- United States

- /

- Specialty Stores

- /

- NYSE:CANG

3 US Penny Stocks With Market Caps Under $200M

Reviewed by Simply Wall St

As the U.S. stock market experiences a downturn, with major indexes like the Dow Jones and Nasdaq seeing declines, investors are increasingly cautious about where to place their bets. In this climate, penny stocks—traditionally seen as high-risk investments—continue to attract attention for their potential growth opportunities in smaller or newer companies. While the term "penny stocks" might seem outdated, these low-priced shares can still offer value when backed by strong financial health and clear growth prospects.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.786075 | $5.8M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.63 | $2.06B | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.33 | $517.9M | ★★★★★★ |

| ARC Document Solutions (NYSE:ARC) | $3.42 | $147.91M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.57 | $51.81M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.21 | $8.33M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $3.75 | $114.35M | ★★★★★★ |

| MIND C.T.I (NasdaqGM:MNDO) | $1.88 | $39.56M | ★★★★★★ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.07 | $98.03M | ★★★★★☆ |

Click here to see the full list of 755 stocks from our US Penny Stocks screener.

We'll examine a selection from our screener results.

eHealth (NasdaqGS:EHTH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: eHealth, Inc. operates a health insurance marketplace offering consumer engagement, education, and enrollment solutions in the United States with a market cap of approximately $139.68 million.

Operations: The company's revenue is primarily derived from two segments: Medicare, which generated $430.84 million, and Employer and Individual, contributing $40.36 million.

Market Cap: $139.68M

eHealth, Inc. currently operates with a market cap of approximately US$139.68 million and remains unprofitable, reporting a net loss of US$27.97 million in the latest quarter. Despite this, the company maintains a strong cash position with short-term assets significantly exceeding both short and long-term liabilities, providing more than three years of cash runway even if free cash flow decreases slightly. Recent executive changes include the addition of Prama Bhatt to its board, bringing expertise in digital transformation which could be beneficial for strategic growth initiatives amid ongoing leadership transitions as CEO Fran Soistman plans retirement by mid-2025.

- Click to explore a detailed breakdown of our findings in eHealth's financial health report.

- Learn about eHealth's future growth trajectory here.

Cango (NYSE:CANG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cango Inc. operates an automotive transaction service platform in the People’s Republic of China, connecting various stakeholders in the automotive industry, with a market cap of approximately $182.64 million.

Operations: The company's revenue segment includes Retail - Gasoline & Auto Dealers, generating CN¥593.38 million.

Market Cap: $182.64M

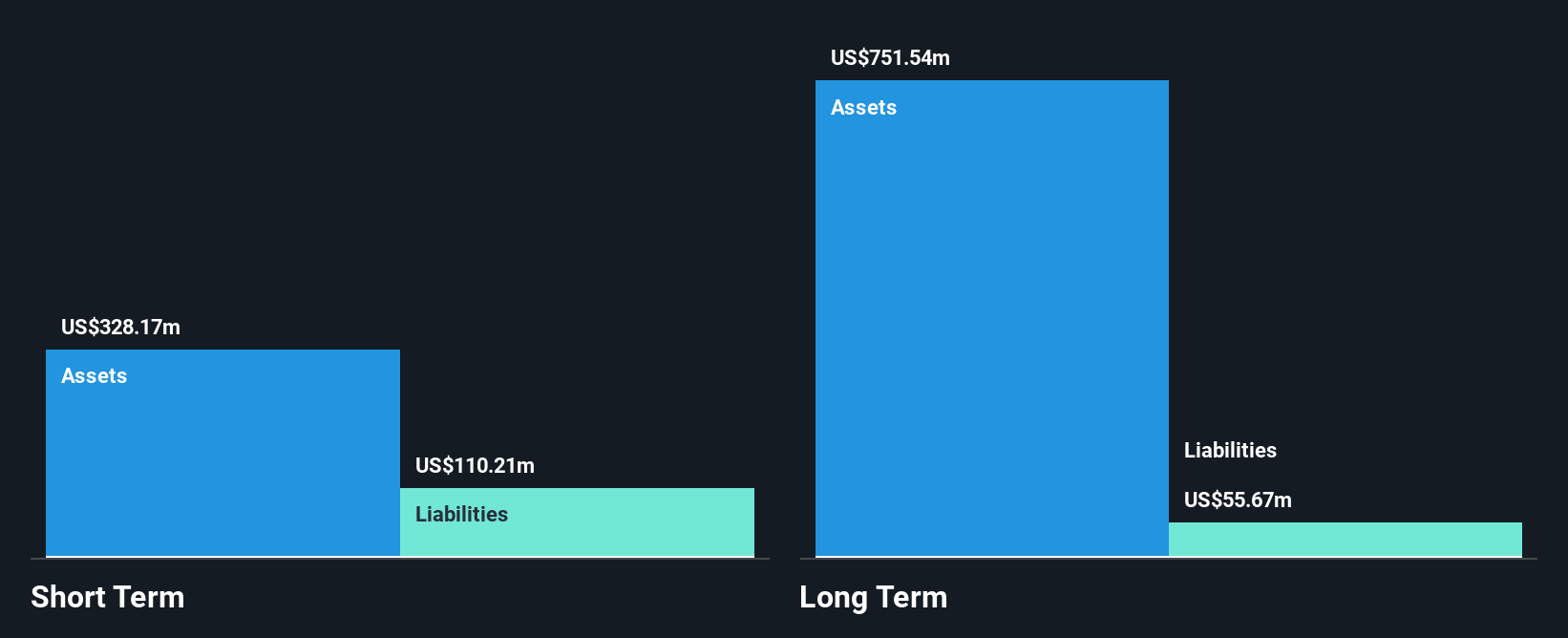

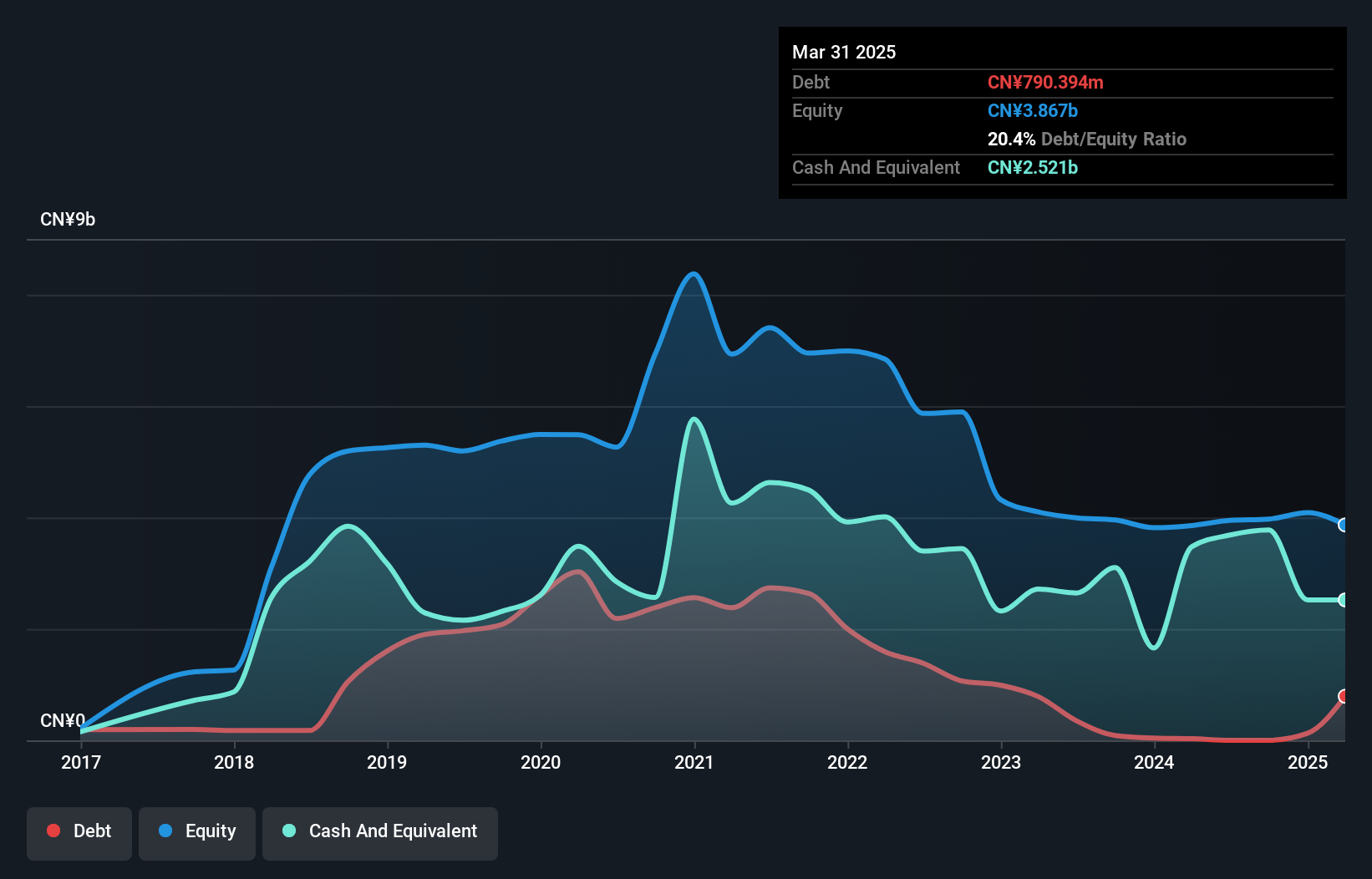

Cango Inc., with a market cap of approximately $182.64 million, has recently become profitable, despite experiencing a significant one-off loss of CN¥153.6 million in the last year. The company's short-term assets far exceed both its short and long-term liabilities, indicating strong liquidity. However, revenue has sharply declined from CN¥1,218.04 million to CN¥109.5 million over six months compared to the previous year. Cango's debt management is robust with cash exceeding total debt and operating cash flow well covering its obligations. Recent share buybacks indicate confidence from management amidst stable weekly volatility over the past year.

- Navigate through the intricacies of Cango with our comprehensive balance sheet health report here.

- Examine Cango's past performance report to understand how it has performed in prior years.

Chegg (NYSE:CHGG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Chegg, Inc. operates a direct-to-student learning platform focused on building essential life and job skills for learners in the United States and internationally, with a market cap of approximately $157.58 million.

Operations: The company's revenue is primarily generated from its online retailers segment, amounting to $683.34 million.

Market Cap: $157.58M

Chegg, Inc., with a market cap of US$157.58 million, faces challenges as it remains unprofitable and reported a significant net loss of US$616.88 million for the second quarter of 2024. Despite this, the company has sufficient cash runway for more than three years due to positive free cash flow growth. The company's high net debt to equity ratio of 69.9% indicates financial leverage concerns, although its short-term assets exceed long-term liabilities. Recent board changes and participation in investment conferences highlight ongoing strategic adjustments amidst trading at a substantial discount to estimated fair value.

- Click here and access our complete financial health analysis report to understand the dynamics of Chegg.

- Assess Chegg's future earnings estimates with our detailed growth reports.

Make It Happen

- Take a closer look at our US Penny Stocks list of 755 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CANG

Cango

Operates an automotive transaction service platform that connects dealers, original equipment manufacturers, financial institutions, car buyers, insurance brokers, and companies in the People’s Republic of China.

Flawless balance sheet and slightly overvalued.