- United States

- /

- Hospitality

- /

- NYSE:FUN

Has the Six Flags Stock Slide Gone Too Far in 2025?

Reviewed by Bailey Pemberton

- If you are wondering whether Six Flags Entertainment is a beaten down bargain or a value trap, you are in the right place to unpack what the current share price is really telling us.

- After a bruising slide that has the stock down 23.3% over the last month and about 67.3% year to date, even a modest 3.0% bounce in the last week raises the question of whether sentiment has finally swung too far.

- Investors have been reacting to a mix of headlines about debt loads, capital spending plans, and strategic moves to revive park attendance and pricing. All of these factors can meaningfully shift the narrative around future cash flows. At the same time, broader worries about consumer discretionary spending and higher financing costs have made the market more skeptical of highly cyclical, leveraged names like Six Flags.

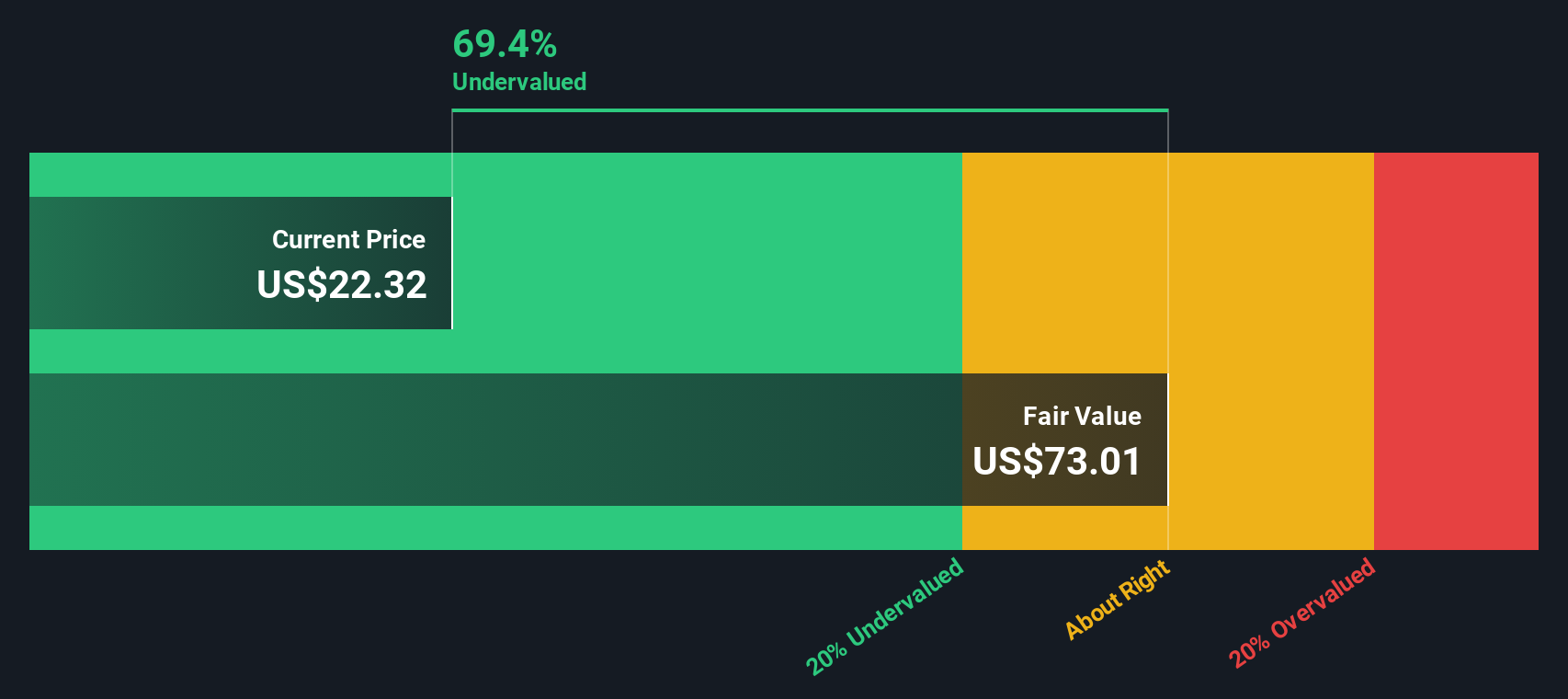

- Despite that negativity, our checks suggest Six Flags scores a solid 5/6 on valuation, hinting that the market might be underestimating its intrinsic value, at least on traditional metrics. Next we will walk through what different valuation approaches say about the stock, and then circle back to a more powerful way of thinking about value that ties all of those numbers into a single story.

Find out why Six Flags Entertainment's -66.9% return over the last year is lagging behind its peers.

Approach 1: Six Flags Entertainment Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting its future cash flows and then discounting those back to the present. For Six Flags Entertainment, the model used here is a 2 stage Free Cash Flow to Equity approach.

Six Flags is currently generating negative free cash flow of about $93.6 Million, reflecting heavy investment and pressure on near term profitability. However, analyst forecasts and extrapolations from Simply Wall St indicate a sharp recovery, with free cash flow expected to reach roughly $547 Million by 2029 and to reach about $854 Million by 2035. These projections combine a few years of explicit analyst estimates, followed by gradually moderating growth assumptions.

When these projected cash flows are discounted back to today, the DCF model produces an intrinsic value of about $58.50 per share. That suggests the stock is trading at roughly a 73.3% discount to this estimated fair value, indicating the market may be heavily discounting Six Flags future cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Six Flags Entertainment is undervalued by 73.3%. Track this in your watchlist or portfolio, or discover 908 more undervalued stocks based on cash flows.

Approach 2: Six Flags Entertainment Price vs Sales

For companies where current earnings are volatile or negative, the Price to Sales ratio is often a more reliable yardstick, because it focuses on the revenue engine that future profits will ultimately depend on. What investors are really deciding is how many dollars they are willing to pay today for each dollar of annual sales, and that answer shifts with growth expectations and perceived risk.

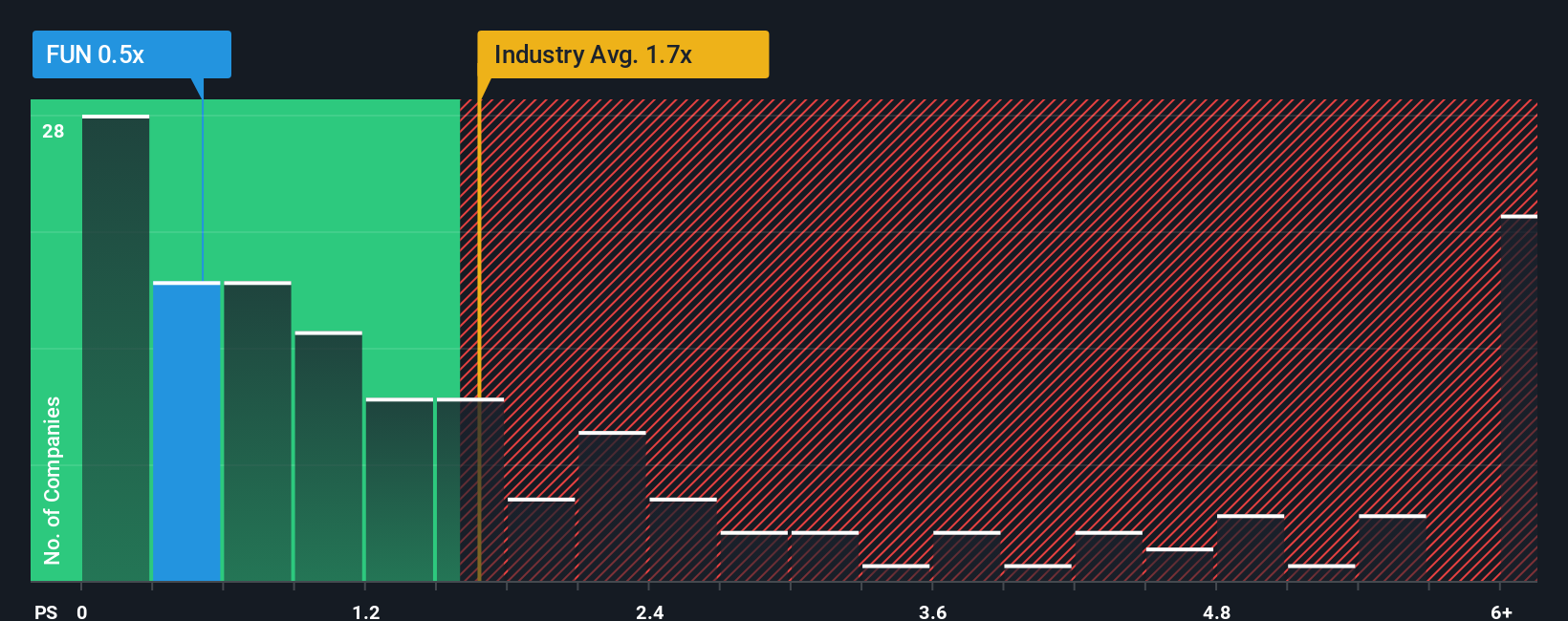

Six Flags is trading on a Price to Sales multiple of about 0.51x, which is well below both the hospitality industry average of roughly 1.66x and the peer group average of about 1.11x. On the surface, that discount suggests the market is skeptical about the durability of Six Flags revenue and margins. Simply Wall St tackles this by estimating a Fair Ratio of 0.91x, a proprietary view of what the multiple should be after factoring in the company’s growth outlook, profitability, risk profile, industry, and size.

Because the Fair Ratio of 0.91x sits meaningfully above the current 0.51x, the preferred multiple view lines up with the DCF work and points to a stock that looks too cheap relative to its fundamentals.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

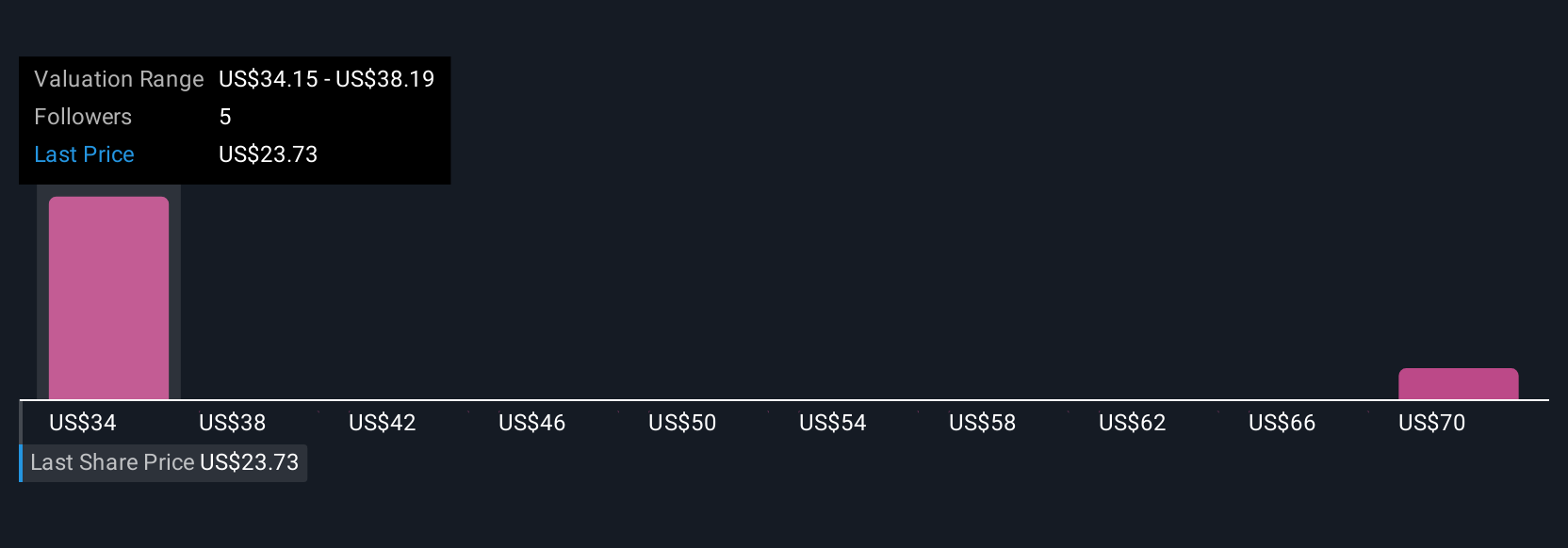

Upgrade Your Decision Making: Choose your Six Flags Entertainment Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework on Simply Wall St’s Community page that lets you turn your view of Six Flags Entertainment into a clear story. It connects assumptions about future revenue, earnings and margins to a forecast and then to a Fair Value. This can help you decide what the current price implies by comparing that Fair Value to the market price, with the numbers updating automatically as new news or earnings arrive. One investor might build a bullish Six Flags Narrative around activist pressure, a new CEO, the Cedar Fair merger and improving digital monetization, and use that to justify a higher fair value closer to the top analyst target of $43. Another might craft a more cautious Narrative focused on high leverage, weather risk and aging assets, and anchor fair value nearer the low end around $23. The platform makes it easy to see, compare and refine these different perspectives as conditions change.

Do you think there's more to the story for Six Flags Entertainment? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FUN

Six Flags Entertainment

Operates amusement parks and resort properties in North America.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026