- United States

- /

- Hospitality

- /

- NYSE:CCL

Carnival (CCL): Is the Cruise Giant’s Valuation Reflecting Slowdown Signals After New Industry Discounts?

Reviewed by Kshitija Bhandaru

Investors in Carnival Corporation & may be feeling uncertain after the latest news out of the cruise sector. Recent analyst commentary points to a wave of promotions and price cuts across the industry, with Carnival stepping up its efforts to fill cabins and boost bookings. While these moves are aimed at keeping ships busy and revenues flowing, they also signal a shift away from the rapid growth phase that caught the market’s eye over the past year. This has made some investors pause to re-evaluate their expectations.

The stock retreated nearly 3% in the most recent trading day, a dip that mirrors sector-wide weakness as investors factor in the potential impact of these discounts on future margins. Despite this, Carnival has posted gains of over 60% in the past year and is up 22% year-to-date. This shows that momentum has been on its side, though perhaps not at the same rapid pace seen earlier. Efforts to modernize the fleet, strengthen the balance sheet, and ramp up customer deposits have also contributed to the company’s gradual turnaround from pandemic lows.

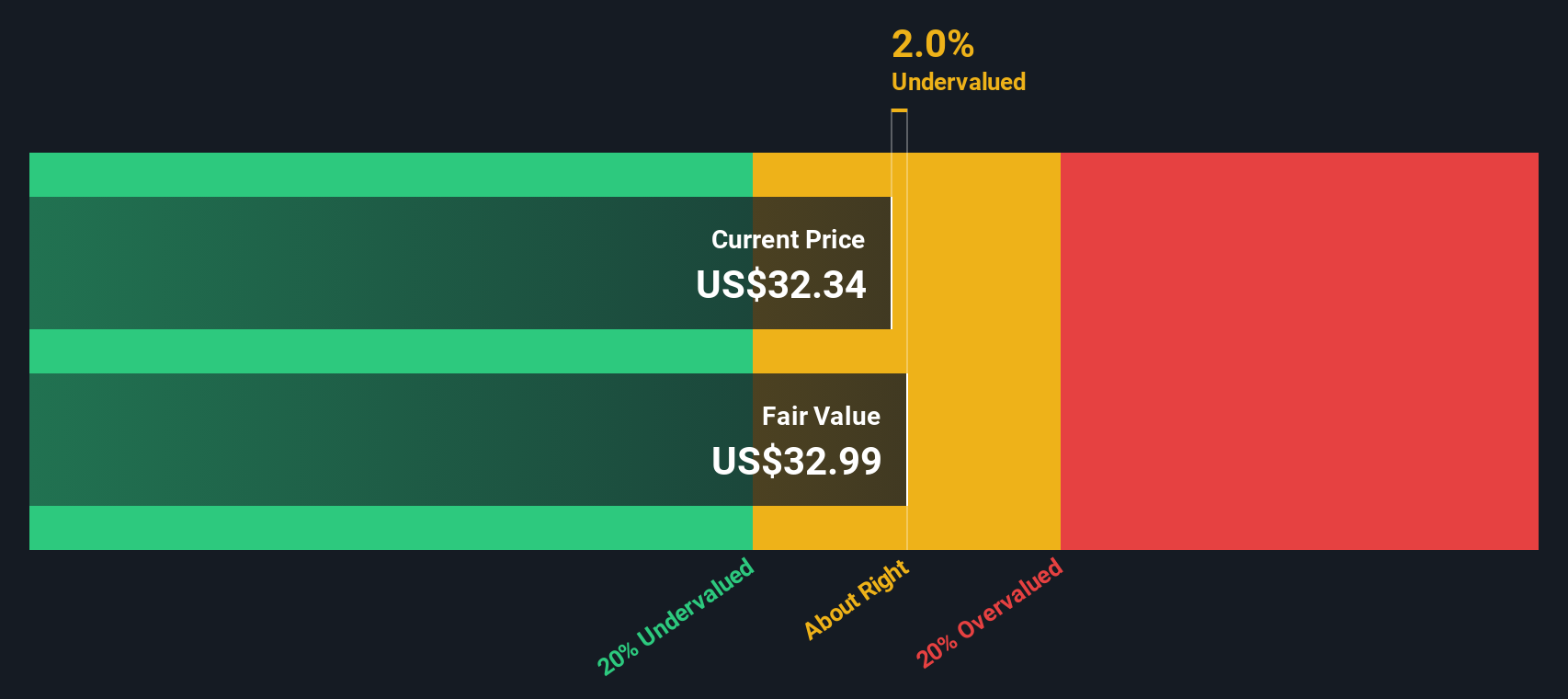

But after a year of solid gains and with earnings just around the corner, the key question is whether Carnival’s stock is now undervalued after this pullback or if the market is simply pricing in normalized growth ahead.

Most Popular Narrative: 10.9% Undervalued

The current market narrative sees Carnival Corporation & as carrying notable upside, with analysts highlighting ongoing fleet modernization, strategic growth initiatives, and robust demand as key reasons for undervaluation.

Fleet modernization and strategic initiatives, including the launch of Celebration Key and new loyalty programs, are expected to drive further margin expansion and differentiation. Analysts highlight Carnival’s “favorable risk/reward setup” as industry fundamentals (such as cruise yields and cash flow growth) continue to exceed expectations, especially relative to other travel/leisure segments.

What is at the core of this bullish view? Analysts are betting on a blend of aggressive modernization, exclusive new destinations, and fresh customer incentives driving the next growth surge. The real twist lies in just how optimistic their growth assumptions are, especially for earnings and profit margins rather than just headline revenue. Want to discover the ambitious forecasts and financial benchmarks that power this valuation? The narrative waits, promising clear opinions and even clearer numbers.

Result: Fair Value of $34.27 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent geopolitical instability or a slower than expected fleet upgrade could challenge this upbeat view and weigh on Carnival’s growth outlook.

Find out about the key risks to this Carnival Corporation & narrative.Another View: Discounted Cash Flow Signals a Cautious Approach

Our SWS DCF model presents a less optimistic picture compared to the analyst consensus. This suggests Carnival’s shares may currently be overvalued. Could this cash flow perspective highlight financial risks that the market narrative might not be considering?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Carnival Corporation & for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Carnival Corporation & Narrative

If you have a different perspective, or want to see how the numbers stack up for yourself, you’re free to shape your own conclusions in just minutes. Do it your way

A great starting point for your Carnival Corporation & research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Take control of your investment journey and seize new opportunities. If you want to move ahead of the market, these stock ideas are the perfect place to start.

- Unlock growth potential by assessing penny stocks with strong financials; find opportunities others overlook with penny stocks with strong financials.

- Power up your portfolio with next-generation technology leaders. Track quantum computing breakthroughs through quantum computing stocks.

- Boost your income with reliable picks offering attractive yields. Search for dividend stocks with yields over 3% using dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CCL

Carnival Corporation &

A cruise company, provides leisure travel services in North America, Australia, Europe, and internationally.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives