- United States

- /

- Hospitality

- /

- NYSE:CCL

Carnival Corporation & (NYSE:CCL) Launches US$1 Billion Debt Refinancing Offering

Reviewed by Simply Wall St

Carnival Corporation & (NYSE:CCL) recently announced a $1.0 billion debt offering aimed at refinancing its higher-interest notes, reflecting its focus on optimizing its capital structure. This proactive financial move coincided with the company's shares growing 14% last month. The rise may have been supported by positive market sentiment following the U.S.-China tariff reduction deal, which triggered broader market gains, including a strong performance by consumer discretionary stocks like Carnival. These factors combined to enhance investor confidence, as reflected in the company's significant share price increase over the same period.

The recent announcement of Carnival Corporation & plc's US$1.0 billion debt offering is expected to have a significant influence on its broader financial strategy. This move aims to optimize Carnival's capital structure by refinancing its higher-interest notes, which could lead to improved net margins and earnings by lowering interest expenses. While the company saw its shares rise 14% last month, providing a short-term boost likely aided by external factors such as positive market sentiment from the U.S.-China tariff reduction deal, its long-term performance also merits attention. Over a three-year period, Carnival's total shareholder return was 43.29%, indicating a strong uptrend in shareholder value.

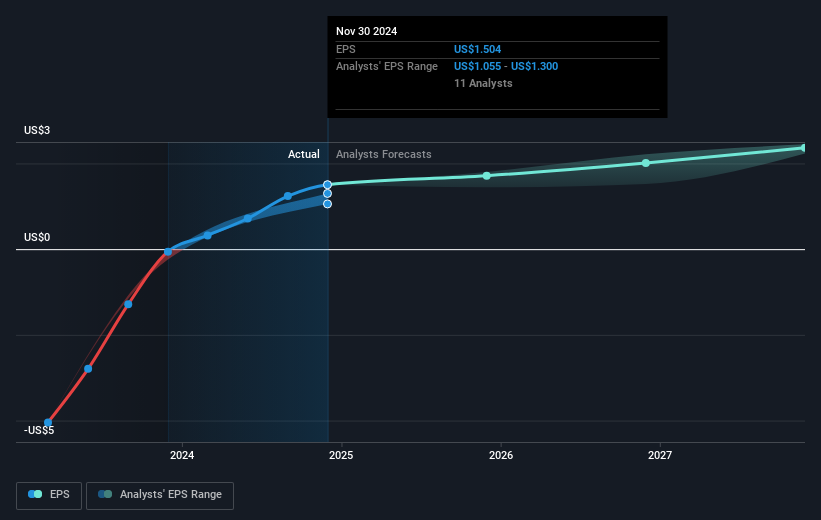

Comparatively, Carnival exceeded the US Hospitality industry, which saw an increase of 7.3% over the past year. This surpassing of industry benchmarks over a shorter timeframe reflects well on its operational recovery strategy. As analysts anticipate future revenue growth, the company's emphasis on refinancing could deliver approximately US$100 million in incremental earnings for 2025 alone. With earnings expected to grow by 15.43% annually, investors might see potential upside, especially considering the stock's current 29.4% discount compared to the consensus analyst price target of US$27.65. However, challenges such as macroeconomic volatility and limited capacity growth could pose risks to these forecasts.

Evaluate Carnival Corporation &'s historical performance by accessing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CCL

Carnival Corporation &

A cruise company, provides leisure travel services in North America, Australia, Europe, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives