- United States

- /

- Hospitality

- /

- NYSE:HLT

Hilton (HLT) Is Up 7.0% After Launching New Diamond Reserve Tier—Has the Loyalty Strategy Paid Off?

Reviewed by Sasha Jovanovic

- Earlier this month, Hilton Worldwide Holdings announced significant updates to its Hilton Honors loyalty program, introducing a new elite Diamond Reserve tier and expanded benefits set to launch in January.

- This move offers both easier access to elevated status levels and broader luxury hotel options, reflecting Hilton’s efforts to enhance guest loyalty amid rising competition in premium travel.

- We’ll examine how the launch of the Diamond Reserve tier and program enhancements may influence Hilton’s positioning and long-term growth outlook.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Hilton Worldwide Holdings Investment Narrative Recap

Staying invested in Hilton Worldwide Holdings means having conviction in Hilton’s ability to capture premium travel demand and expand its loyalty-led guest ecosystem. The recent Hilton Honors program enhancements could aid short-term customer retention and growth, though competitive pressures and sluggish RevPAR in certain key markets remain the biggest headwinds to watch. While these updates may support loyalty and brand differentiation, the most significant near-term catalyst still hinges on broader improvement in core travel demand and revenue per available room; the risk tied to structural demand shifts in business and group travel is largely unchanged by this news.

Among recent developments, Hilton’s rapid expansion of its development pipeline, with 510,000 rooms underway and notable new properties in Asia-Pacific and lifestyle segments, stands out. This growth strategy aligns with efforts to scale Hilton Honors and leverage loyalty program momentum, supporting the company’s ambition to drive long-term topline gains through new markets and customer segments.

But on the other hand, investors should be aware of the persistent risk that if group or business travel demand remains soft, Hilton’s…

Read the full narrative on Hilton Worldwide Holdings (it's free!)

Hilton Worldwide Holdings is projected to achieve $14.8 billion in revenue and $2.5 billion in earnings by 2028. This forecast relies on a 45.4% annual revenue growth rate and a $0.9 billion increase in earnings from the current $1.6 billion.

Uncover how Hilton Worldwide Holdings' forecasts yield a $281.83 fair value, in line with its current price.

Exploring Other Perspectives

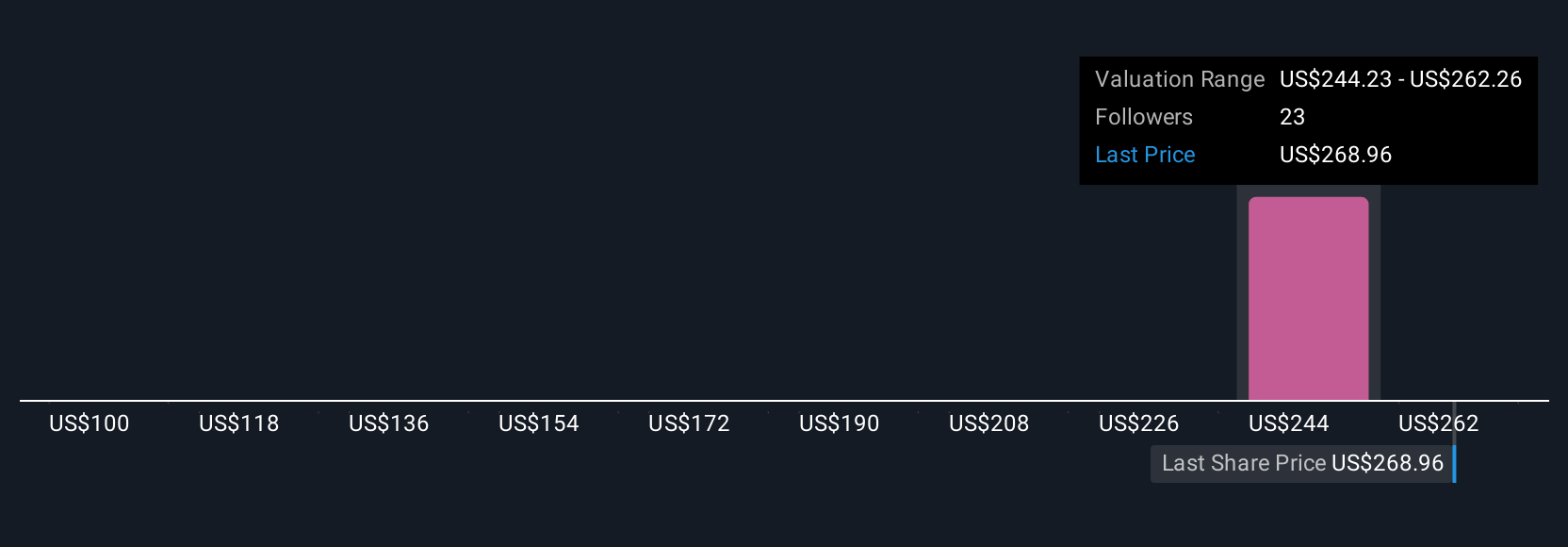

Three distinct fair value estimates from the Simply Wall St Community range from US$168.69 to US$281.83. With core demand segments facing uncertainty, consider how your outlook compares before forming an opinion.

Explore 3 other fair value estimates on Hilton Worldwide Holdings - why the stock might be worth 41% less than the current price!

Build Your Own Hilton Worldwide Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hilton Worldwide Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Hilton Worldwide Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hilton Worldwide Holdings' overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hilton Worldwide Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HLT

Hilton Worldwide Holdings

A hospitality company, engages in managing, franchising, owning, and leasing hotels and resorts.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success