- United States

- /

- Consumer Services

- /

- NYSE:BODI

Investors are selling off Beachbody Company (NYSE:BODY), lack of profits no doubt contribute to shareholders one-year loss

It's not a secret that every investor will make bad investments, from time to time. But it should be a priority to avoid stomach churning catastrophes, wherever possible. So we hope that those who held The Beachbody Company, Inc. (NYSE:BODY) during the last year don't lose the lesson, in addition to the 90% hit to the value of their shares. That'd be a striking reminder about the importance of diversification. Beachbody Company hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. Shareholders have had an even rougher run lately, with the share price down 41% in the last 90 days. Of course, this share price action may well have been influenced by the 17% decline in the broader market, throughout the period. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

Check out our latest analysis for Beachbody Company

Because Beachbody Company made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Beachbody Company's revenue didn't grow at all in the last year. In fact, it fell 8.1%. That's not what investors generally want to see. The share price fall of 90% in a year tells the story. That's a stern reminder that profitless companies need to grow the top line, at the very least. But markets do over-react, so there opportunity for investors who are willing to take the time to dig deeper and understand the business.

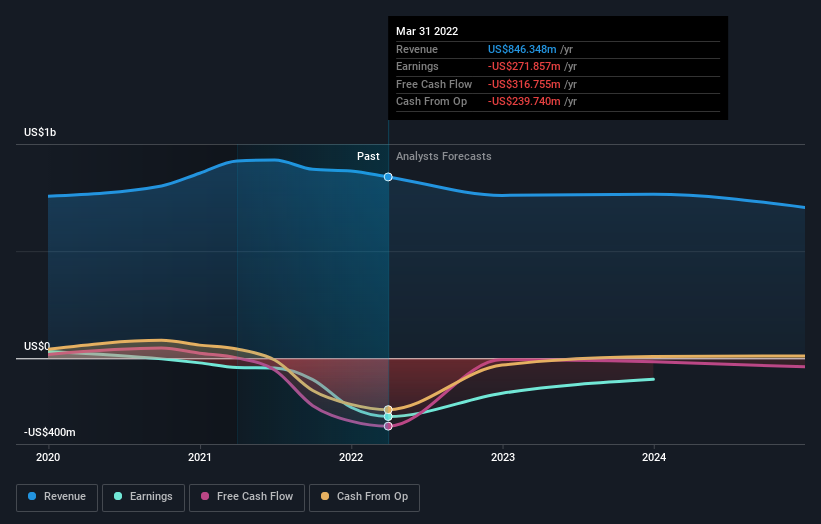

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. This free report showing analyst forecasts should help you form a view on Beachbody Company

A Different Perspective

Beachbody Company shareholders are down 90% for the year, even worse than the market loss of 18%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. With the stock down 41% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. It's always interesting to track share price performance over the longer term. But to understand Beachbody Company better, we need to consider many other factors. To that end, you should be aware of the 3 warning signs we've spotted with Beachbody Company .

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Beachbody Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BODI

Beachbody Company

Operates as a fitness and nutrition company in the United States, Canada, the United Kingdom, and France.

Adequate balance sheet and fair value.

Market Insights

Community Narratives