- United States

- /

- Consumer Services

- /

- NYSE:BODI

Improved Revenues Required Before The Beachbody Company, Inc. (NYSE:BODI) Stock's 27% Jump Looks Justified

The Beachbody Company, Inc. (NYSE:BODI) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 24% over that time.

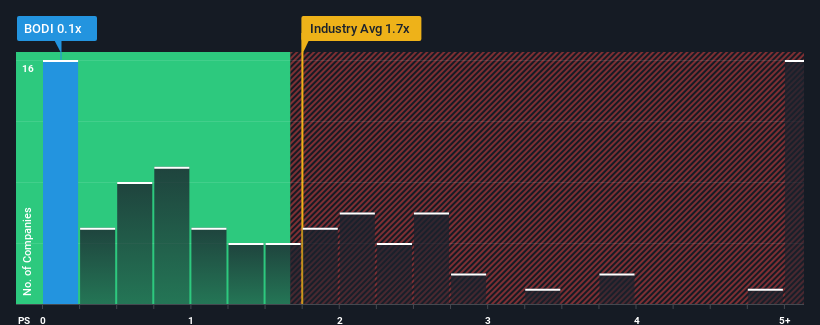

Although its price has surged higher, considering around half the companies operating in the United States' Consumer Services industry have price-to-sales ratios (or "P/S") above 1.7x, you may still consider Beachbody Company as an solid investment opportunity with its 0.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Beachbody Company

What Does Beachbody Company's Recent Performance Look Like?

Beachbody Company could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Beachbody Company's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Beachbody Company?

Beachbody Company's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a frustrating 19% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 49% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 20% as estimated by the three analysts watching the company. That's not great when the rest of the industry is expected to grow by 13%.

With this in consideration, we find it intriguing that Beachbody Company's P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What Does Beachbody Company's P/S Mean For Investors?

Despite Beachbody Company's share price climbing recently, its P/S still lags most other companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Beachbody Company's analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

Plus, you should also learn about these 3 warning signs we've spotted with Beachbody Company.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Beachbody Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BODI

Beachbody Company

Operates as a subscription health and wellness company that provides fitness, nutrition, and stress-reducing programs in the United States and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives