- United States

- /

- Hospitality

- /

- NYSE:CMG

Is Chipotle Still Priced for Perfection After Its Sharp 2025 Share Price Rebound

Reviewed by Bailey Pemberton

- If you have been wondering whether Chipotle Mexican Grill is a bargain after its slide or still priced for perfection, you are not alone. This article is going to tackle that head on.

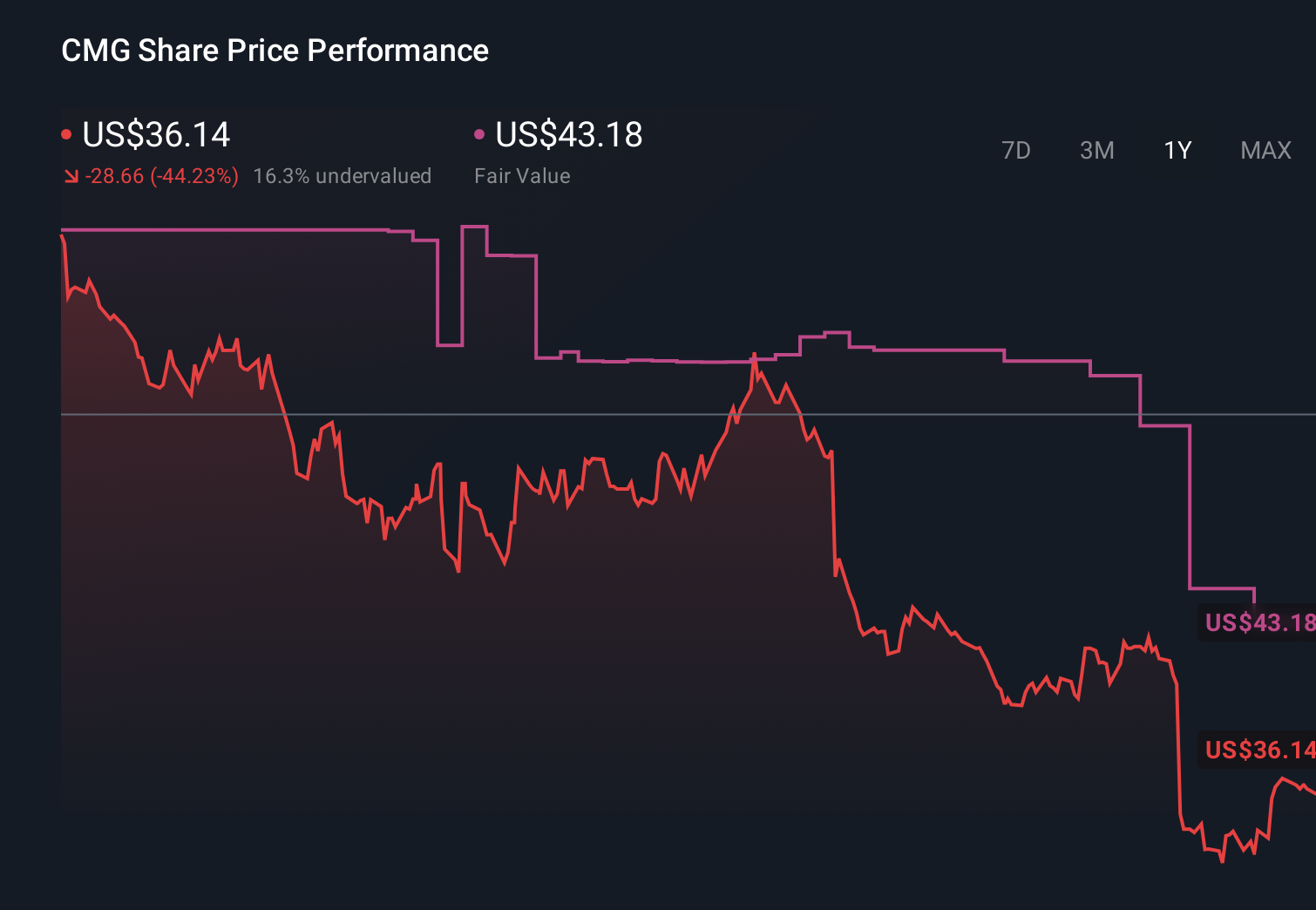

- Over the last week the stock is up 4.2%, building on a strong 19.0% move over the past month, even though it is still down 37.2% year to date and 39.2% over the last year, while longer term holders have seen roughly 33.3% and 33.2% gains over three and five years.

- Recently, investors have been reacting to a mix of headlines around consumer spending resilience and the ongoing appeal of fast casual dining. This often puts resilient brands like Chipotle back on watchlists when sentiment swings. At the same time, broader market volatility and shifting expectations on interest rates have made growth names more sensitive to any hint that demand or pricing power could soften.

- Against that backdrop, Chipotle currently scores 0/6 on our valuation checks, which suggests it does not screen as undervalued on traditional metrics right now. Next we will walk through those valuation approaches in detail, and then finish by looking at a more nuanced way to think about what the market may really be pricing in.

Chipotle Mexican Grill scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Chipotle Mexican Grill Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it can generate in the future and then discounting those cash flows back to their value in $ today.

For Chipotle Mexican Grill, the latest twelve month Free Cash Flow is about $1.57 billion. Analysts provide detailed forecasts for the next few years, and from there Simply Wall St extrapolates longer term growth. Under this two stage Free Cash Flow to Equity model, Chipotle’s annual free cash flow is projected to rise steadily, reaching roughly $3.51 billion by 2035, reflecting expectations for robust expansion that gradually slows over time.

When all those projected cash flows are discounted back, the model arrives at an estimated intrinsic value of $35.05 per share. Compared with the current share price, this implies the stock is about 7.4% overvalued. This is close enough that it could reasonably be viewed as trading around fair value with a modest premium for quality and growth.

Result: ABOUT RIGHT

Chipotle Mexican Grill is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Chipotle Mexican Grill Price vs Earnings

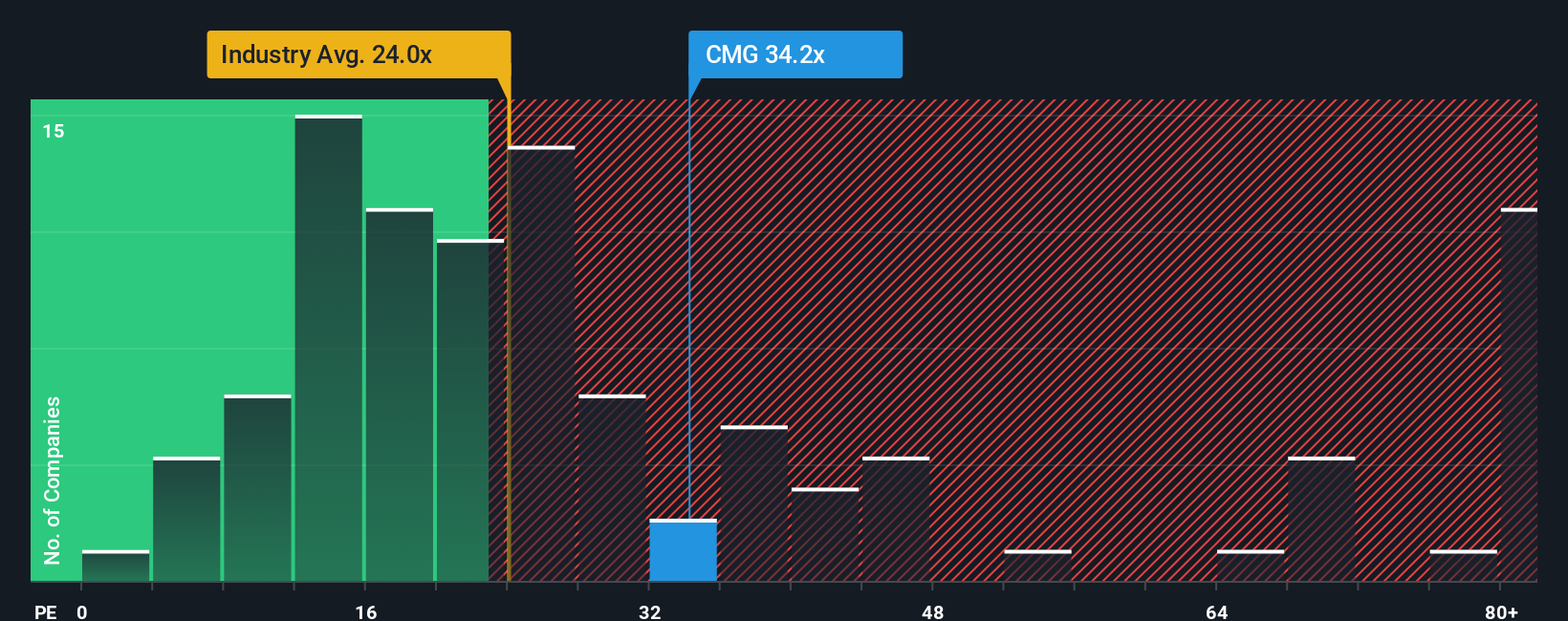

For profitable companies like Chipotle, the price to earnings, or PE, ratio is a straightforward way to gauge how much investors are willing to pay for each dollar of current earnings. In general, faster earnings growth and lower perceived risk justify a higher PE, while slower growth or greater uncertainty call for a discount.

Chipotle currently trades on a PE of about 32.4x. That is a premium to the Hospitality industry average of roughly 22.0x, but very close to the peer group average of around 32.0x, which suggests investors already ascribe it blue chip growth status within its niche. Simply Wall St also calculates a Fair Ratio of about 26.6x, which reflects the PE you might expect given Chipotle’s specific mix of earnings growth, margins, industry positioning, size and risk profile.

This Fair Ratio is more informative than a simple peer or industry comparison because it adjusts for Chipotle’s own fundamentals rather than assuming all companies deserve the same multiple. When compared with the current 32.4x PE, the 26.6x Fair Ratio implies the shares are trading on a meaningful premium to what those fundamentals alone would justify.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1462 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Chipotle Mexican Grill Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of a company’s story with a concrete forecast for its future revenue, earnings and margins, and then a fair value you can compare to today’s price.

A Narrative on Simply Wall St’s Community page lets you spell out why you think Chipotle Mexican Grill will win or struggle, translate that view into numbers, and then instantly see how your fair value compares to the current price.

Because Narratives on the platform are updated dynamically when new information like earnings results, traffic data or tariff news comes in, they stay current and can support more measured, less emotional reactions.

For Chipotle, one Narrative might lean bullish, assuming faster international expansion, improving margins and a fair value closer to an analyst target of about $65.00. Another more cautious Narrative could focus on traffic headwinds, macro pressure and thinner margins, landing near a lower target of roughly $46.00. Those different fair values naturally lead to very different potential conclusions at today’s price.

Do you think there's more to the story for Chipotle Mexican Grill? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMG

Chipotle Mexican Grill

Owns and operates Chipotle Mexican Grill restaurants.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion