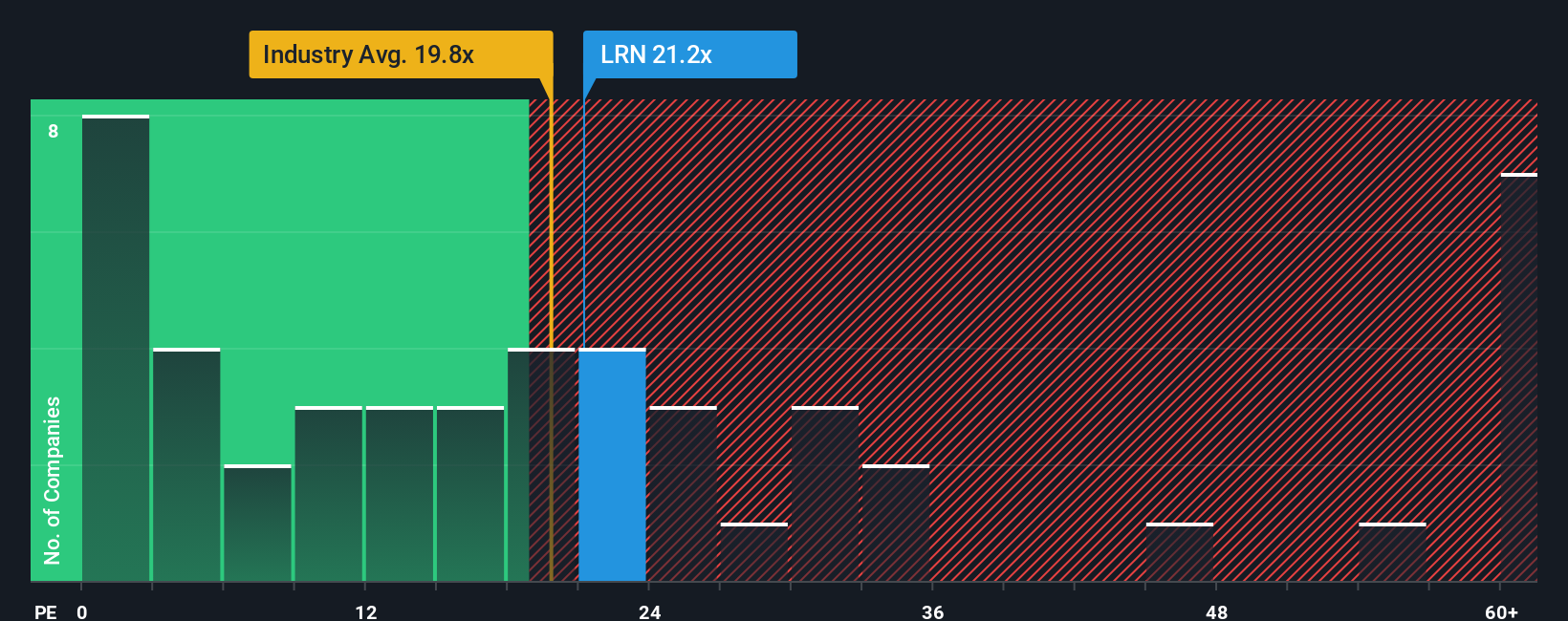

Find out about the key risks to this Stride narrative.Another View: Industry Comparison

Looking at how Stride is priced compared to the rest of its industry offers a different story. This view suggests the stock is on the expensive side in relation to sector averages. Which perspective captures the real opportunity, and which one misses the mark?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Stride to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Stride Narrative

If you see things differently or want a hands-on perspective, you can dive into the data yourself and shape a personalized story in just minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Stride.

Looking for More Compelling Investment Opportunities?

Smart investors never stop at just one idea. Make sure you give yourself the fullest advantage by checking out these powerful stock themes catching our attention right now:

- Unlock potential with small-cap movers that are securing strong financials and promising growth by checking out penny stocks with strong financials.

- Capitalize on fast-growing income opportunities and stable payouts through stocks offering dividend stocks with yields > 3%.

- Ride the wave of tomorrow’s digital breakthroughs in artificial intelligence by getting involved with AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:LRN

Stride

Provides proprietary and third-party online curriculum, software systems, and educational services in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)