The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Carnival Corporation & plc (NYSE:CCL) does use debt in its business. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Carnival Corporation &

How Much Debt Does Carnival Corporation & Carry?

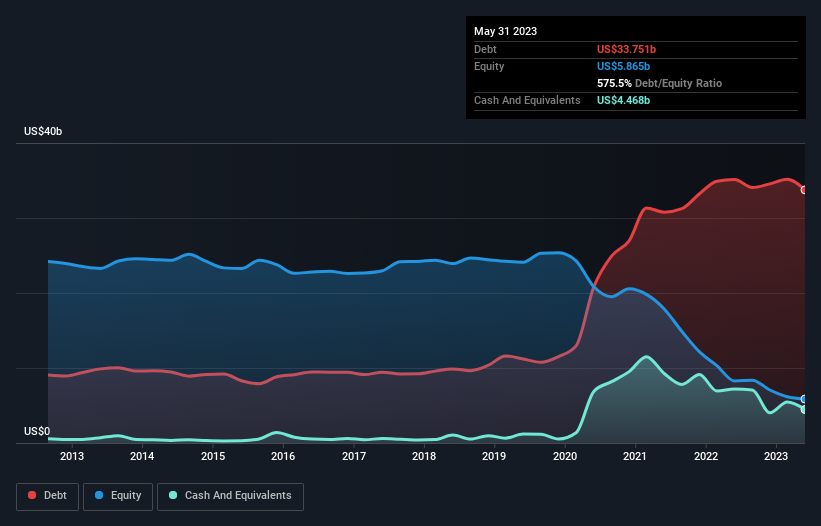

The chart below, which you can click on for greater detail, shows that Carnival Corporation & had US$33.8b in debt in May 2023; about the same as the year before. However, it also had US$4.47b in cash, and so its net debt is US$29.3b.

How Strong Is Carnival Corporation &'s Balance Sheet?

We can see from the most recent balance sheet that Carnival Corporation & had liabilities of US$11.8b falling due within a year, and liabilities of US$34.2b due beyond that. Offsetting these obligations, it had cash of US$4.47b as well as receivables valued at US$771.0m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$40.8b.

This deficit casts a shadow over the US$21.0b company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. At the end of the day, Carnival Corporation & would probably need a major re-capitalization if its creditors were to demand repayment. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Carnival Corporation &'s ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year Carnival Corporation & wasn't profitable at an EBIT level, but managed to grow its revenue by 199%, to US$17b. So its pretty obvious shareholders are hoping for more growth!

Caveat Emptor

While we can certainly appreciate Carnival Corporation &'s revenue growth, its earnings before interest and tax (EBIT) loss is not ideal. To be specific the EBIT loss came in at US$1.0b. Considering that alongside the liabilities mentioned above make us nervous about the company. We'd want to see some strong near-term improvements before getting too interested in the stock. Not least because it had negative free cash flow of US$2.4b over the last twelve months. So suffice it to say we consider the stock to be risky. When I consider a company to be a bit risky, I think it is responsible to check out whether insiders have been reporting any share sales. Luckily, you can click here ito see our graphic depicting Carnival Corporation & insider transactions.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CCL

Carnival Corporation &

A cruise company, provides leisure travel services in North America, Australia, Europe, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives