- United States

- /

- Healthcare Services

- /

- NasdaqCM:VMD

3 US Growth Stocks With Up To 20% Insider Ownership

Reviewed by Simply Wall St

As 2024 comes to a close, the U.S. stock market has experienced a strong year overall, despite ending on a weaker note with the Dow posting its largest monthly loss in over two years. The Nasdaq Composite and S&P 500 still managed impressive annual gains of 29% and 23%, respectively. In this context, growth companies with high insider ownership can be particularly attractive as they often signal confidence from those closest to the business in its potential for future success.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.7% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| BBB Foods (NYSE:TBBB) | 22.9% | 41% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.3% | 66.3% |

| Credit Acceptance (NasdaqGS:CACC) | 14.0% | 49% |

| Ryan Specialty Holdings (NYSE:RYAN) | 16.8% | 36.6% |

| Similarweb (NYSE:SMWB) | 25.4% | 126.3% |

| CarGurus (NasdaqGS:CARG) | 17% | 42.4% |

Let's review some notable picks from our screened stocks.

Community West Bancshares (NasdaqCM:CWBC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Community West Bancshares is the bank holding company for Central Valley Community Bank, offering commercial banking services to small and middle-market businesses and individuals in California's central valley, with a market cap of $366.98 million.

Operations: The company generates revenue of $95.15 million from its banking operations, providing commercial banking services in California's central valley.

Insider Ownership: 12%

Community West Bancshares shows potential with forecasted revenue growth of 18.4% per year, outpacing the US market's 9.2%. However, recent earnings have declined, with net income dropping to US$3.39 million in Q3 2024 from US$6.39 million a year ago. Despite substantial insider trading activity and dilution over the past year, analysts expect significant earnings growth of 73.8% annually over the next three years, suggesting optimism about its future performance despite current challenges.

- Navigate through the intricacies of Community West Bancshares with our comprehensive analyst estimates report here.

- The analysis detailed in our Community West Bancshares valuation report hints at an deflated share price compared to its estimated value.

Viemed Healthcare (NasdaqCM:VMD)

Simply Wall St Growth Rating: ★★★★☆☆

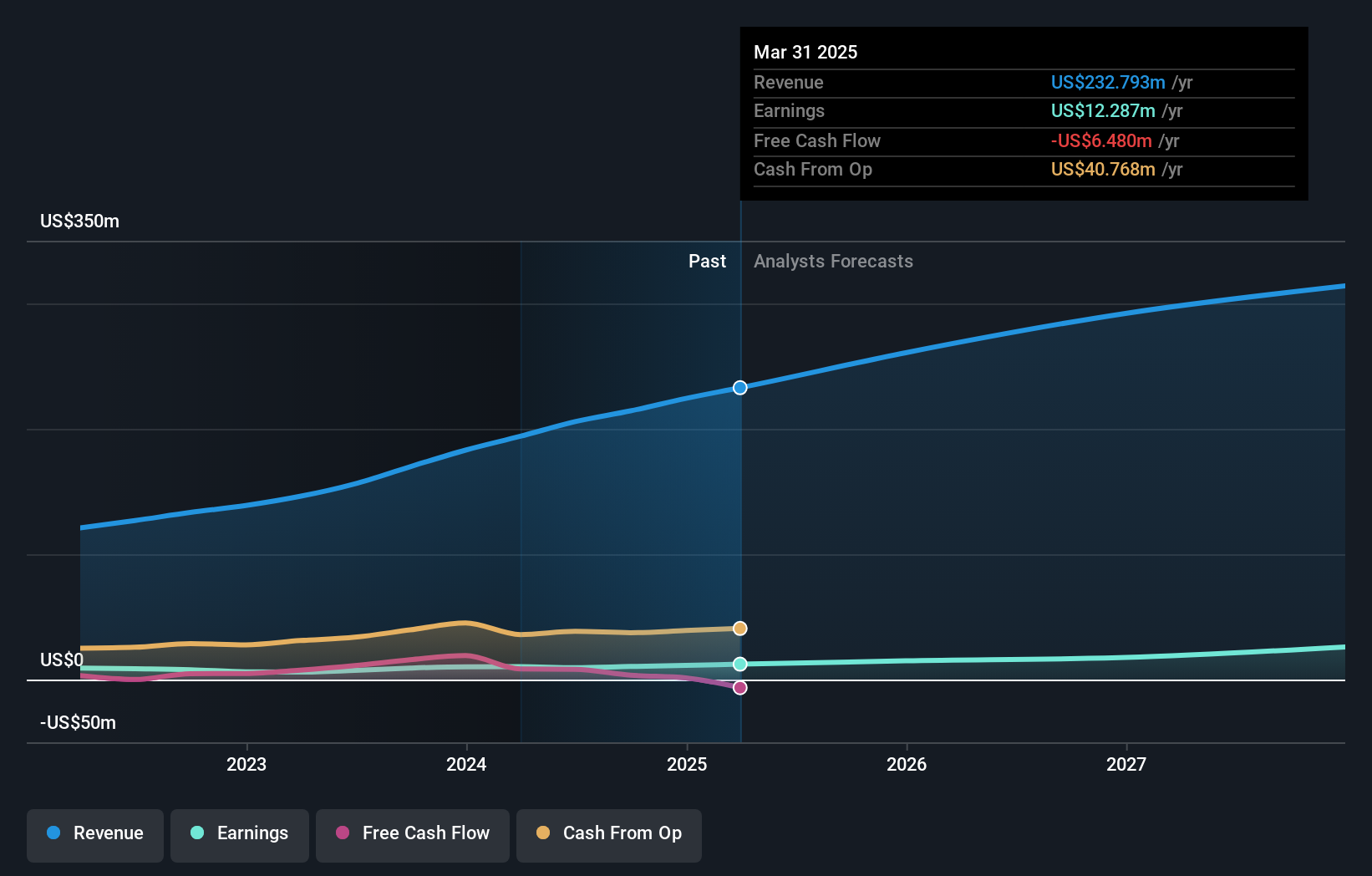

Overview: Viemed Healthcare, Inc. operates in the United States, offering home medical equipment and post-acute respiratory healthcare services, with a market cap of approximately $311.49 million.

Operations: The company's revenue is primarily generated from the Sleep and Respiratory Disorders Sector, amounting to $214.30 million.

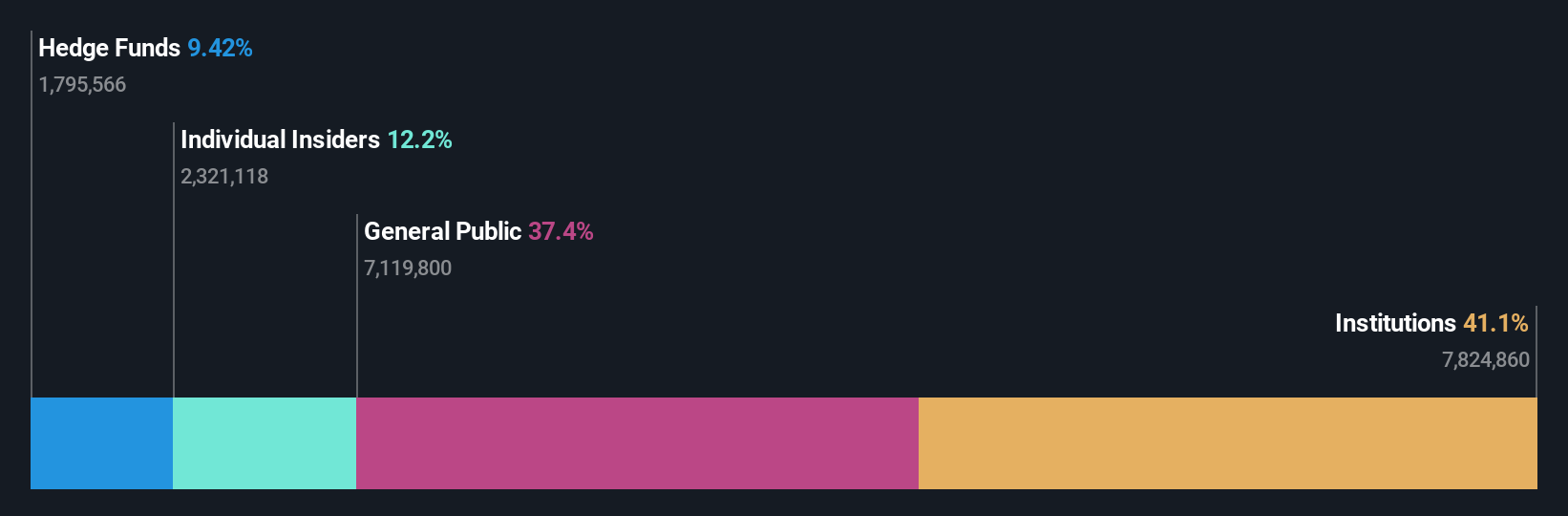

Insider Ownership: 12.6%

Viemed Healthcare's Q3 2024 earnings showed sales of US$58 million, up from US$49.4 million a year ago, with net income rising to US$3.88 million. The company forecasts revenue growth of 12.9% annually, surpassing the broader US market's 9.2%. Analysts expect earnings to grow significantly at 32.5% per year over the next three years, indicating strong potential despite no substantial insider trading activity recently and modest historical profit growth of 13.3%.

- Get an in-depth perspective on Viemed Healthcare's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Viemed Healthcare's current price could be quite moderate.

Youdao (NYSE:DAO)

Simply Wall St Growth Rating: ★★★★☆☆

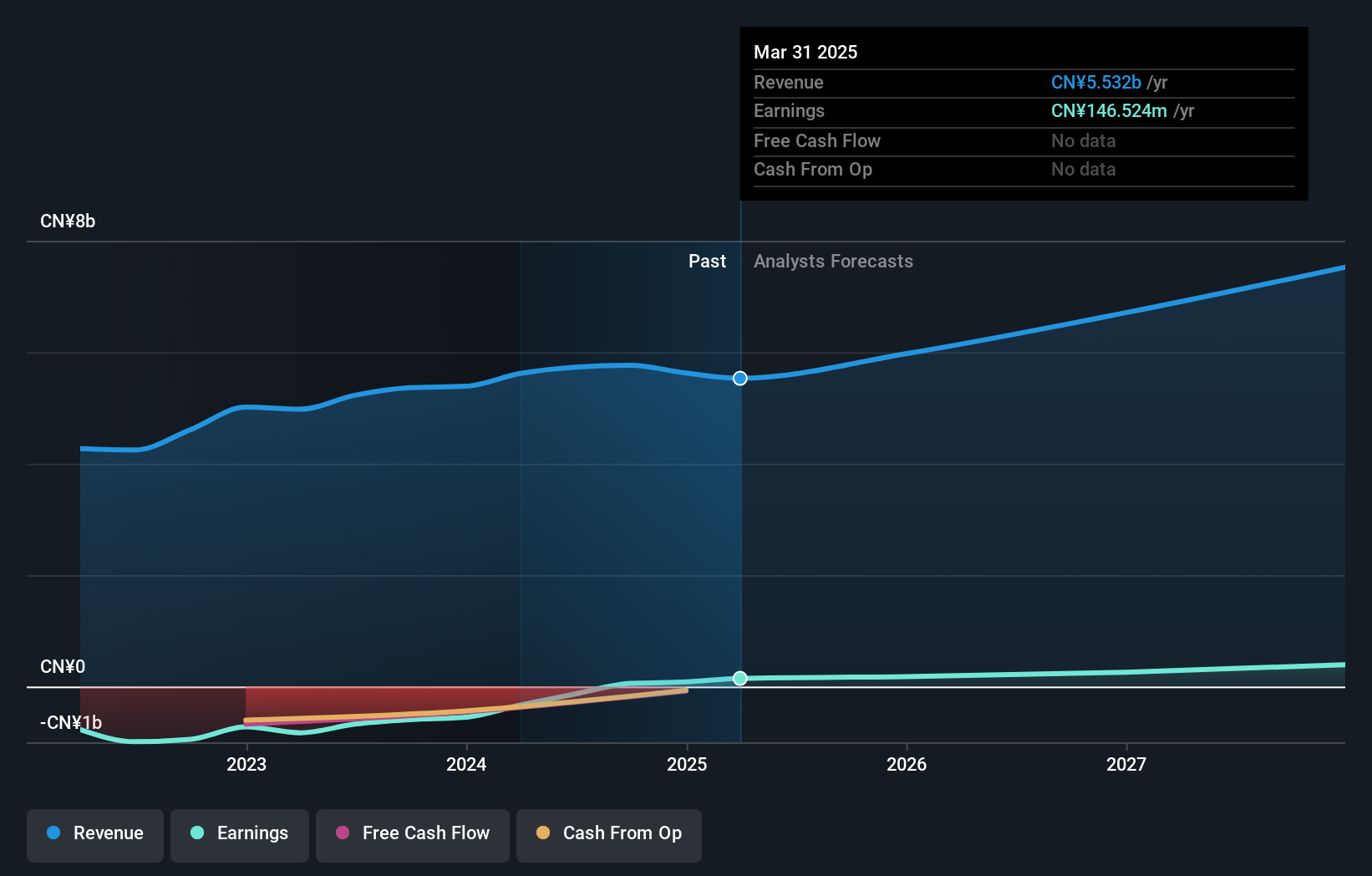

Overview: Youdao, Inc. is an internet technology company offering online services in content, community, communication, and commerce in China with a market cap of $827.07 million.

Operations: The company's revenue segments include Smart Devices generating CN¥885.63 million, Learning Services with CN¥2.91 billion, and Online Marketing Services at CN¥1.97 billion.

Insider Ownership: 20.3%

Youdao's recent earnings reveal a turnaround, achieving a net income of CNY 86.25 million from a loss last year. The company forecasts robust annual earnings growth of 98.6%, outpacing the US market average, though its revenue growth is slower at 11.8%. Despite high volatility in share price and negative shareholder equity, Youdao's profitability marks significant progress. However, financial stability concerns persist with interest payments not well covered by earnings and no substantial insider trading activity reported recently.

- Unlock comprehensive insights into our analysis of Youdao stock in this growth report.

- The analysis detailed in our Youdao valuation report hints at an inflated share price compared to its estimated value.

Seize The Opportunity

- Investigate our full lineup of 200 Fast Growing US Companies With High Insider Ownership right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:VMD

Viemed Healthcare

Provides home medical equipment (HME) and post-acute respiratory healthcare services to patients in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives