- United States

- /

- Hospitality

- /

- NYSE:BROS

What Recent Dutch Bros Price Swings and Expansion Plans Signal for Investors in 2025

Reviewed by Bailey Pemberton

If you’re considering what to do with Dutch Bros stock right now, you’re not alone. The company’s share price has been on a bit of a rollercoaster lately, prompting a lot of debate about where it could be headed next. Over just the past month, shares dropped by 25.5%, which naturally turned some heads. Dig a little deeper and you’ll notice the seven-day change is also in the red at -7.0%. Yet, look at the bigger picture and the story pivots: Dutch Bros has actually delivered a 54.1% gain over the past year, and a 52.1% return over three years. Whatever short-term jitters might be in play, long-term investors have benefited significantly.

Some of these swings reflect shifting market vibes and broader investor sentiment about fast-growing regional brands like Dutch Bros, especially as competition heats up and consumer trends evolve. At the most recent closing price of $47.93, the key question is whether Dutch Bros is undervalued, fairly priced, or still a bit frothy after 2023’s impressive run. Looking at our value score, Dutch Bros checks 2 out of 6 undervaluation boxes right now. That’s not a screaming bargain, but it does suggest there may be selective price appeal for patient investors willing to dig beneath the surface.

So, how do major valuation metrics stack up for Dutch Bros? Let’s break down how the company holds up through different valuation lenses, and make sense of what those numbers actually mean for you as a potential investor. And at the end, I’ll share a smarter way to think about what Dutch Bros is really worth: beyond the usual ratios and headlines.

Dutch Bros scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Dutch Bros Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is worth today by forecasting how much cash it could generate in the future and then "discounting" that cash back to the present. The idea is simple: future cash is worth less than cash in your hand right now, so analysts use projections and a discount rate to determine fair value.

For Dutch Bros, the current Free Cash Flow (FCF) stands at negative $5.3 million, reflecting ongoing investments and rapid expansion. However, projections point to strong growth ahead. By 2029, FCF is expected to reach $344.1 million, and longer-term estimates stretch toward $777.8 million by 2035. Analyst forecasts cover the next five years, while anything beyond that is an extrapolation based on current trends.

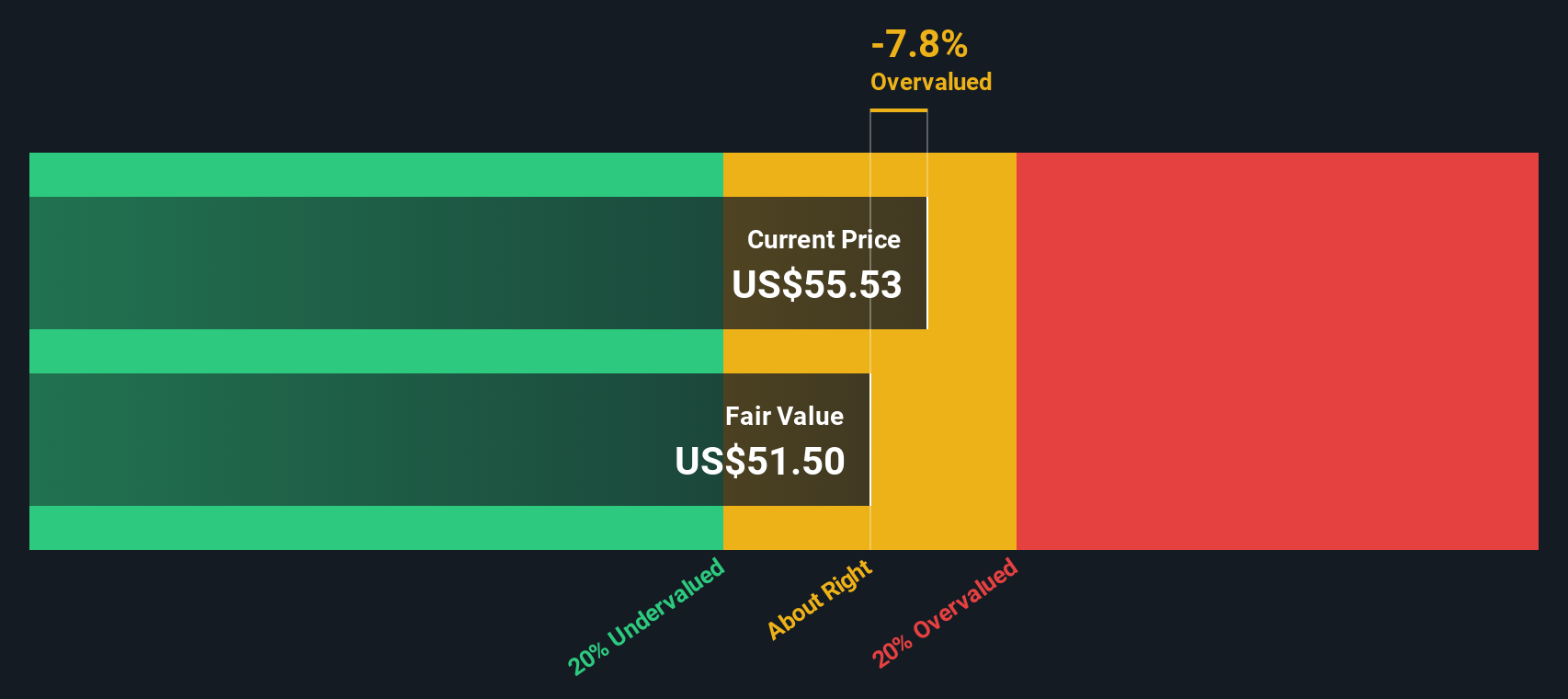

Based on this two-stage cash flow model, Dutch Bros' intrinsic value comes out to $50.33 per share. With the latest closing price at $47.93, the DCF suggests the stock is trading at a slight 4.8% discount to its projected value. This means the market price closely matches what the numbers imply, with just a touch of undervaluation.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Dutch Bros's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Dutch Bros Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is a key metric for valuing profitable companies because it directly links a company’s stock price to its ongoing earnings power. For investors, the PE ratio is an easy way to gauge what the market is willing to pay today for future profits, which is especially relevant for companies like Dutch Bros that have moved into consistent profitability.

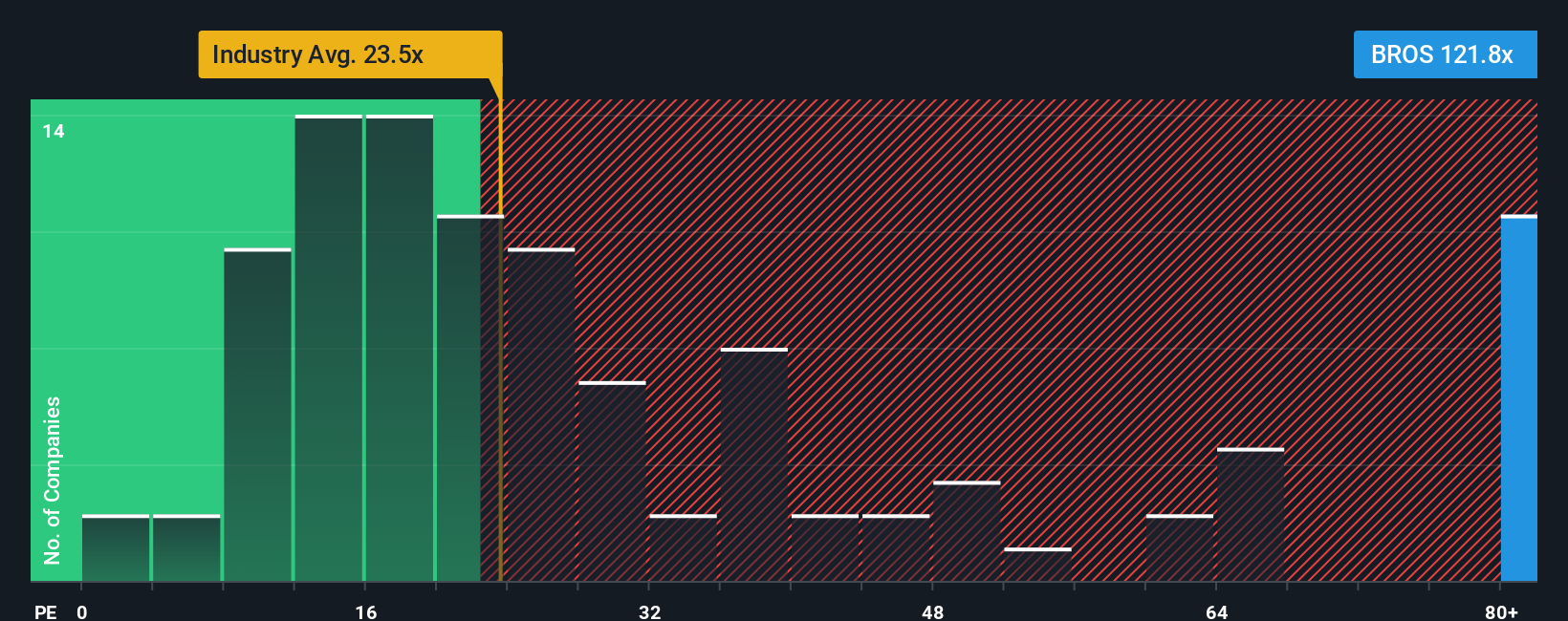

It’s important to remember that a “normal” or “fair” PE ratio depends largely on future growth expectations and the risks the business faces. Fast-growing, innovative brands like Dutch Bros can justify a higher PE, while more mature or riskier ones usually trade at lower multiples. Dutch Bros currently trades at a lofty 106.3x, which stands out when compared with both the hospitality industry average of 24.8x and its peer group’s average of 36.5x. At first glance, that is a big premium, but context is crucial.

This is where the Simply Wall St Fair Ratio comes in. The Fair Ratio, at 35.3x for Dutch Bros, reflects a tailored benchmark that factors in the company’s unique growth outlook, margins, market cap, and industry profile. Unlike simple peer or industry averages, this proprietary metric aims to create a more accurate comparison, adjusting for things that make Dutch Bros distinct. When we compare today’s market PE to the Fair Ratio, the gap is significant and suggests that shares may be pricing in more positive news than the fundamentals justify.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Dutch Bros Narrative

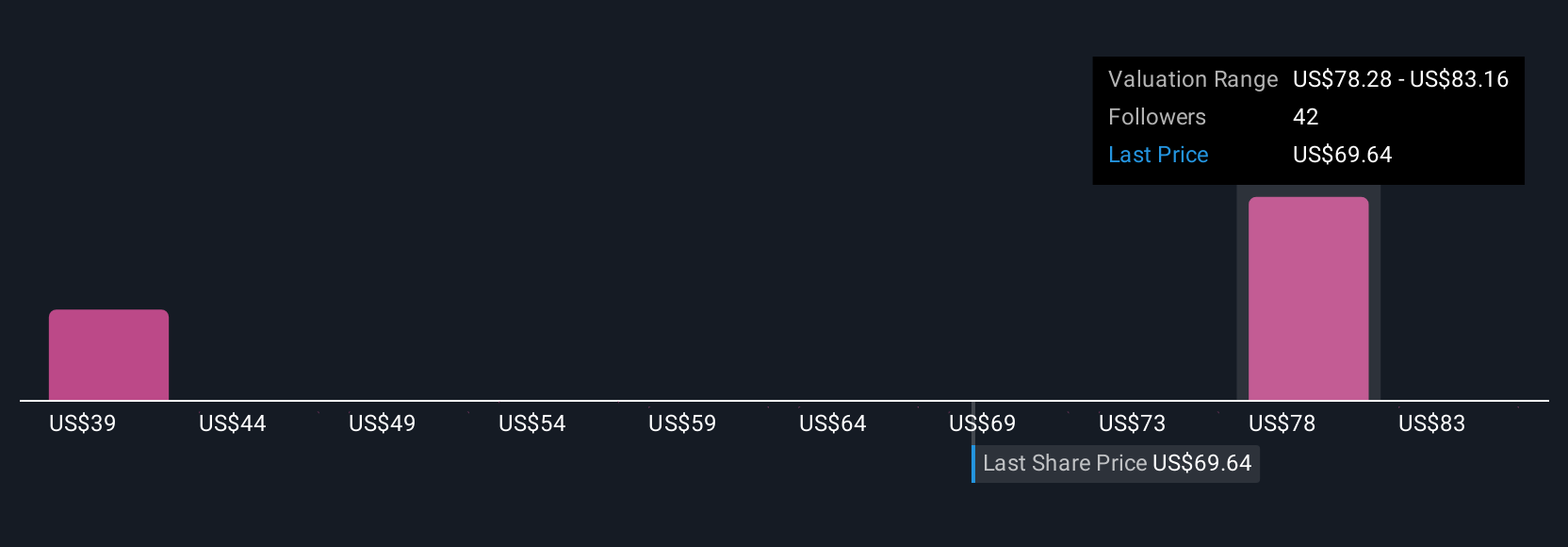

Earlier, we mentioned a smarter way to understand valuation. Let’s introduce you to Narratives. A Narrative connects your personal view of Dutch Bros' story—how you see its brand, growth, and industry future—to specific financial forecasts and an estimated fair value. Rather than relying solely on ratios or headlines, Narratives allow you to lay out your assumptions about future revenue, margins, and earnings. This creates a living “story behind the numbers.”

Narratives are easy to use and accessible right on Simply Wall St’s Community page, where millions of investors share and update their outlooks. They empower you to spot when the share price is above or below your fair value, so you can make more confident buy or sell decisions. Plus, these Narratives respond dynamically when fresh news, earnings, or data emerge. This helps keep your investment thesis current and relevant.

For example, one Dutch Bros Narrative might forecast rapid expansion and rising margins, justifying a fair value up near $92.00. Another, more cautious take might factor in rising costs or competitive risks, suggesting a fair value closer to $73.00. Your Narrative is your perspective— informed, dynamic, and ready for the next big move.

Do you think there's more to the story for Dutch Bros? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BROS

Dutch Bros

Operates and franchises drive-thru shops in the United States.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives