- United States

- /

- Consumer Services

- /

- NYSE:HRB

How Slowing Revenue Growth and Rising Competition at H&R Block (HRB) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- H&R Block recently faced operational headwinds, with reports highlighting lackluster revenue growth and mounting competition affecting its profitability and market outlook.

- This signals potential challenges in maintaining its competitive position as industry pressures intensify, calling attention to risks that could shape future performance.

- We'll explore how the ongoing revenue growth concerns and rising competition influence H&R Block's overall investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

H&R Block Investment Narrative Recap

To own shares in H&R Block today, you need confidence in its ability to sustain earnings through tax law complexity, digital innovation, and margin stability, even as recent reports point to weak revenue growth and tougher competition. While the latest news highlights these operational headwinds, the near-term outlook hinges more on the company's ability to win back market share; so far, the immediate effect on key business drivers seems limited, but ongoing pressure from digital rivals remains a primary risk to watch.

Among recent company updates, H&R Block's decision to raise its quarterly dividend by 12% stands out. This move signals ongoing confidence in its cash flow and long-term focus on shareholder returns, even as near-term catalysts depend on staving off competition and engaging customers through digital expansion.

In contrast, investors should be aware of the risk that, despite management’s focus on digital initiatives, persistent market share losses could still threaten profitability if...

Read the full narrative on H&R Block (it's free!)

H&R Block's narrative projects $4.1 billion in revenue and $653.0 million in earnings by 2028. This requires 3.0% yearly revenue growth and a $46.3 million earnings increase from the current $606.7 million.

Uncover how H&R Block's forecasts yield a $55.00 fair value, a 8% upside to its current price.

Exploring Other Perspectives

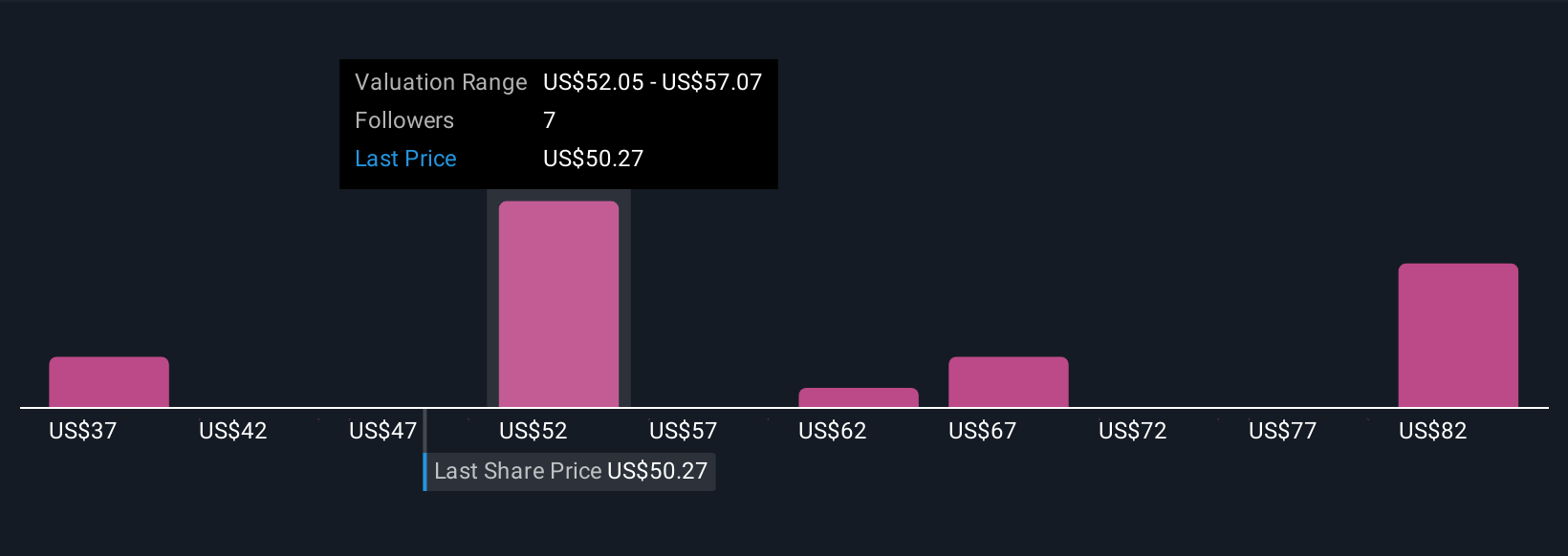

Seven members of the Simply Wall St Community provide fair value estimates for H&R Block ranging from US$37 to US$89, showing broad divergence in expectations. With many focused on digital threats and slow revenue growth, it’s clear opinions on the company’s future performance vary, explore multiple viewpoints to get the full picture.

Explore 7 other fair value estimates on H&R Block - why the stock might be worth 27% less than the current price!

Build Your Own H&R Block Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your H&R Block research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free H&R Block research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate H&R Block's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if H&R Block might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HRB

H&R Block

Through its subsidiaries, provides assisted and do-it-yourself (DIY) tax return preparation services in the United States, Canada, and Australia.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives