- United States

- /

- Hospitality

- /

- NYSE:GENI

### 3 US Growth Stocks With Insider Ownership And Up To 114% Earnings Growth ###

Reviewed by Simply Wall St

As the S&P 500 and Nasdaq Composite look to extend their winning streaks, investor sentiment appears buoyed by positive economic data and strong earnings reports. In this optimistic market environment, identifying growth companies with high insider ownership can be particularly compelling, as these firms often benefit from aligned interests between shareholders and management.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atlas Energy Solutions (NYSE:AESI) | 28.9% | 42.6% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.6% |

| PDD Holdings (NasdaqGS:PDD) | 32.1% | 21.8% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 24.1% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 12% | 32.1% |

| Hims & Hers Health (NYSE:HIMS) | 13.7% | 40.9% |

| On Holding (NYSE:ONON) | 28.4% | 24.7% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.4% | 60.9% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 74.9% |

| BBB Foods (NYSE:TBBB) | 22.9% | 70.7% |

Here we highlight a subset of our preferred stocks from the screener.

Fiverr International (NYSE:FVRR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Fiverr International Ltd. operates a global online marketplace and has a market cap of $820.75 million.

Operations: Fiverr generates revenue of $372.22 million from its Internet Software & Services segment.

Insider Ownership: 13.9%

Earnings Growth Forecast: 42.9% p.a.

Fiverr International, a growth company with high insider ownership, has seen significant earnings growth, becoming profitable this year with forecasts of 42.9% annual profit growth over the next three years. The company recently completed a $100 million share buyback and raised its revenue guidance for 2024 to between $383 million and $387 million. Analysts agree that the stock is trading below its fair value estimate by 25.5%, indicating potential for price appreciation.

- Get an in-depth perspective on Fiverr International's performance by reading our analyst estimates report here.

- The analysis detailed in our Fiverr International valuation report hints at an deflated share price compared to its estimated value.

Genius Sports (NYSE:GENI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Genius Sports Limited develops and sells technology-driven products and services for the sports, sports betting, and sports media industries, with a market cap of approximately $1.48 billion.

Operations: Genius Sports generates revenue primarily from its data processing segment, which brought in $444.07 million.

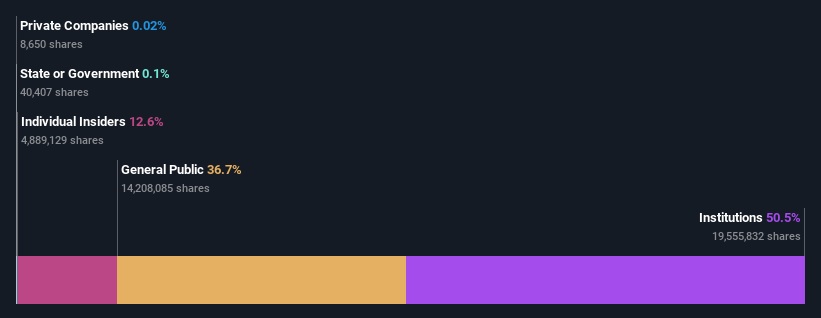

Insider Ownership: 11.9%

Earnings Growth Forecast: 76.6% p.a.

Genius Sports, with substantial insider ownership, is forecast to become profitable within three years and sees annual earnings growth of 76.62%. Recent launches like GeniusIQ, an AI-driven data platform enhancing sports analysis and fan engagement, underscore its innovative edge. Despite a net loss of US$21.79 million in Q2 2024, revenue grew to US$95.45 million from US$86.85 million year-over-year. The company expects full-year revenue of US$510 million for 2024, indicating robust growth potential.

- Take a closer look at Genius Sports' potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Genius Sports is trading behind its estimated value.

Similarweb (NYSE:SMWB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Similarweb Ltd. offers cloud-based digital intelligence solutions across multiple regions including the United States, Europe, the Asia Pacific, the United Kingdom, Israel, and internationally with a market cap of $646.60 million.

Operations: The company's revenue segment primarily consists of online financial information providers, generating $231.21 million.

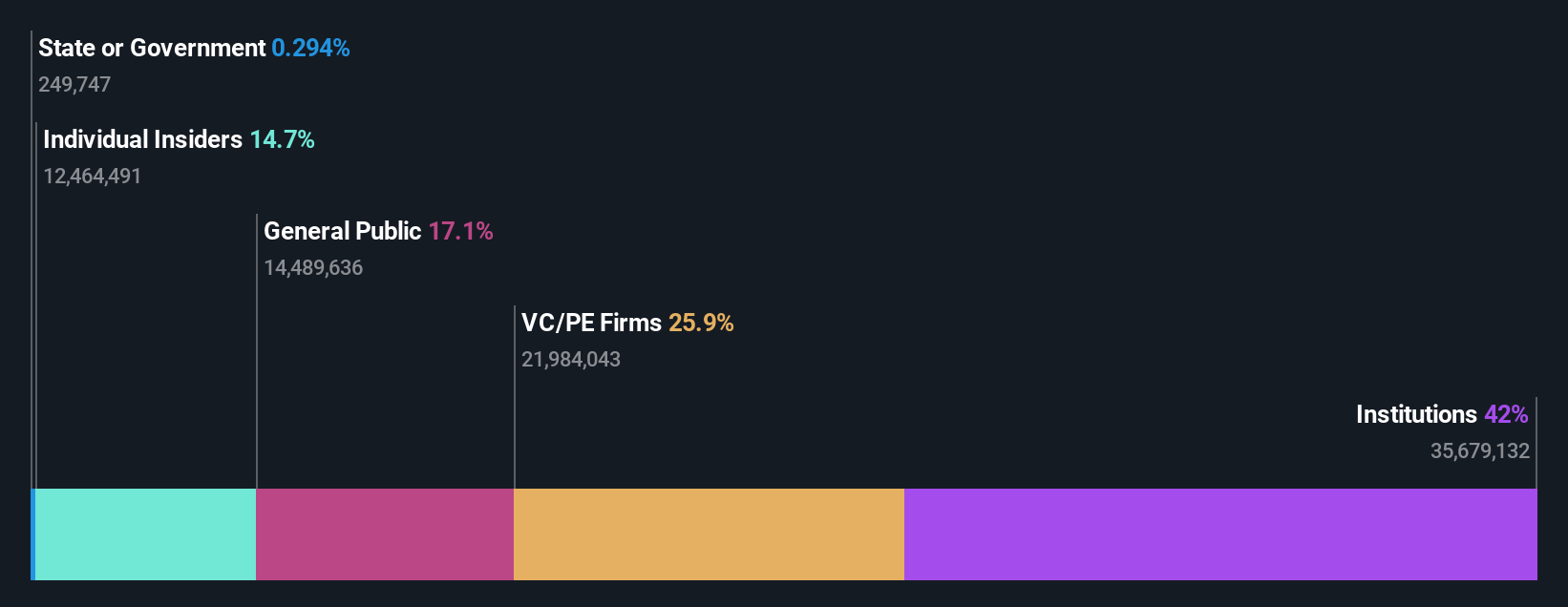

Insider Ownership: 25.6%

Earnings Growth Forecast: 114.9% p.a.

Similarweb, a growth company with high insider ownership, recently appointed Kipp Bodnar to its Board of Directors, enhancing its strategic direction. The company raised its full-year revenue guidance to US$246 million-US$248 million and reported Q2 2024 sales of US$60.64 million. Despite a net loss reduction from US$9.29 million to US$0.738 million year-over-year, the stock trades at 68.3% below estimated fair value and is forecasted to become profitable within three years with strong earnings growth prospects.

- Unlock comprehensive insights into our analysis of Similarweb stock in this growth report.

- Our valuation report unveils the possibility Similarweb's shares may be trading at a discount.

Make It Happen

- Embark on your investment journey to our 174 Fast Growing US Companies With High Insider Ownership selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GENI

Genius Sports

Engages in the development and sale of technology-led products and services to the sports, sports betting, and sports media industries.

Excellent balance sheet with reasonable growth potential.