- United States

- /

- Hospitality

- /

- NYSE:CCL

Carnival Corporation & (NYSE:CCL) Restructures Debt with €1B and $2B Note Offerings

Reviewed by Simply Wall St

Carnival Corporation & (NYSE:CCL) undertook a notable debt refinancing initiative last quarter, which may have influenced its stock price jump of nearly 80%. The company issued €1 billion of unsecured notes due in 2031 and $2 billion of similar notes due in 2032, focusing on reducing secured debt and simplifying capital structure. During this period, broader market trends showed mixed results, with a 1.8% rise for the week amidst broader uncertainties such as tariff worries. However, Carnival's specific actions likely added weight to its substantial positive movement against the backdrop of these broader market conditions.

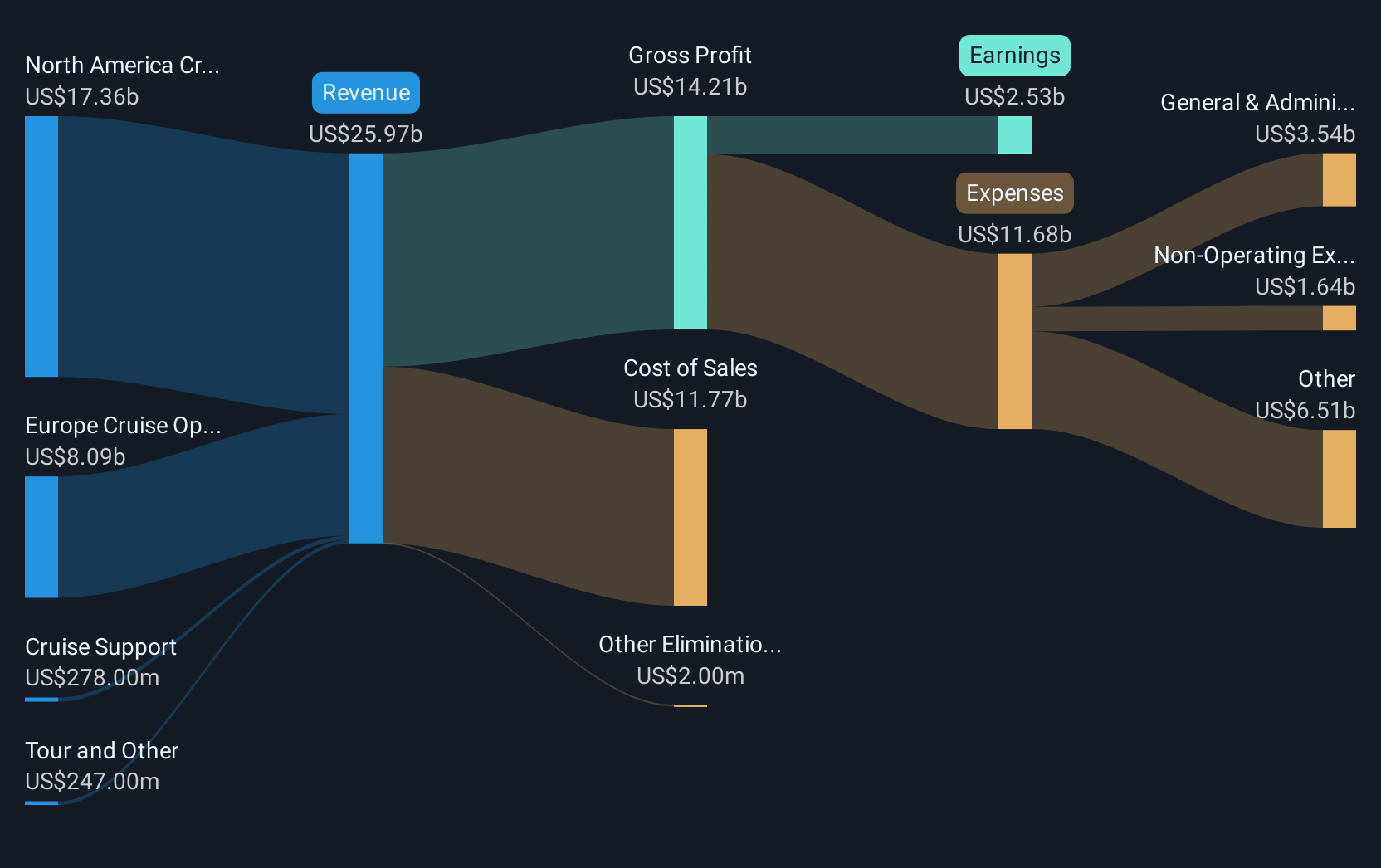

The recent debt refinancing by Carnival Corporation, which involved issuing €1 billion and US$2 billion in notes due in 2031 and 2032, respectively, aligns with its ongoing fleet modernization strategy. This move may enhance long-term earnings stability by reducing secured debt and thereby potentially lowering interest expenses. Analysts forecast earnings to grow to US$3.7 billion by 2028, with profit margins expected to expand to 12.6%. This outlook reflects the company's aim to strengthen its financial health through effective capacity management and sustainability initiatives.

In terms of share performance, over a three-year period, Carnival achieved a total return of 252.89%, reflecting a very large appreciation in shareholder value. Over the past year, the stock has also outperformed the US market, which returned 13.7%. This notable longer-term performance indicates strong market reception of Carnival's initiatives, including its unique private destinations and loyalty programs.

Even though the company's share price recently experienced a substantial increase, bringing it close to the analysts' consensus price target of US$30.80, the current valuation suggests there could still be a 7% upside compared to the price target. The performance is underpinned by the anticipated growth in revenue and earnings, as well as improved Return on Equity. Investors, however, should consider the potential risks from geopolitical instability and modernization costs that could impact profitability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CCL

Carnival Corporation &

A cruise company, provides leisure travel services in North America, Australia, Europe, and internationally.

Very undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)