- United States

- /

- Hospitality

- /

- NYSE:HLT

Hilton (HLT) Stock Up After Removal from Major Russell Value Indices - What's Changed

- Hilton Worldwide Holdings Inc. (NYSE: HLT) has been removed from several major Russell indices, including the Russell 3000 Value, Russell 1000 Value, Russell Midcap Value, and Russell 1000 Value-Defensive indices, a shift that may impact its index-linked fund ownership and market visibility.

- This extensive removal from multiple value-oriented indices signals a reassessment of Hilton's style classification, which could alter its investor base and highlight evolving perceptions about its valuation profile.

- We'll explore how Hilton's exclusion from key value indices could shift investor sentiment and influence its expanding international growth story.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Hilton Worldwide Holdings Investment Narrative Recap

Owning Hilton Worldwide Holdings means believing in its ability to drive long-term value through international expansion and its growing pipeline of hotels, especially in high-growth markets. The recent removal from key Russell value indices is unlikely to materially impact Hilton’s primary short-term catalysts, which remain tied to new hotel openings and expansion efforts, but it does slightly elevate near-term risk by potentially affecting its visibility among institutional owners.

While recent executive changes, such as the appointment of Apoorva Tripathi as Director of Finance at Hilton Mumbai International Airport, highlight the company’s commitment to financial discipline overseas, these developments are not directly related to index exclusions or the immediate top-line catalysts. Instead, the main focus remains on Hilton’s ability to counterbalance any fluctuations in demand through global portfolio growth and operational improvements.

However, with ongoing macroeconomic uncertainty and leisure demand softness, investors should remain aware that ...

Read the full narrative on Hilton Worldwide Holdings (it's free!)

Hilton Worldwide Holdings' narrative projects $14.4 billion in revenue and $2.4 billion in earnings by 2028.

Exploring Other Perspectives

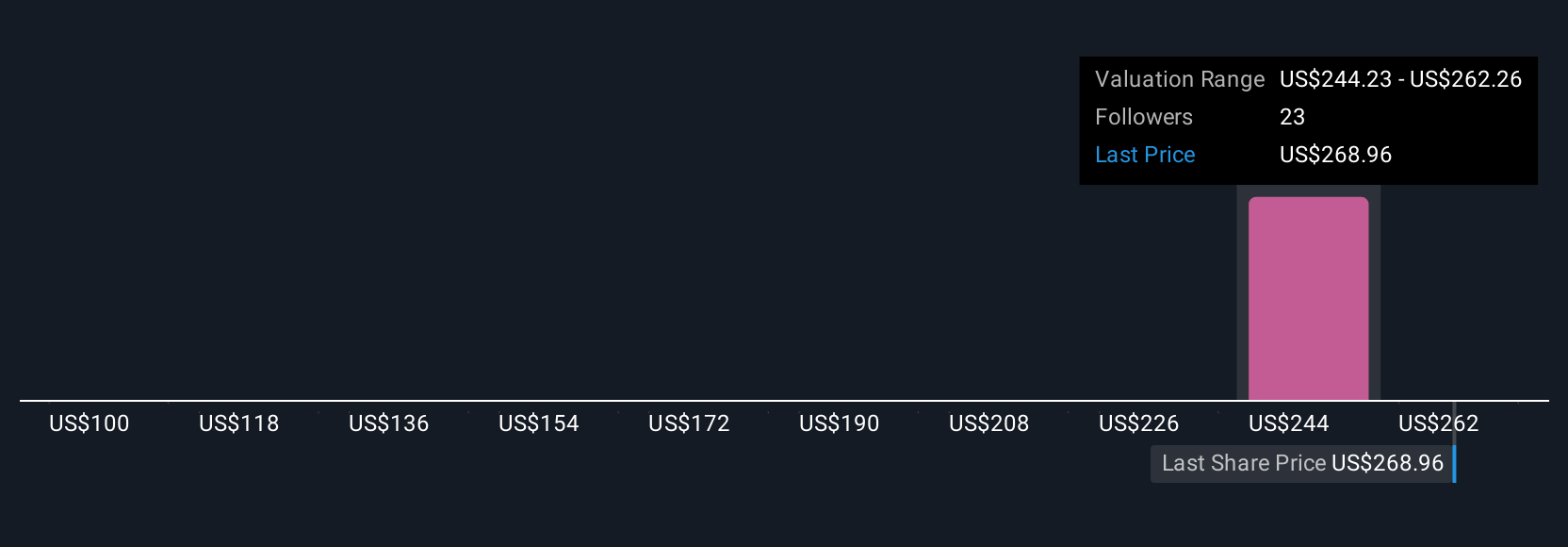

Four different Simply Wall St Community fair value estimates for Hilton range from US$100 to US$280.29, reflecting significantly varied outlooks. While many anticipate gains from global hotel expansion, macroeconomic risks and shifting institutional attention may challenge near-term performance, explore these differing views to shape your own understanding.

Build Your Own Hilton Worldwide Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hilton Worldwide Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Hilton Worldwide Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hilton Worldwide Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 24 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hilton Worldwide Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HLT

Hilton Worldwide Holdings

A hospitality company, engages in managing, franchising, owning, and leasing hotels and resorts.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives