- United States

- /

- Diversified Financial

- /

- NYSE:GHLD

3 Growth Companies Insiders Are Betting On

Reviewed by Simply Wall St

As the U.S. stock market continues to rally, with major indices like the Dow and S&P 500 setting fresh records despite economic uncertainties such as a government shutdown, investors are keenly observing where insiders are placing their bets. In this climate of optimism and resilience, companies with high insider ownership can be particularly appealing as they often indicate confidence in future growth potential from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Upstart Holdings (UPST) | 12.6% | 93.2% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| IREN (IREN) | 11.2% | 67.4% |

| Hippo Holdings (HIPO) | 14.0% | 41.2% |

| Hesai Group (HSAI) | 14.9% | 41.5% |

| FTC Solar (FTCI) | 23.1% | 63% |

| Credo Technology Group Holding (CRDO) | 11.3% | 33.7% |

| Celsius Holdings (CELH) | 10.8% | 32% |

| Atour Lifestyle Holdings (ATAT) | 18.2% | 23.5% |

| Astera Labs (ALAB) | 12.1% | 36.8% |

We're going to check out a few of the best picks from our screener tool.

Bitdeer Technologies Group (BTDR)

Simply Wall St Growth Rating: ★★★★★☆

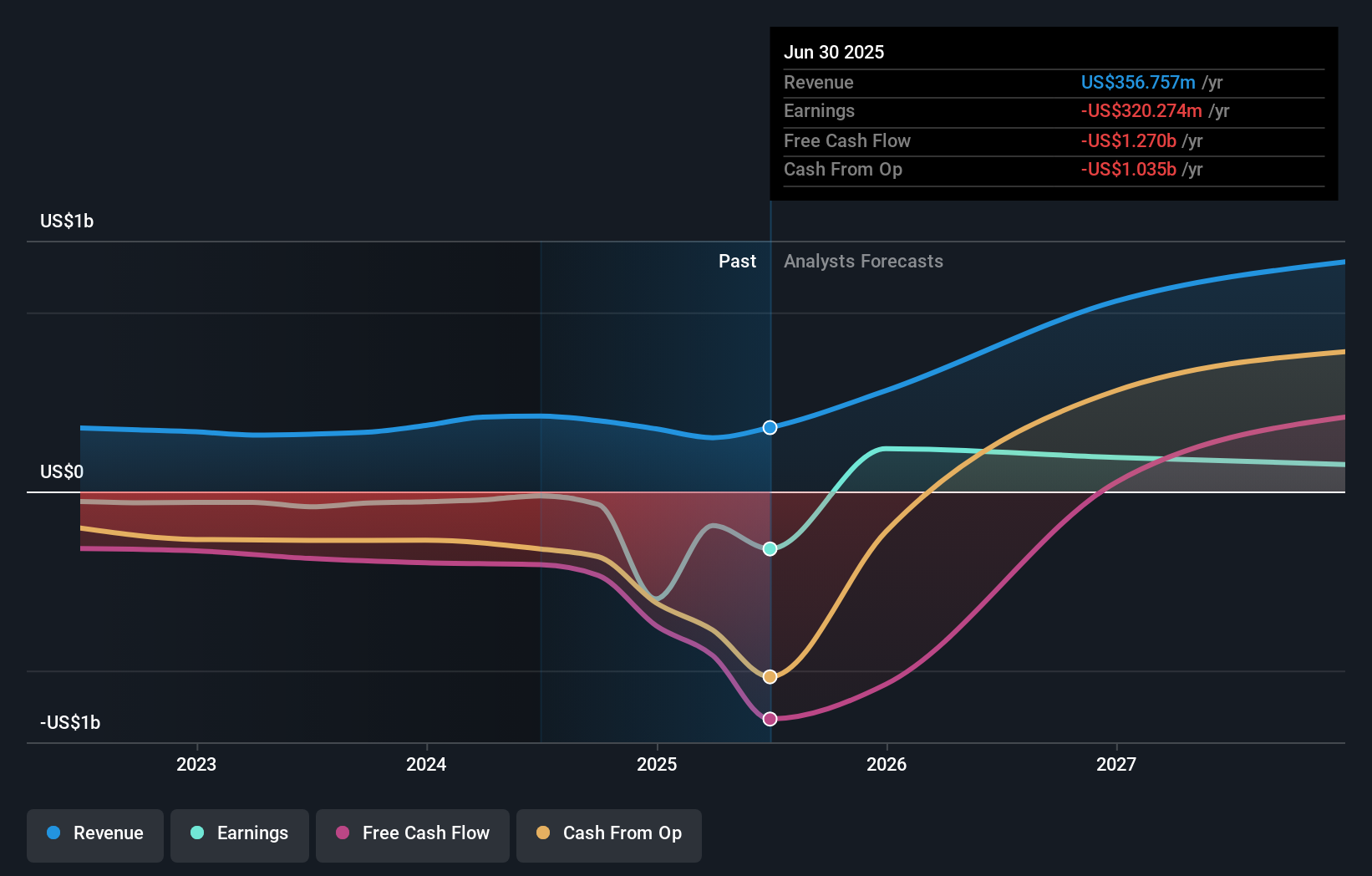

Overview: Bitdeer Technologies Group is a technology company specializing in blockchain and high-performance computing (HPC) with operations in Singapore, the United States, Bhutan, and Norway, and has a market cap of $3.62 billion.

Operations: The company generates revenue primarily from its data processing segment, which amounts to $356.76 million.

Insider Ownership: 37.3%

Bitdeer Technologies Group is expected to achieve profitability within three years, with revenue growth forecasted at 52.3% annually, surpassing the US market average. Despite a volatile share price and past shareholder dilution, it trades significantly below its estimated fair value. Recent product advancements in Bitcoin mining equipment highlight increased efficiency and reduced operational costs. However, financial stability concerns persist due to limited cash runway and historical net losses despite rising revenues.

- Take a closer look at Bitdeer Technologies Group's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Bitdeer Technologies Group is trading behind its estimated value.

Guild Holdings (GHLD)

Simply Wall St Growth Rating: ★★★★☆☆

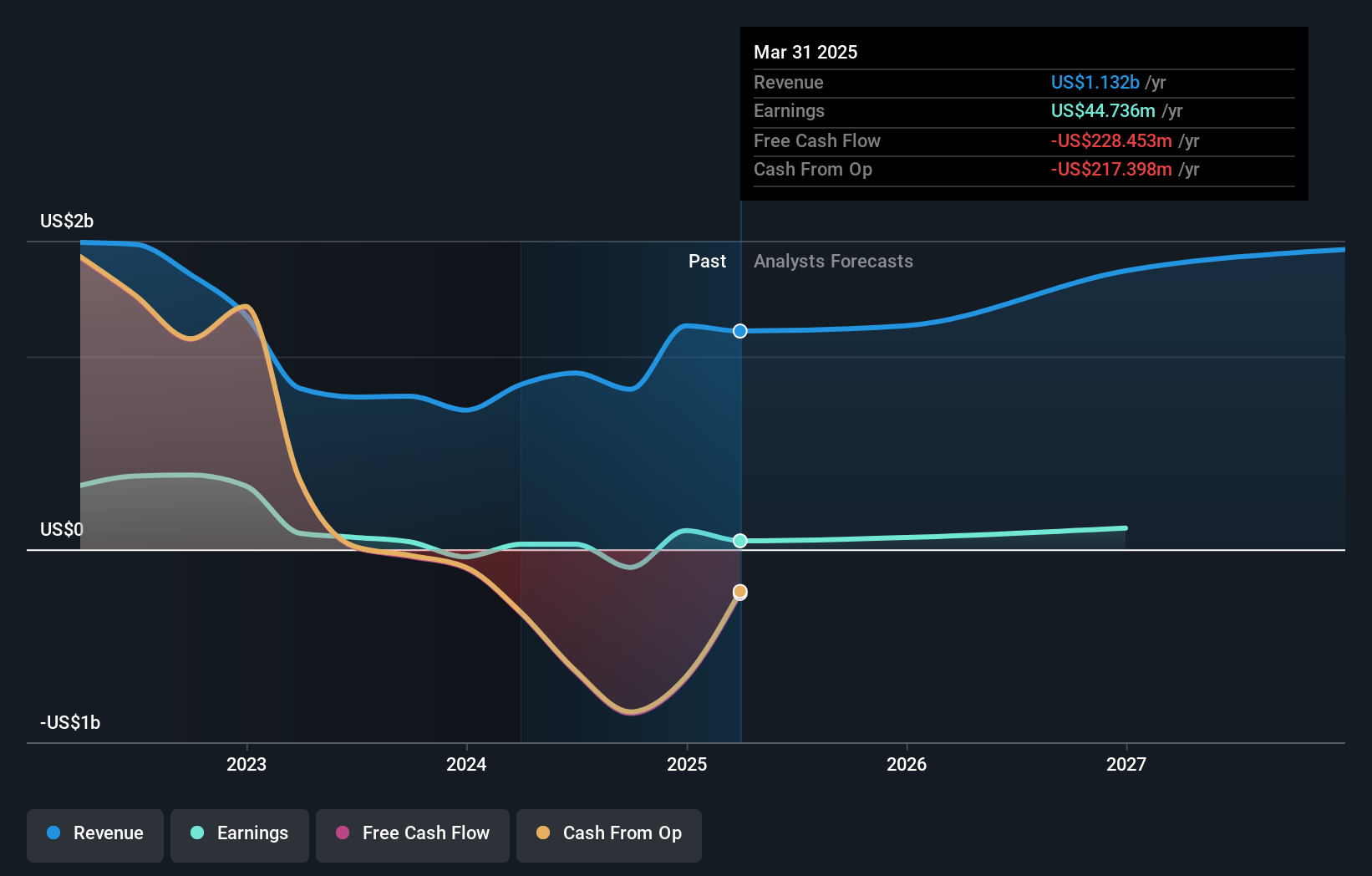

Overview: Guild Holdings Company, with a market cap of $1.24 billion, operates in the United States through its subsidiary to originate, sell, and service residential mortgage loans.

Operations: The company's revenue segments include $862.76 million from origination and $115.26 million from servicing residential mortgage loans in the United States.

Insider Ownership: 11.5%

Guild Holdings is experiencing challenges with declining revenue and net income, as evidenced by its recent earnings report. Despite this, its earnings are forecasted to grow significantly at 59.2% annually, outpacing the US market average. Revenue growth is also expected to exceed the market rate at 14.1% per year. The company declared a special dividend of $0.25 per share and completed a share buyback program, reflecting efforts to return value to shareholders amidst financial hurdles like low return on equity forecasts and inadequate interest coverage from earnings.

- Unlock comprehensive insights into our analysis of Guild Holdings stock in this growth report.

- Our comprehensive valuation report raises the possibility that Guild Holdings is priced higher than what may be justified by its financials.

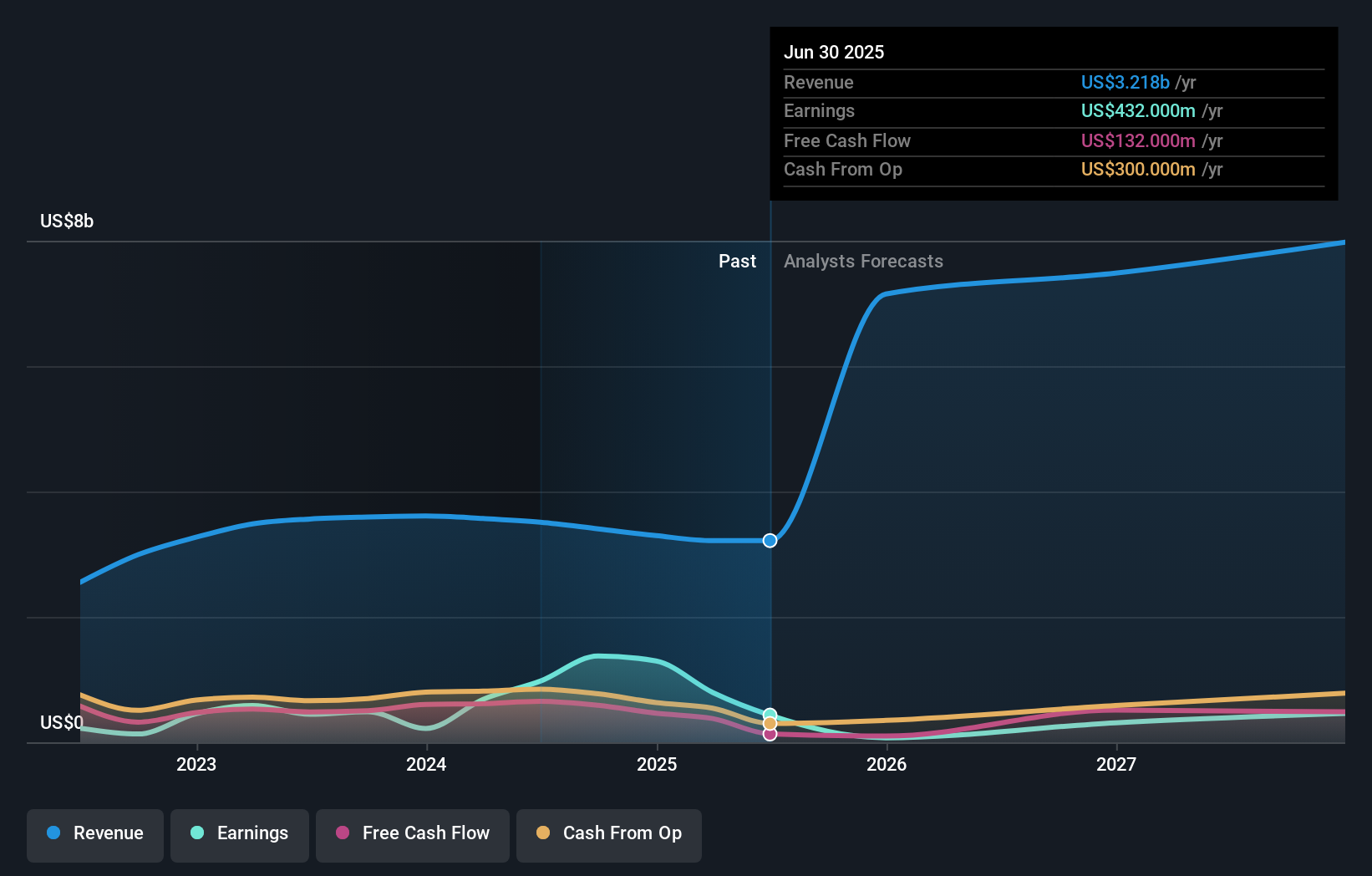

Hyatt Hotels (H)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hyatt Hotels Corporation is a hospitality company that operates both in the United States and internationally, with a market capitalization of approximately $13.55 billion.

Operations: Hyatt's revenue segments include Distribution at $1 billion, Owned and Leased at $1.09 billion, and Management and Franchising at $1.18 billion.

Insider Ownership: 11.3%

Hyatt Hotels is poised for significant earnings growth of 20.7% annually, surpassing the US market average. Despite recent financial challenges, including a net loss and reduced profit margins, Hyatt's strategic global expansion under the Park Hyatt brand aims to bolster revenue growth at 18.3% per year, outpacing market expectations. Insider transactions have seen more shares bought than sold recently, indicating confidence in its long-term potential amidst ongoing business developments and strategic initiatives.

- Dive into the specifics of Hyatt Hotels here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, Hyatt Hotels' share price might be too optimistic.

Seize The Opportunity

- Reveal the 202 hidden gems among our Fast Growing US Companies With High Insider Ownership screener with a single click here.

- Seeking Other Investments? Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GHLD

Guild Holdings

Through its subsidiary, originates, sells, and services residential mortgage loans in the United States.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives