- United States

- /

- Consumer Services

- /

- NYSE:HRB

H&R Block (HRB): Assessing Valuation After Sweeping H-1B Policy Shakeup Drives Talent Cost Surge

Reviewed by Kshitija Bhandaru

H&R Block (HRB) has landed in the spotlight after sweeping changes to US immigration policy, most notably a steep $100,000 fee now required for every new H-1B visa application. As these rules take effect, many investors are re-evaluating how this new cost pressure, especially on large employers who rely on skilled immigrant labor, could shake up the competitive landscape. For H&R Block, known for its broad consumer tax services, the question is whether these policy moves threaten its growth outlook or create unexpected opportunities as rivals face higher hiring hurdles and talent concerns.

The past year has not been smooth for H&R Block’s stock price, with shares down nearly 19% over the last twelve months. The slide has happened against a backdrop of modest revenue and net income growth, a lackluster performance compared to some longer-term metrics. While the company’s five-year return still boasts a meaningful gain, momentum has faded recently as investors weigh economic shifts and new headwinds like the H-1B policy revamp. The reaction leaves the stock trading below recent highs, and some are asking whether the market is too cautious or simply realistic about the risks ahead.

With the stock drifting lower and a disruptive national policy now in play, is H&R Block priced as a bargain or is Wall Street simply bracing for slower growth ahead?

Most Popular Narrative: 9.2% Undervalued

The prevailing narrative pegs H&R Block as trading at a nearly double-digit discount to its fair value, pointing to room for upside if current assumptions play out. This assessment is based on a methodical set of forecasts around earnings, revenue growth, and future profit margins.

The ongoing growth in tax code complexity, illustrated by recent legislative changes (e.g., One Big Beautiful Bill) and the shift of more consumers, including higher-income and small business clients, to professional assistance, positions H&R Block to benefit from increased client demand and higher-value client segments. This is likely to drive sustained revenue growth and an improved earnings mix over time.

Curious what really drives that bullish price target? Behind this valuation is a recipe of future earnings growth and profit margin assumptions that could reshape the path for H&R Block. Wondering which key figures and game-changing catalysts analysts are betting on? The narrative lays it all out, but only for those who dig deeper.

Result: Fair Value of $55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, shifting consumer preferences toward fully online tax solutions and rising competition from digital-first platforms could put new pressure on H&R Block's traditional model.

Find out about the key risks to this H&R Block narrative.Another View: Discounted Cash Flow Signals Even More Value

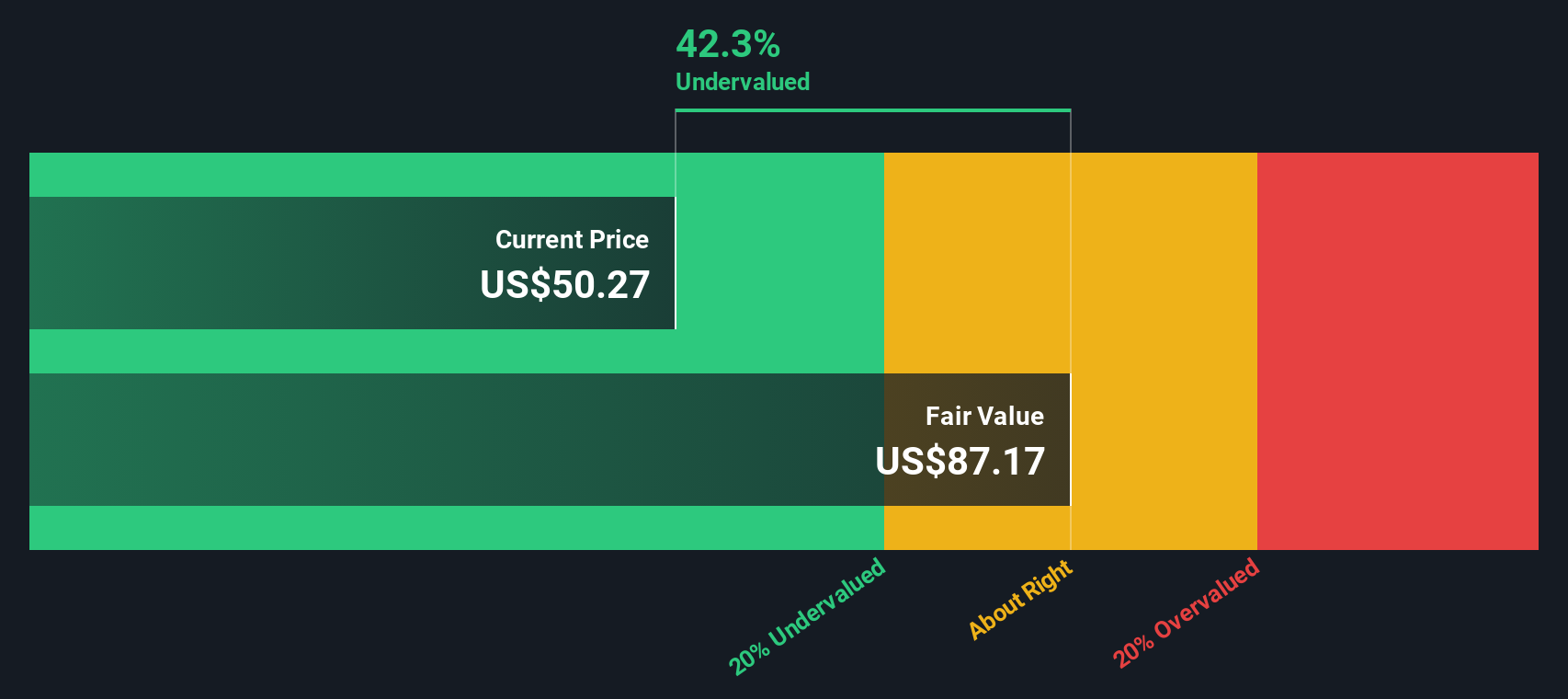

While analysts see H&R Block as modestly undervalued, our DCF model suggests the stock could be trading at an even bigger discount. This second approach weighs future cash flows instead of just profits. Which tells the truer story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out H&R Block for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own H&R Block Narrative

If you see things differently or want a fresh perspective, you can dig into the numbers and craft your own story in just a few minutes. Do it your way.

A great starting point for your H&R Block research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Expand your horizons and give your portfolio a powerful edge by checking out some of the most exciting opportunities on Simply Wall Street’s Screener. Miss these and you could be letting real potential pass you by.

- Supercharge your search for stocks with high future potential and cutting-edge innovation by jumping into AI penny stocks.

- Get ahead with yield-generating companies by starting your hunt among dividend stocks with yields > 3% and discover firms offering attractive income streams.

- Unearth undervalued gems that the market may be missing with the insight-packed undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if H&R Block might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HRB

H&R Block

Through its subsidiaries, provides assisted and do-it-yourself (DIY) tax return preparation services in the United States, Canada, and Australia.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives