- United States

- /

- Hospitality

- /

- NYSE:BYD

How Declining Demand and Cyber Legal Risks at Boyd Gaming (BYD) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- In the past week, Boyd Gaming disclosed that it is facing ongoing demand challenges, with sales projected to decline by 12% over the next year, alongside multiple federal lawsuits stemming from a recent cyberattack that compromised sensitive personal data.

- This combination of declining demand and increasing legal risks highlights heightened operational uncertainty for Boyd Gaming at a critical time for the business.

- We will explore how concerns over deteriorating demand and heightened legal exposure may impact Boyd Gaming’s investment outlook.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Boyd Gaming Investment Narrative Recap

To be a Boyd Gaming shareholder, you need to believe in the company’s ability to overcome a temporary downturn in demand while managing operational risks, especially in light of recent federal lawsuits and a projected 12% decline in sales over the next year. This news directly impacts the business’s most important near-term catalyst, which is a recovery in regional gaming demand, while elevating legal and cybersecurity threats as the key risks to watch in the immediate future.

Among recent announcements, the company’s disclosure of six federal lawsuits stemming from a cyberattack stands out as particularly relevant, as it adds new operational and financial uncertainty and could influence short-term sentiment while the company addresses both declining demand and reputational challenges. The outcome of these legal proceedings, alongside Boyd’s ongoing efforts to maintain customer trust and regulatory compliance, will likely factor into near-term performance and investor confidence.

Yet in contrast to management’s prior optimism, the pending lawsuit details and potential costs are something every investor should be aware of…

Read the full narrative on Boyd Gaming (it's free!)

Boyd Gaming's outlook forecasts $3.5 billion in revenue and $563.3 million in earnings by 2028. This reflects a 4.7% annual revenue decline and a $1.2 million decrease in earnings from the current $564.5 million.

Uncover how Boyd Gaming's forecasts yield a $90.77 fair value, a 4% upside to its current price.

Exploring Other Perspectives

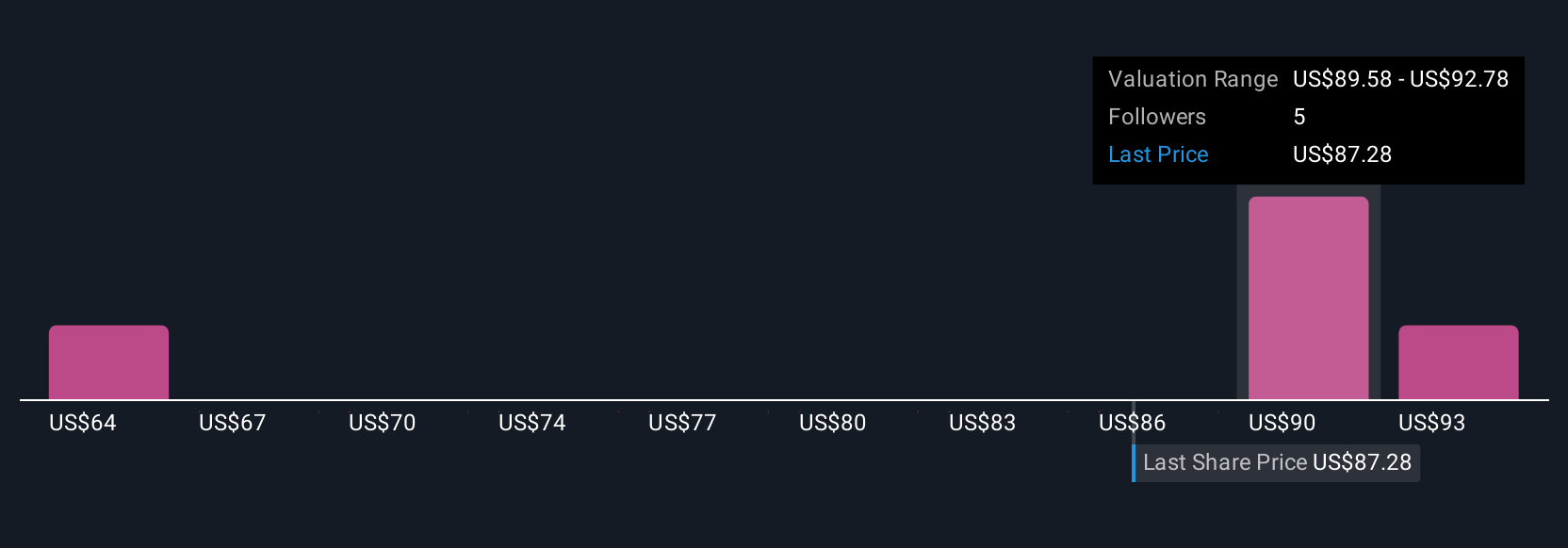

Fair value estimates from the Simply Wall St Community range from US$64.03 to US$98.18, based on four individual perspectives. With projected demand headwinds and ongoing legal actions, your view on Boyd’s performance may diverge widely from others, consider the full spectrum of opinions before making decisions.

Explore 4 other fair value estimates on Boyd Gaming - why the stock might be worth 26% less than the current price!

Build Your Own Boyd Gaming Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Boyd Gaming research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Boyd Gaming research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Boyd Gaming's overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boyd Gaming might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BYD

Boyd Gaming

Operates as a multi-jurisdictional gaming company in the United States and Canada.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives