- United States

- /

- Hospitality

- /

- NYSE:HGV

Hilton Grand Vacations (HGV) One-Off $137M Loss Reinforces Concerns Over High Valuation and Profit Trends

Reviewed by Simply Wall St

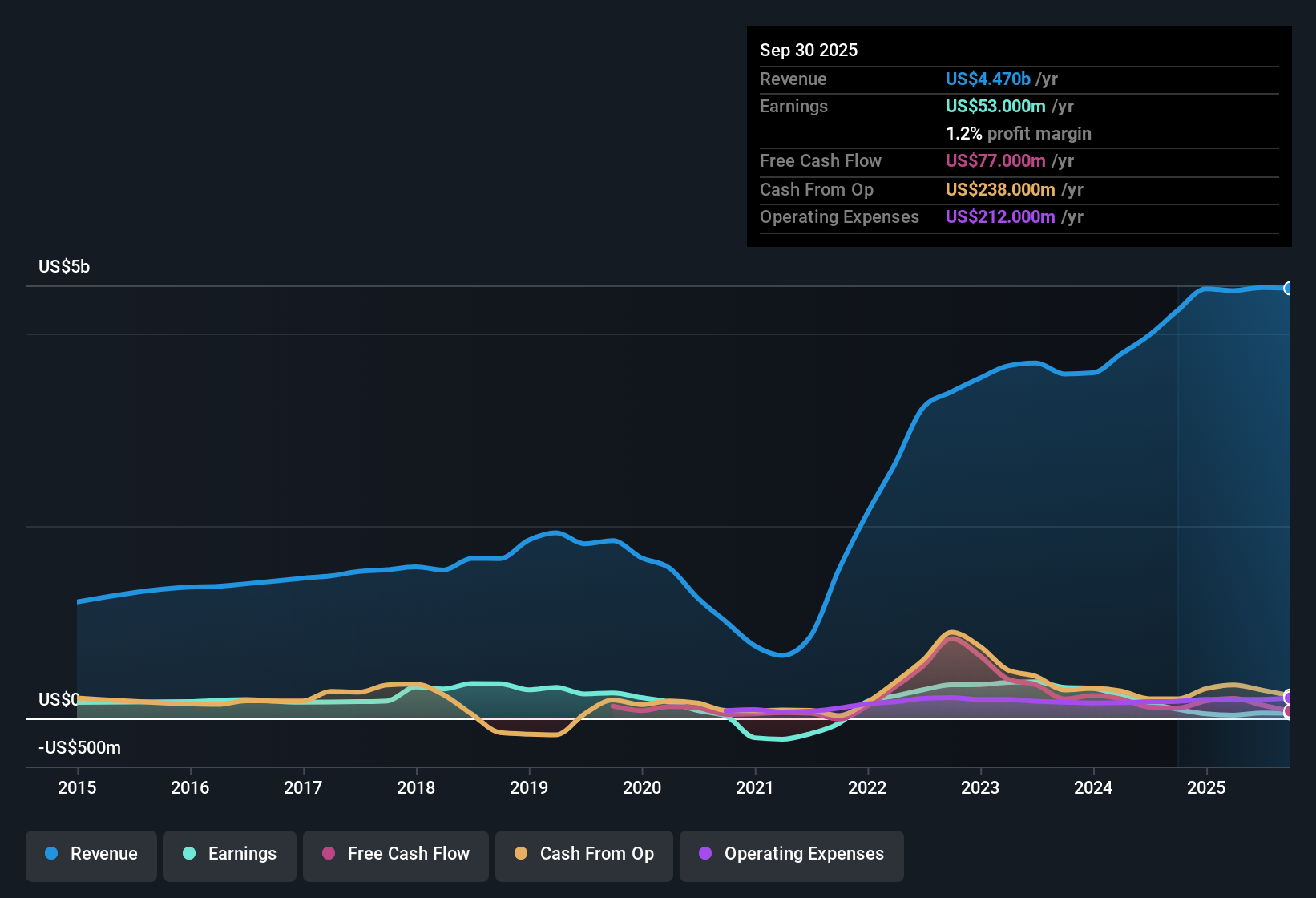

Hilton Grand Vacations (HGV) posted revenue growth of 5.7% per year, trailing the broader US market’s 10.3% pace. Net profit margins compressed to 1.3% from 4% as the company absorbed a one-off loss of $137.0 million in the twelve months ending September 30, 2025, reversing its five-year trend of 22.8% annual earnings growth into negative territory for the latest year. With shares trading at $41.22 and a Price-to-Earnings multiple of 63.7x, which is well above industry and peer averages, investors are weighing slowing growth and profitability against premium pricing and recent one-off losses.

See our full analysis for Hilton Grand Vacations.Next, we’ll see how these headline results compare with the prevailing market narratives, evaluating whether the numbers back up the story or challenge it.

See what the community is saying about Hilton Grand Vacations

Profit Margin Pressure Persists at 1.3%

- Net profit margin fell further from a recent 4% level to 1.3%, highlighting a major shift in overall profitability in the most recent twelve months ending September 30, 2025.

- Analysts' consensus view expects margin expansion to 12.3% within three years, which stands in contrast to the current compression.

- This turnaround relies on stronger contract sales and successful integration of Bluegreen and Diamond Resorts, catering to rising member loyalty and premium product offerings.

- On the other hand, the reliance on risky customer loans and a higher allowance for bad debt (27% of gross receivables) poses a threat to both profit recovery and long-term balance sheet quality.

One-off $137 Million Loss Distorts Recent Performance

- Hilton Grand Vacations reported a one-time loss of $137.0 million, which disrupted what had been a five-year stretch of 22.8% annual earnings growth, reversing momentum and driving negative earnings for the year.

- Bears argue this outsized charge casts doubt on operational resilience and magnifies current risks around acquisition integration and market concentration.

- Concern centers on the company’s exposure to volatile markets like Las Vegas and the possibility that execution missteps on integrating big deals could lead to further non-recurring costs or margin pressure.

- Persistent softness in new owner growth (up just 0.6%) and an uptick in lower-margin, fee-for-service sales also support this cautious view.

Valuation Premium: PE at 63.7x vs Industry 23.7x

- Shares trade for a substantial premium, with Price-to-Earnings at 63.7x, far higher than both the hospitality sector average (23.7x) and immediate peers (12.2x). The current price ($41.22) is also well above DCF fair value of $30.42.

- Analysts' consensus points out that the current valuation seems justified only if revenue growth accelerates to 12.6% annually and margins expand sharply, both assumptions that may be tested by the company’s ability to manage recent risks.

- Consensus price target is $53.22, or about 29% above current price, but outcome depends on executing cost efficiencies, reducing debt risks, and achieving projected EPS of $10.84 by 2028.

- With negative earnings growth just reported, achieving the necessary PE compression to 6.7x on future earnings will be challenging if near-term profitability and market trends do not quickly improve.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Hilton Grand Vacations on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique interpretation of the results? Share your outlook and craft your own market narrative in just a few minutes: Do it your way

A great starting point for your Hilton Grand Vacations research is our analysis highlighting 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Hilton Grand Vacations faces pressure from compressed profit margins, a one-off loss, elevated debt risk, and valuation concerns that are well above industry norms.

If you want more compelling value and lower risk from your investments, focus on these 848 undervalued stocks based on cash flows to target stocks trading at better prices with fundamentals that support stronger long-term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hilton Grand Vacations might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HGV

Hilton Grand Vacations

Develops, markets, sells, manages, and operates the resorts, timeshare plans, and ancillary reservation services under the Hilton Grand Vacations brand in the United States and Europe.

Low risk with concerning outlook.

Similar Companies

Market Insights

Community Narratives