- United States

- /

- Consumer Services

- /

- NasdaqCM:XWEL

Not Many Are Piling Into XWELL, Inc. (NASDAQ:XWEL) Stock Yet As It Plummets 29%

The XWELL, Inc. (NASDAQ:XWEL) share price has fared very poorly over the last month, falling by a substantial 29%. For any long-term shareholders, the last month ends a year to forget by locking in a 76% share price decline.

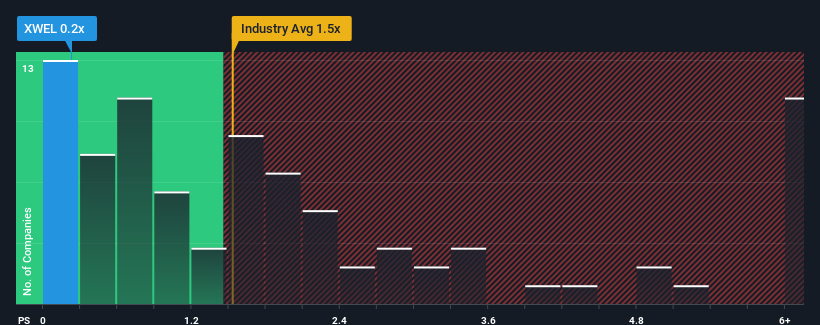

Following the heavy fall in price, it would be understandable if you think XWELL is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.2x, considering almost half the companies in the United States' Consumer Services industry have P/S ratios above 1.5x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for XWELL

How XWELL Has Been Performing

While the industry has experienced revenue growth lately, XWELL's revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on XWELL will help you uncover what's on the horizon.How Is XWELL's Revenue Growth Trending?

In order to justify its P/S ratio, XWELL would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 61%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 71% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next year should generate growth of 16% as estimated by the lone analyst watching the company. That's shaping up to be materially higher than the 13% growth forecast for the broader industry.

With this in consideration, we find it intriguing that XWELL's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What Does XWELL's P/S Mean For Investors?

XWELL's recently weak share price has pulled its P/S back below other Consumer Services companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

XWELL's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

You need to take note of risks, for example - XWELL has 4 warning signs (and 2 which don't sit too well with us) we think you should know about.

If these risks are making you reconsider your opinion on XWELL, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:XWEL

XWELL

Provides health and wellness services to travelers in the United States and internationally.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives