- United States

- /

- Hospitality

- /

- NYSE:HGV

Hilton Grand Vacations (HGV) Is Down 8.4% After Margin Slump and Large Buybacks Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- Hilton Grand Vacations recently reported third-quarter results showing revenue of US$1.3 billion and net income of US$25 million, missing analyst expectations and reflecting a sharp decline in operating margin.

- The company also completed major share repurchase programs totaling nearly US$570 million in the past quarter, reducing its share count by over 15% since August 2024.

- We'll examine how Hilton Grand Vacations' earnings miss and ongoing buybacks could alter its previously positive investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Hilton Grand Vacations Investment Narrative Recap

To invest in Hilton Grand Vacations, you need to believe that the company can leverage its premium timeshare model and member engagement programs, especially HGV Max and the Diamond/Bluegreen integrations, to drive continued contract sales growth, despite current financial headwinds. The recent earnings miss directly impacts the stock’s short-term narrative as it has heightened concerns about profitability, particularly with the sharp collapse in operating margin, while the company’s largest risk continues to be potential increases in bad debt allowance if consumer delinquencies rise. If short-term financial performance remains weak, it could overshadow even the most promising catalysts like expanding member offerings.

The most relevant recent announcement is the company’s completion of nearly US$570 million in share buybacks since August 2024, reducing Hilton Grand Vacations’ share count by over 15%. While buybacks can improve per-share metrics and signal management’s focus on returning capital to shareholders, the magnitude and timing of this program now stands in stark contrast to the soft operating results just reported, bringing the company’s capital allocation priorities into sharper focus amid margin pressures.

In contrast, investors should be aware that continued pressure on repayment rates and the allowance for bad debt could...

Read the full narrative on Hilton Grand Vacations (it's free!)

Hilton Grand Vacations' narrative projects $6.4 billion in revenue and $785.5 million in earnings by 2028. This requires 12.6% yearly revenue growth and a $728.5 million earnings increase from the current $57.0 million.

Uncover how Hilton Grand Vacations' forecasts yield a $53.44 fair value, a 29% upside to its current price.

Exploring Other Perspectives

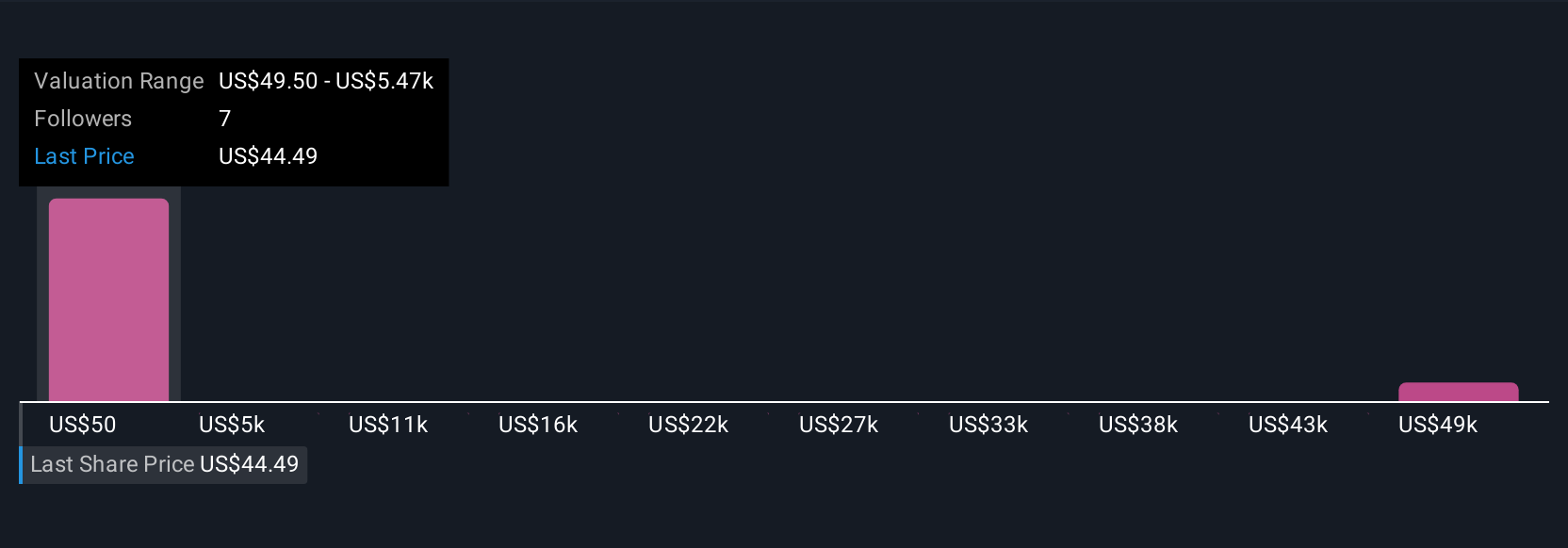

Simply Wall St Community opinions on HGV’s fair value span from US$53 to over US$54,000, based on four unique analyses. With bad debt risks rising after recent results, these contrasting viewpoints signal why it pays to examine more than one angle on future performance.

Explore 4 other fair value estimates on Hilton Grand Vacations - why the stock might be worth just $53.44!

Build Your Own Hilton Grand Vacations Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hilton Grand Vacations research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Hilton Grand Vacations research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hilton Grand Vacations' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hilton Grand Vacations might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HGV

Hilton Grand Vacations

Develops, markets, sells, manages, and operates the resorts, timeshare plans, and ancillary reservation services under the Hilton Grand Vacations brand in the United States and Europe.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives