- United States

- /

- Consumer Services

- /

- NYSE:BFAM

Is a New $450 Million Loan and Buyback Update Reshaping the Investment Case for BFAM?

Reviewed by Simply Wall St

- Bright Horizons Family Solutions recently amended its credit agreement to add a new US$450 million term B loan facility and announced an update to its equity buyback plan that was initially introduced in June 2025.

- This combination of securing additional funding and modifying its capital return approach reflects evolving financial strategies that may affect the company's ability to invest in growth and shareholder returns.

- To understand the wider impact, we'll explore how securing a substantial new term loan could reshape the company's investment outlook.

This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

Bright Horizons Family Solutions Investment Narrative Recap

To be a shareholder in Bright Horizons Family Solutions, you need confidence in the long-term demand for employer-sponsored childcare, sustained enrollment growth, and the ongoing shift toward dual-income families needing quality care services. The addition of a US$450 million term B loan facility and an updated share buyback plan may provide flexibility for investment and returns, but these financing changes do not materially shift the focus from the most pressing catalyst, broadening partnerships with large employers, or the most significant current risk: persistent low occupancy in a portion of its centers.

Of the recent announcements, the share repurchase program, initiated in June 2025, aligns most closely with this funding update. The commencement of buyback activities alongside new debt could appeal to investors seeking capital returns, but this does not address the root challenge of low-performing centers that continue to constrain the company’s margin recovery and topline growth potential.

However, investors should also consider the persistent risk related to…

Read the full narrative on Bright Horizons Family Solutions (it's free!)

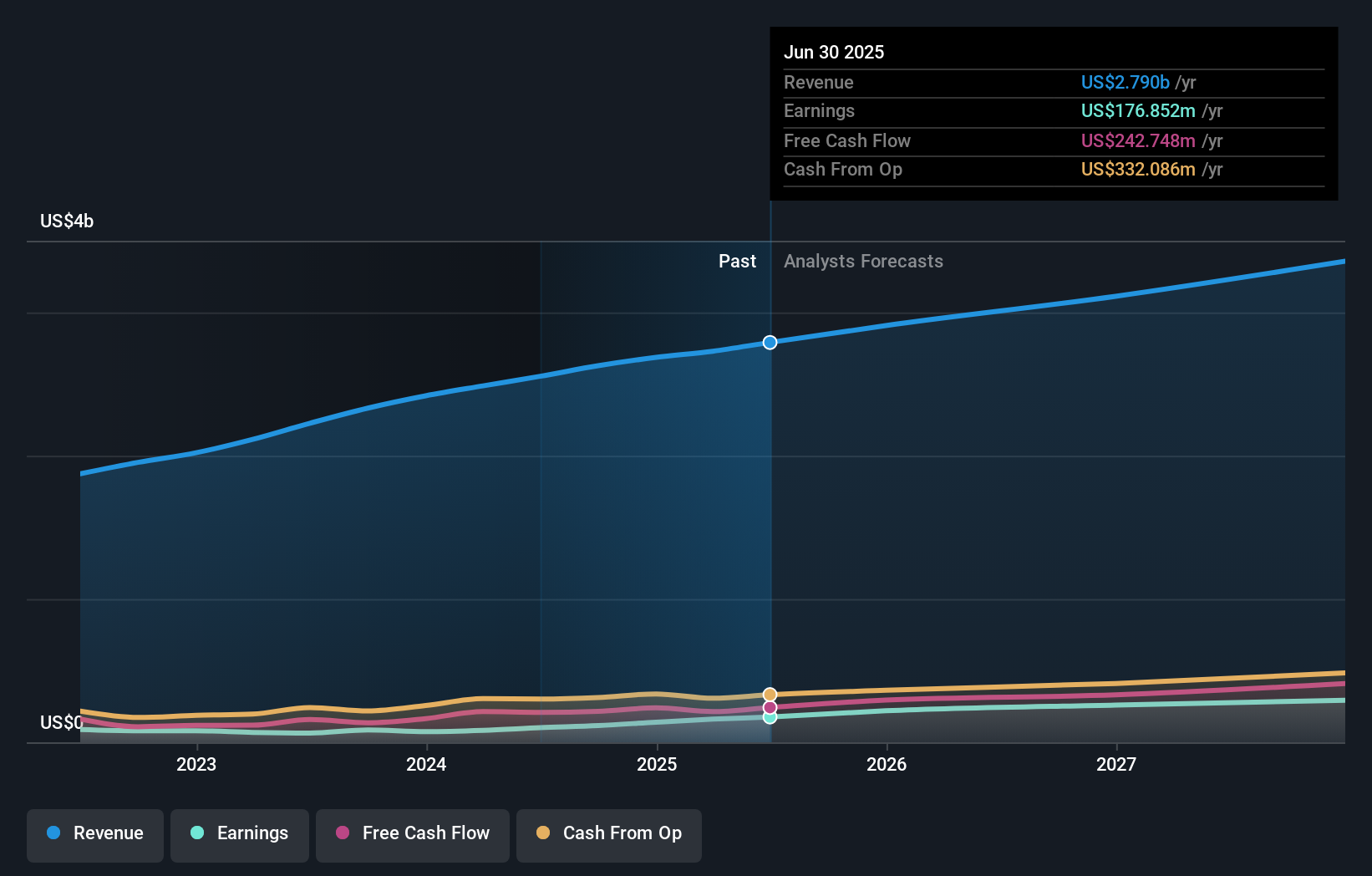

Bright Horizons Family Solutions is projected to reach $3.5 billion in revenue and $329.7 million in earnings by 2028. This outlook is based on analysts’ assumptions of 7.5% annual revenue growth and a $152.8 million increase in earnings from the current level of $176.9 million.

Uncover how Bright Horizons Family Solutions' forecasts yield a $140.89 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community range from US$88.59 to US$208.02, reflecting a wide span of views. While opinions differ, many are watching for margin improvements that depend on enrollment growth in weaker centers, a factor that could weigh on future results.

Explore 4 other fair value estimates on Bright Horizons Family Solutions - why the stock might be worth as much as 69% more than the current price!

Build Your Own Bright Horizons Family Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bright Horizons Family Solutions research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Bright Horizons Family Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bright Horizons Family Solutions' overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bright Horizons Family Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BFAM

Bright Horizons Family Solutions

Provides early education and childcare, back-up care, educational advisory, and other workplace solutions services for employers and families in the United States, Puerto Rico, the United Kingdom, the Netherlands, Australia, and India.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives