- United States

- /

- Consumer Services

- /

- NYSE:ADT

Follow-On Equity Offering and Earnings Beat Might Change The Case For Investing In ADT (ADT)

Reviewed by Simply Wall St

- Earlier this week, ADT Inc. reported higher second quarter earnings and revenue, reaffirmed its annual guidance, declared a US$0.055 dividend, updated its share buyback program, and announced a follow-on equity offering of 71 million shares.

- The combination of increased profitability, ongoing shareholder returns, and a move to raise additional capital signals active efforts to balance growth with financial flexibility.

- We’ll explore how the follow-on equity offering could shape ADT’s investment narrative and future capital allocation choices.

ADT Investment Narrative Recap

ADT shareholders are often focused on the ability of the company to grow its customer base and earnings while managing debt and sustaining cash flow, a balance reflected in recent profitability and ongoing buybacks. The new follow-on equity offering does not appear to materially shift the key short-term catalyst, which remains centered on execution of growth initiatives and customer retention, but it may have implications for dilution risk. The biggest operational concern right now is whether net margins will be pressured as ADT transitions to a model where customers own their installed equipment.

Among ADT's recent announcements, the update on the company's share buyback program stands out. The repurchase of nearly 6% of outstanding shares so far this year has been a meaningful element of capital allocation, supporting earnings per share and potentially offsetting some dilution from new equity issuance. This action is closely connected to investors' concerns about striking the right balance between raising capital and rewarding ongoing shareholders.

But despite these positives, investors should keep in mind the new equity offering highlights a risk that...

Read the full narrative on ADT (it's free!)

ADT's outlook anticipates $5.6 billion in revenue and $800.8 million in earnings by 2028. This projection implies 4.1% annual revenue growth and an increase in earnings of about $202.8 million from the current $598.0 million.

Uncover how ADT's forecasts yield a $9.24 fair value, a 7% upside to its current price.

Exploring Other Perspectives

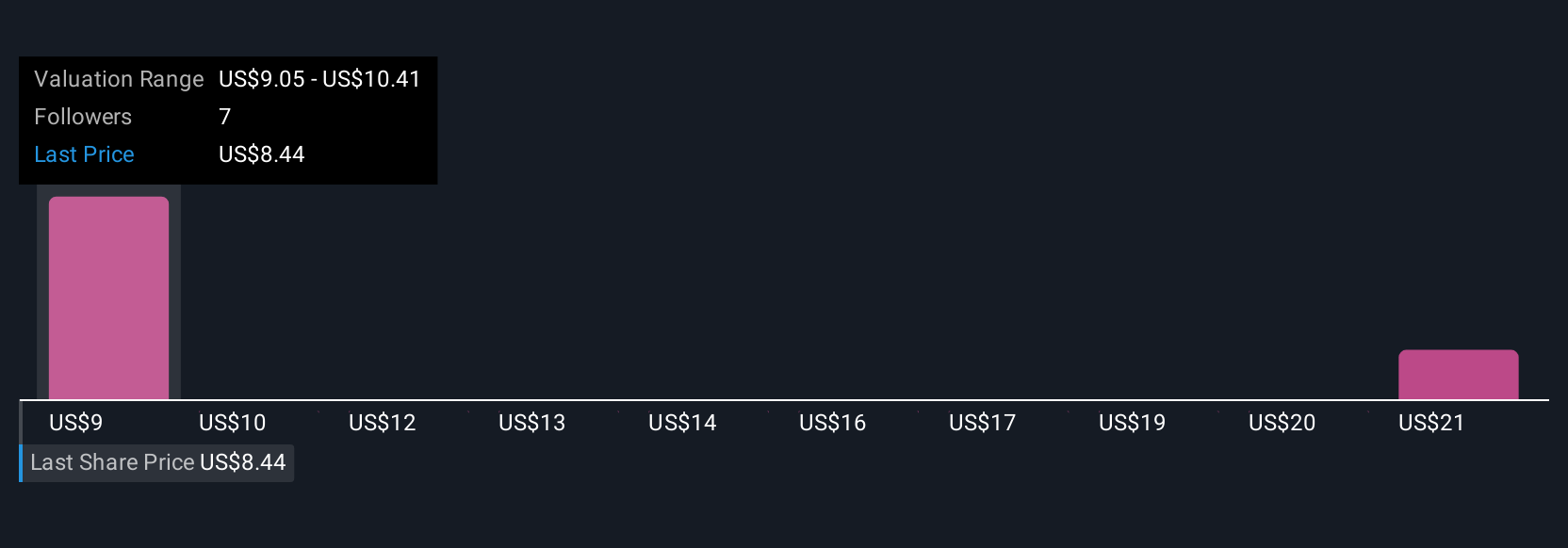

Three members of the Simply Wall St Community have provided fair value estimates for ADT, ranging from US$9.05 to US$20.69. Differences in these opinions reflect how assumptions about ADT's profit margins and capital structure can shape broader expectations for the company’s future performance.

Build Your Own ADT Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ADT research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ADT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ADT's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 26 companies in the world exploring or producing it. Find the list for free.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ADT

ADT

Provides security, interactive, and smart home solutions in the United States.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives