- United States

- /

- Hospitality

- /

- NYSE:CAVA

CAVA Group (CAVA) Lowers Guidance After Sales Slowdown Are Long-Term Growth Assumptions at Risk?

Reviewed by Sasha Jovanovic

- Earlier this month, CAVA Group revised its full-year guidance after experiencing a slowdown in revenue growth and negative trends in same-store sales.

- This shift underscores growing concerns about the company's ability to deliver sustained growth and operational efficiency amid evolving consumer demand and a competitive fast-casual dining landscape.

- Now, we'll examine how lowered guidance and softer comparable sales may challenge CAVA Group's previous growth assumptions and long-term outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

CAVA Group Investment Narrative Recap

To be a shareholder in CAVA Group, you would need to believe in the company’s ability to revive strong same-store sales growth and expand efficiently as it moves toward its 1,000-location target. The recent revision in full-year guidance directly impacts this narrative, with softer comparable sales growth emerging as the most immediate catalyst and risk. If these trends persist, CAVA could face challenges justifying its premium valuation and aggressive growth plans. Among recent company news, the announcement on November 4 of reduced guidance for same-restaurant sales growth to 3.0%–4.0% stands out. This lowered expectation signals that top-line expansion, the core short-term catalyst for CAVA, could be pressured by shifting consumer behavior and heightened competition, posing questions about the durability of its expansion strategy. On the other hand, investors should be aware that even rapid new unit openings could put strain on margins if...

Read the full narrative on CAVA Group (it's free!)

CAVA Group's narrative projects $1.9 billion in revenue and $126.2 million in earnings by 2028. This requires 20.4% yearly revenue growth and a $14.5 million earnings decrease from current earnings of $140.7 million.

Uncover how CAVA Group's forecasts yield a $67.89 fair value, a 37% upside to its current price.

Exploring Other Perspectives

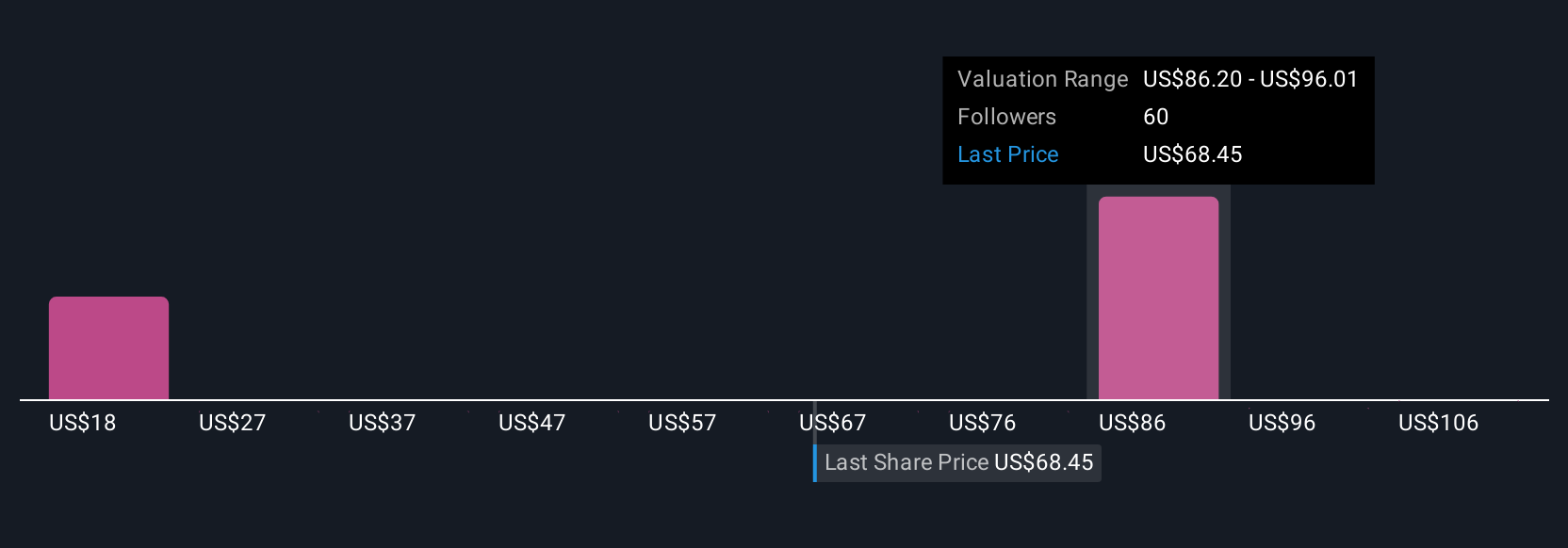

Twelve fair value estimates from the Simply Wall St Community range from US$38.45 to US$118.75 per share. While these opinions span wide, current concerns around slower same-store sales growth illustrate why diverse forecasts on CAVA's outlook exist, take time to explore a range of investor viewpoints.

Explore 12 other fair value estimates on CAVA Group - why the stock might be worth 23% less than the current price!

Build Your Own CAVA Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CAVA Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CAVA Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CAVA Group's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CAVA

CAVA Group

Owns and operates a chain of restaurants under the CAVA brand in the United States.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success