Almirall And Two Additional Stocks Considered Below Estimated Market Value

Reviewed by Simply Wall St

Amidst a complex landscape where global markets display mixed signals, investors are increasingly turning their attention to value and small-cap stocks. This shift comes as major indices like the Dow Jones Industrial Average see notable performance, highlighting a growing divergence from growth stocks which have recently underperformed. In such an environment, identifying undervalued stocks becomes crucial. These are shares that trade below what they are fundamentally worth, offering potential for significant returns when the market corrects these discrepancies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vente-Unique.com (ENXTPA:ALVU) | €15.50 | €30.85 | 49.8% |

| Sachem Capital (NYSEAM:SACH) | US$2.65 | US$5.29 | 49.9% |

| Cyber Security Cloud (TSE:4493) | ¥2172.00 | ¥4319.25 | 49.7% |

| Duckhorn Portfolio (NYSE:NAPA) | US$7.20 | US$14.40 | 50% |

| Kraken Robotics (TSXV:PNG) | CA$1.12 | CA$2.24 | 49.9% |

| IPH (ASX:IPH) | A$5.91 | A$11.80 | 49.9% |

| Calnex Solutions (AIM:CLX) | £0.49 | £0.98 | 49.8% |

| ArcticZymes Technologies (OB:AZT) | NOK24.30 | NOK48.56 | 50% |

| INKON Life Technology (SZSE:300143) | CN¥7.36 | CN¥14.64 | 49.7% |

| SBF (DB:CY1K) | €2.86 | €5.69 | 49.7% |

Here's a peek at a few of the choices from the screener.

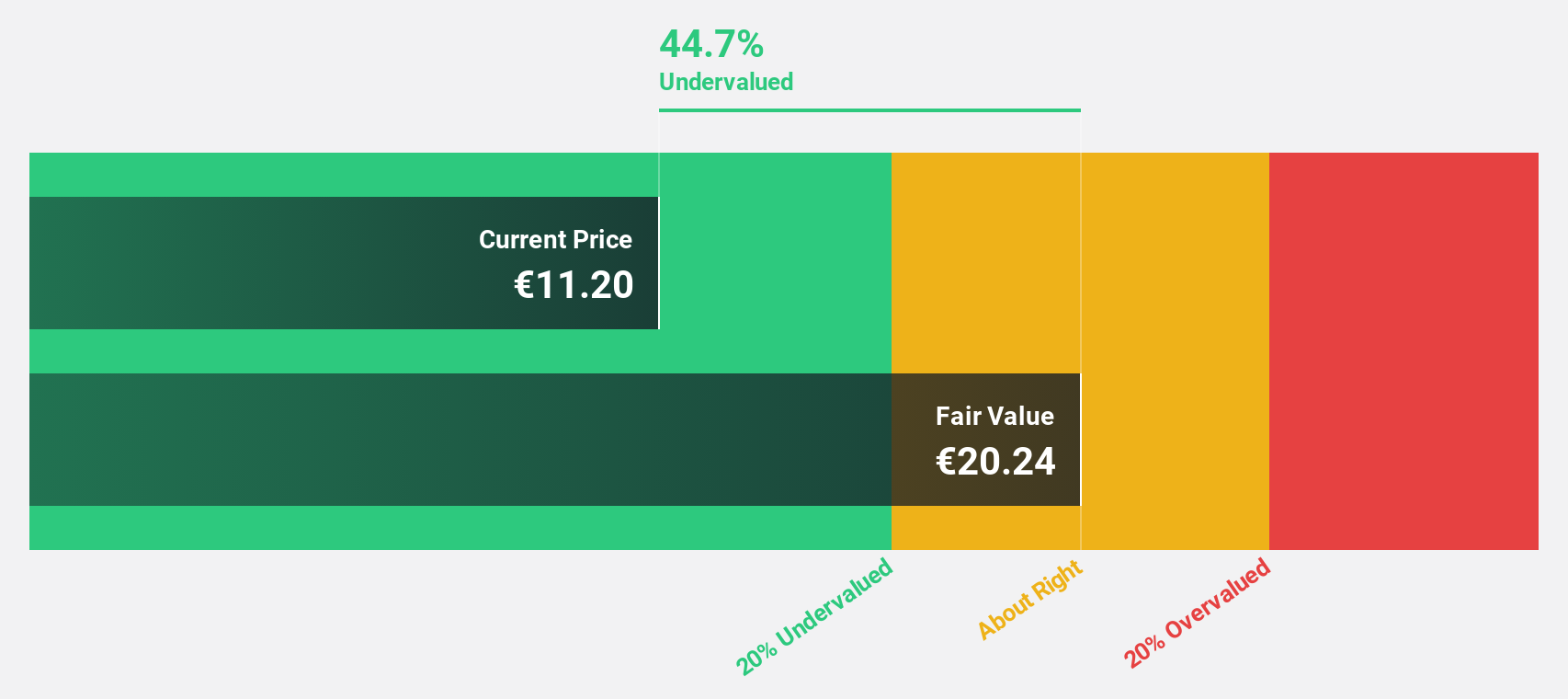

Almirall (BME:ALM)

Overview: Almirall, S.A. is a biopharmaceutical company focused on the development and distribution of skin-health medicines across Europe, the Middle East, the United States, Asia, and Africa, with a market capitalization of approximately €2.05 billion.

Operations: The company generates revenue from the sale of skin-health medicines across various global regions including Europe, the Middle East, the United States, Asia, and Africa.

Estimated Discount To Fair Value: 44.2%

Almirall, despite its modest recent financial performance with a net income of €15.39 million for H1 2024, is considered undervalued based on cash flows. The company's stock price is trading significantly below the estimated fair value and analysts expect a substantial rise in the stock price. While Almirall's revenue growth forecast at 9.8% per year may not be stellar, it is expected to outpace the Spanish market's growth. Additionally, Almirall has reiterated its guidance for high single-digit sales growth and an EBITDA between €175 million and €190 million for FY 2024, indicating stability in its financial outlook.

- Insights from our recent growth report point to a promising forecast for Almirall's business outlook.

- Take a closer look at Almirall's balance sheet health here in our report.

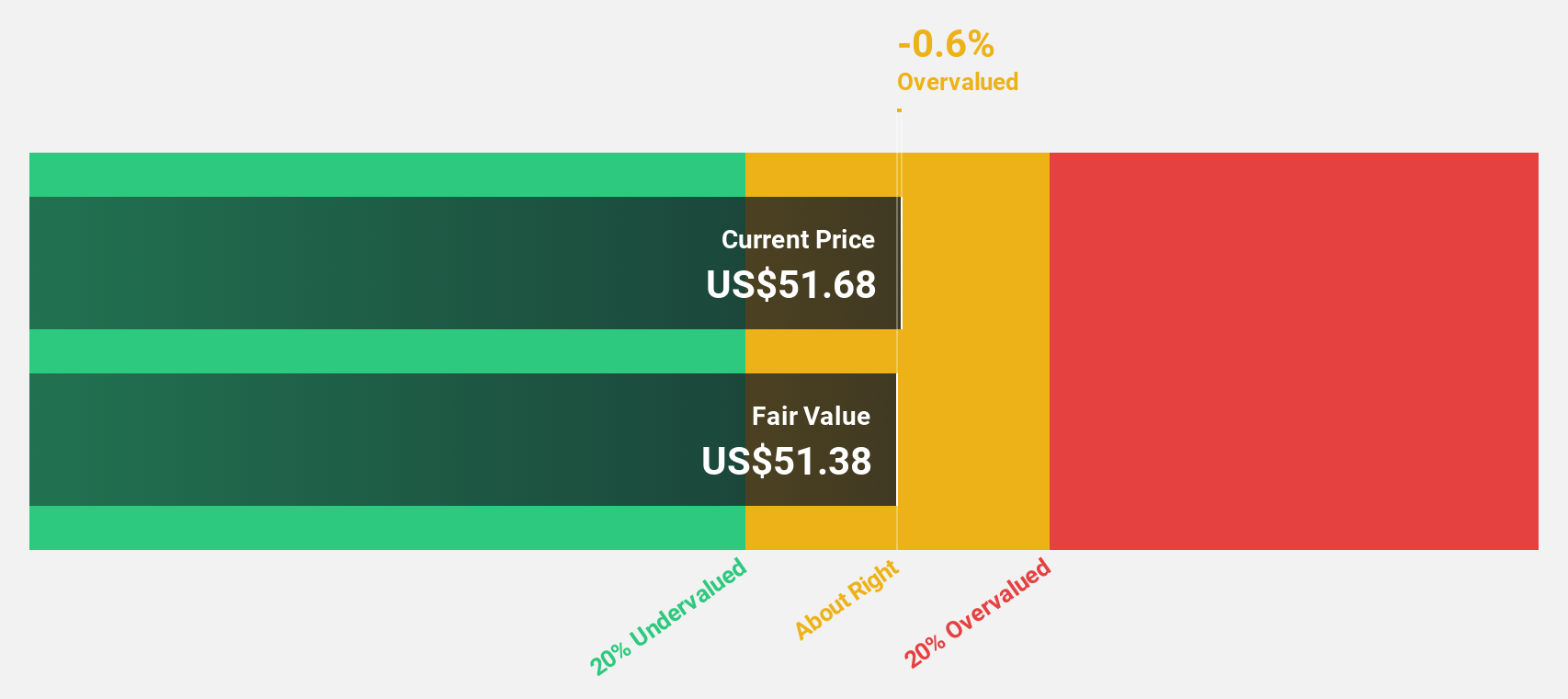

Flex (NasdaqGS:FLEX)

Overview: Flex Ltd. offers manufacturing solutions across multiple sectors, operating in Asia, the Americas, and Europe, with a market capitalization of approximately $11.85 billion.

Operations: The company's revenue is primarily derived from two segments: Flex Agility Solutions at $13.92 billion and Flex Reliability Solutions at $12.49 billion.

Estimated Discount To Fair Value: 32.5%

Flex Ltd. recently reported a dip in quarterly sales and net income, but its stock appears undervalued based on cash flow analysis, trading at US$31.76 against an estimated fair value of US$47.08. Despite slower revenue growth projections of 2.4% per year compared to the broader U.S. market, Flex's earnings are expected to grow significantly at 20.1% annually over the next three years, outpacing the U.S market forecast of 14.8%. The company also faces challenges with executive transitions as it seeks a new CFO following Paul Lundstrom's departure.

- The analysis detailed in our Flex growth report hints at robust future financial performance.

- Get an in-depth perspective on Flex's balance sheet by reading our health report here.

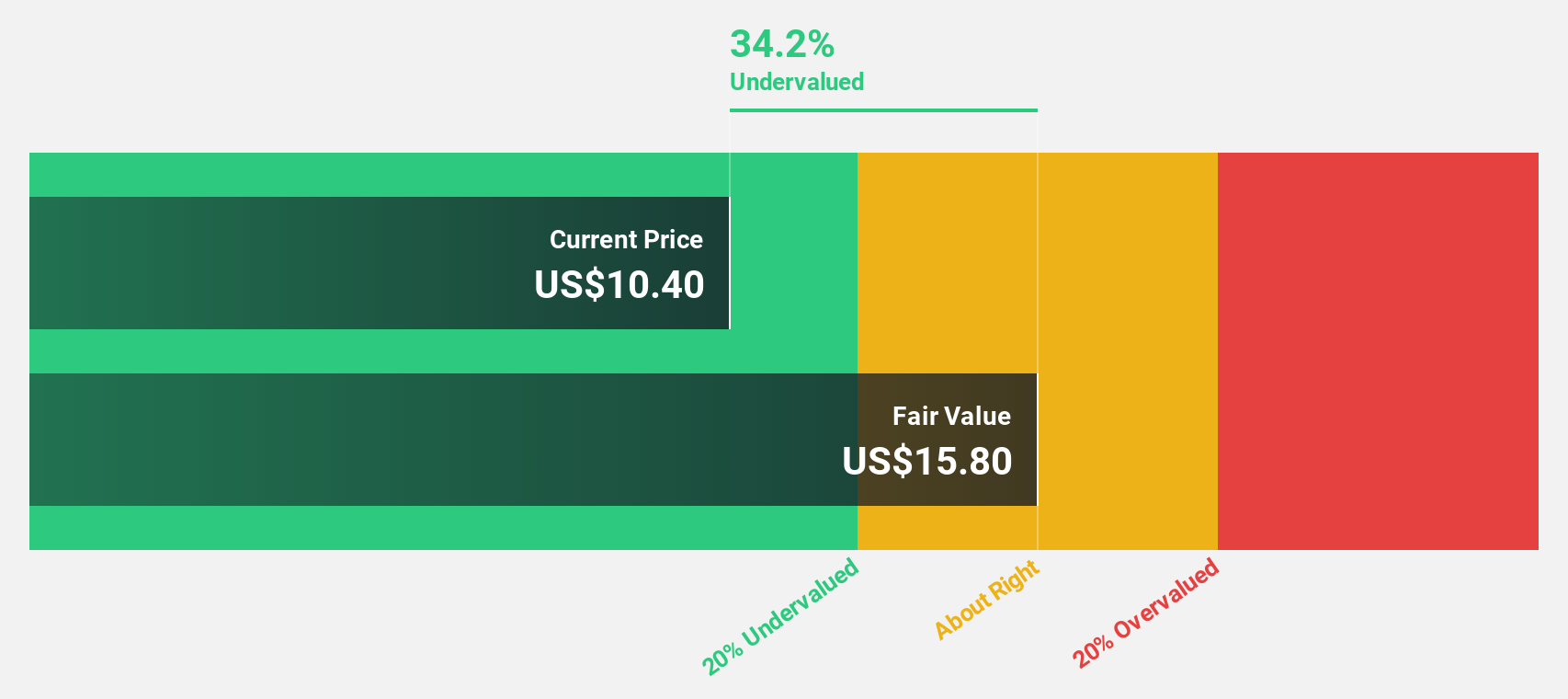

Genius Sports (NYSE:GENI)

Overview: Genius Sports Limited specializes in providing technology-driven products and services to the sports, sports betting, and sports media industries, with a market capitalization of approximately $1.42 billion.

Operations: The company generates revenue primarily through its data processing segment, which earned $435.47 million.

Estimated Discount To Fair Value: 46.2%

Genius Sports, currently trading at US$6.72 against a fair value of US$12.49, appears undervalued based on cash flow metrics. Despite a net loss of US$25.54 million in Q1 2024, the company is expected to become profitable within three years with forecasted revenue growth outpacing the U.S market at 13.4% annually. Recent executive board enhancements and strategic guidance suggest a robust approach towards operational excellence and market expansion, supporting its potential for valuation correction and profitability.

- According our earnings growth report, there's an indication that Genius Sports might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of Genius Sports.

Where To Now?

- Gain an insight into the universe of 982 Undervalued Stocks Based On Cash Flows by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:ALM

Almirall

Operates as a skin health-focused biopharmaceutical company in Spain, Europe, the Middle East, the United States, Asia, and Africa.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives