- United States

- /

- Consumer Services

- /

- NYSEAM:COE

If EPS Growth Is Important To You, 51Talk Online Education Group (NYSE:COE) Presents An Opportunity

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like 51Talk Online Education Group (NYSE:COE). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for 51Talk Online Education Group

51Talk Online Education Group's Improving Profits

51Talk Online Education Group has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. So it would be better to isolate the growth rate over the last year for our analysis. Impressively, 51Talk Online Education Group's EPS catapulted from US$0.32 to US$0.57, over the last year. It's not often a company can achieve year-on-year growth of 80%.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Unfortunately, 51Talk Online Education Group's revenue dropped 56% last year, but the silver lining is that EBIT margins improved from 0.2% to 13%. That's not a good look.

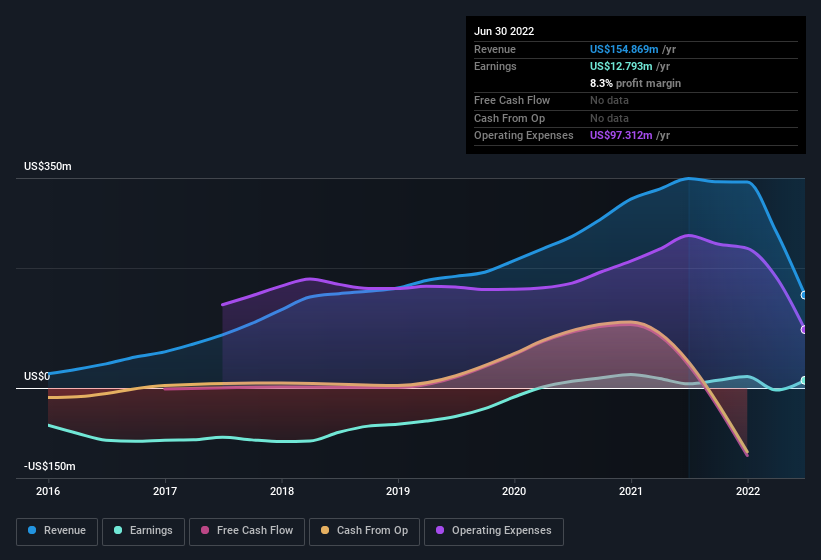

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

51Talk Online Education Group isn't a huge company, given its market capitalisation of US$34m. That makes it extra important to check on its balance sheet strength.

Are 51Talk Online Education Group Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

One shining light for 51Talk Online Education Group is the serious outlay one insider has made to buy shares, in the last year. In one big hit, Founder Jiajia Huang paid US$937k, for shares at an average price of US$1.59 per share. Big insider buys like that are a rarity and should prompt discussion on the merits of the business.

Should You Add 51Talk Online Education Group To Your Watchlist?

51Talk Online Education Group's earnings have taken off in quite an impressive fashion. Growth-minded people will be intrigued by the incredible movement in EPS growth. And may very well signal a significant inflection point for the business. If this these factors intrigue you, then an addition of 51Talk Online Education Group to your watchlist won't go amiss. What about risks? Every company has them, and we've spotted 3 warning signs for 51Talk Online Education Group you should know about.

The good news is that 51Talk Online Education Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSEAM:COE

51Talk Online Education Group

Through its subsidiaries, provides online English language education services to students in the People's Republic of China, Hong Kong, the Philippines, Singapore, Malaysia, and Thailand.

Low and overvalued.

Similar Companies

Market Insights

Community Narratives