- United States

- /

- Auto Components

- /

- NasdaqGS:HSAI

US Growth Stocks With High Insider Ownership For November 2024

Reviewed by Simply Wall St

As the U.S. stock market continues its impressive rally, with the S&P 500 and Dow Jones Industrial Average reaching record highs, investors are increasingly focused on identifying growth opportunities in this bullish environment. In such a climate, stocks with high insider ownership can be particularly appealing as they often indicate confidence from those closest to the company's operations and strategic direction.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.7% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| Duolingo (NasdaqGS:DUOL) | 14.6% | 41.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.6% |

| Coastal Financial (NasdaqGS:CCB) | 18% | 46.1% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Alkami Technology (NasdaqGS:ALKT) | 11% | 98.6% |

| BBB Foods (NYSE:TBBB) | 22.9% | 44.2% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.7% | 95% |

| Credit Acceptance (NasdaqGS:CACC) | 14.1% | 50% |

Here we highlight a subset of our preferred stocks from the screener.

Hesai Group (NasdaqGS:HSAI)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hesai Group develops, manufactures, and sells three-dimensional LiDAR solutions across Mainland China, Europe, North America, and other international markets with a market cap of approximately $605.52 million.

Operations: Revenue Segments (in millions of CN¥): Hesai Group's revenue is derived from its activities in developing, manufacturing, and selling three-dimensional LiDAR solutions across various regions including Mainland China, Europe, North America, and other international markets.

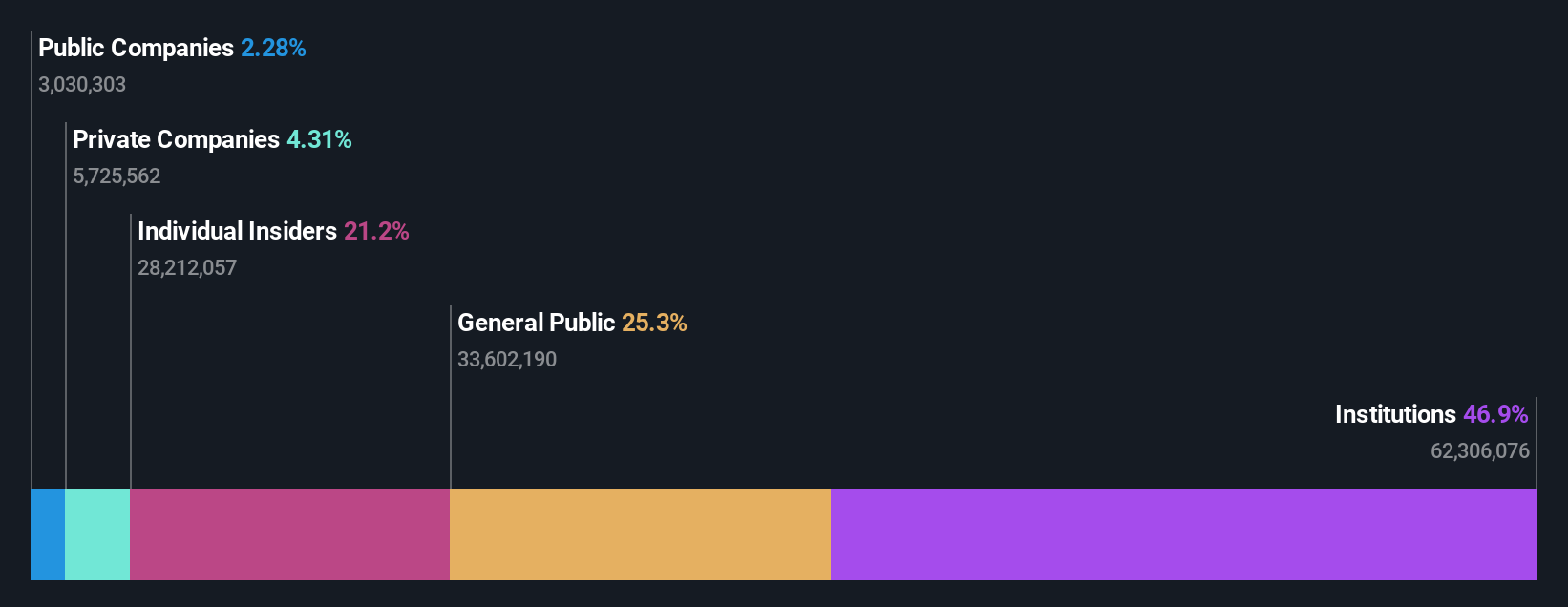

Insider Ownership: 24.4%

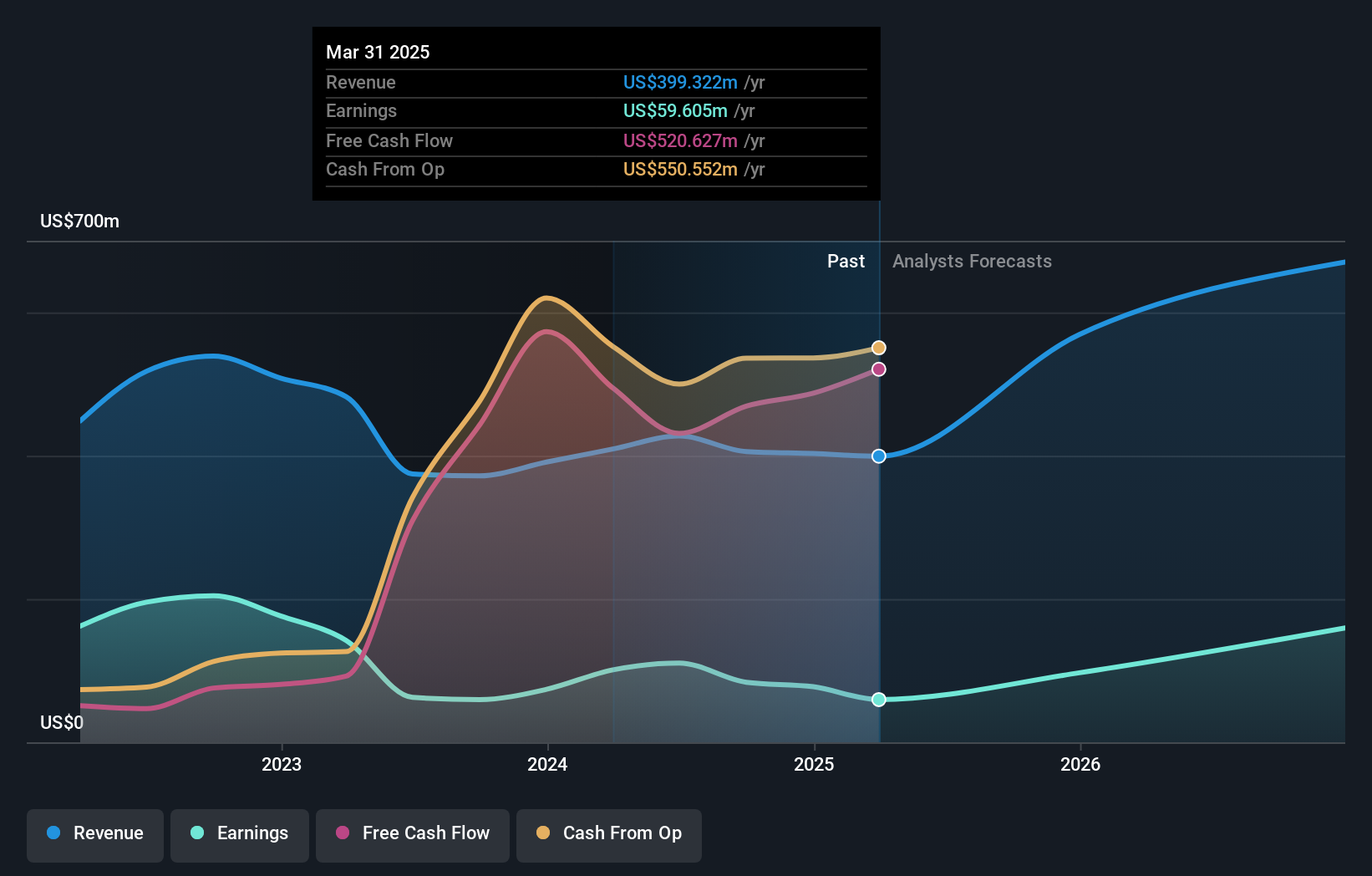

Hesai Group is experiencing significant growth potential, driven by its advanced lidar technology and strategic partnerships, such as with Leapmotor and SAIC Volkswagen. The company forecasts revenue to approach US$100 million in Q4 2024, with an expected net profit of US$20 million. Despite a volatile share price and current losses, Hesai's revenue is forecast to grow at 28.6% annually, outpacing the market average. Its innovative OT128 lidar solution enhances its competitive edge in autonomous driving sectors globally.

- Dive into the specifics of Hesai Group here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Hesai Group is trading beyond its estimated value.

Youdao (NYSE:DAO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Youdao, Inc. is an internet technology company offering online services in content, community, communication, and commerce in China with a market cap of approximately $633.45 million.

Operations: Revenue segments for the company include CN¥2.91 billion from Learning Services, CN¥1.97 billion from Online Marketing Services, and CN¥885.63 million from Smart Devices.

Insider Ownership: 20.3%

Youdao, Inc. has shown a turnaround in profitability with a net income of CNY 86.25 million for Q3 2024, compared to a loss last year, while revenue increased slightly to CNY 1.57 billion. Despite being dropped from the S&P Global BMI Index and having negative shareholder equity, its earnings are forecasted to grow significantly at over 95% annually, outpacing the US market average. The company completed a share buyback of US$33.8 million recently.

- Click to explore a detailed breakdown of our findings in Youdao's earnings growth report.

- Upon reviewing our latest valuation report, Youdao's share price might be too optimistic.

Live Oak Bancshares (NYSE:LOB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Live Oak Bancshares, Inc. is a bank holding company for Live Oak Banking Company, offering a range of banking products and services in the United States, with a market cap of approximately $2.20 billion.

Operations: The company's revenue is primarily derived from its Banking segment, which accounts for $415.44 million, with an additional contribution of $4.23 million from its Fintech operations.

Insider Ownership: 23.7%

Live Oak Bancshares exhibits strong growth potential with forecasted revenue and earnings growth rates significantly exceeding the US market's averages. Despite a high level of non-performing loans at 2.8%, insider transactions show more buying than selling recently, indicating confidence in its prospects. The stock trades at a substantial discount to its estimated fair value. Recent quarterly results revealed increased net interest income but a decline in net income, highlighting mixed financial performance amidst anticipated future growth.

- Take a closer look at Live Oak Bancshares' potential here in our earnings growth report.

- According our valuation report, there's an indication that Live Oak Bancshares' share price might be on the cheaper side.

Make It Happen

- Investigate our full lineup of 208 Fast Growing US Companies With High Insider Ownership right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hesai Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HSAI

Hesai Group

Through with its subsidiaries, engages in the development, manufacture, and sale of three-dimensional light detection and ranging solutions (LiDAR) in Mainland China, Europe, North America, and internationally.

High growth potential with mediocre balance sheet.