- United States

- /

- Hospitality

- /

- NasdaqGS:WING

Wingstop (WING) Is Up 9.9% After Strong Q3, Dividend Hike, and Lowered Sales Outlook – What's Changed

Reviewed by Sasha Jovanovic

- Wingstop recently reported strong third quarter results, raised its quarterly dividend to US$0.30 per share, and completed a buyback under its 2023 authorization, but also lowered its outlook for full-year domestic same-store sales, citing softer consumer demand.

- While earnings and revenue increased, the reduced guidance highlights shifting consumer conditions and prompted analysts to revise expectations for the company's near-term performance.

- We’ll assess how this combination of solid earnings and a more cautious sales outlook affects Wingstop’s longer-term investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Wingstop Investment Narrative Recap

To be a Wingstop shareholder, you need conviction in its digital-led, asset-light growth model and ability to engage customers even amid economic shifts. While strong Q3 earnings and robust buyback execution reaffirm the franchise’s health, the lowered same-store sales outlook means softer consumer demand remains the key near-term risk. Short-term catalysts, such as continued expansion and digital innovation, are not materially affected by recent developments, but close attention to evolving consumer trends remains essential.

The recent update to full-year guidance, flagging a 3% to 4% decline in domestic same-store sales, stands out among recent company actions. Taken in the context of ongoing menu upgrades and aggressive digital efforts, this guidance reduction puts the spotlight firmly on consumer demand as the most important variable for near-term momentum.

However, investors should be aware that even with disciplined cost management and efficient operations, continued softness in consumer demand could still...

Read the full narrative on Wingstop (it's free!)

Wingstop's narrative projects $1.1 billion in revenue and $200.9 million in earnings by 2028. This requires 18.9% annual revenue growth and a $29.4 million increase in earnings from the current $171.5 million level.

Uncover how Wingstop's forecasts yield a $345.84 fair value, a 45% upside to its current price.

Exploring Other Perspectives

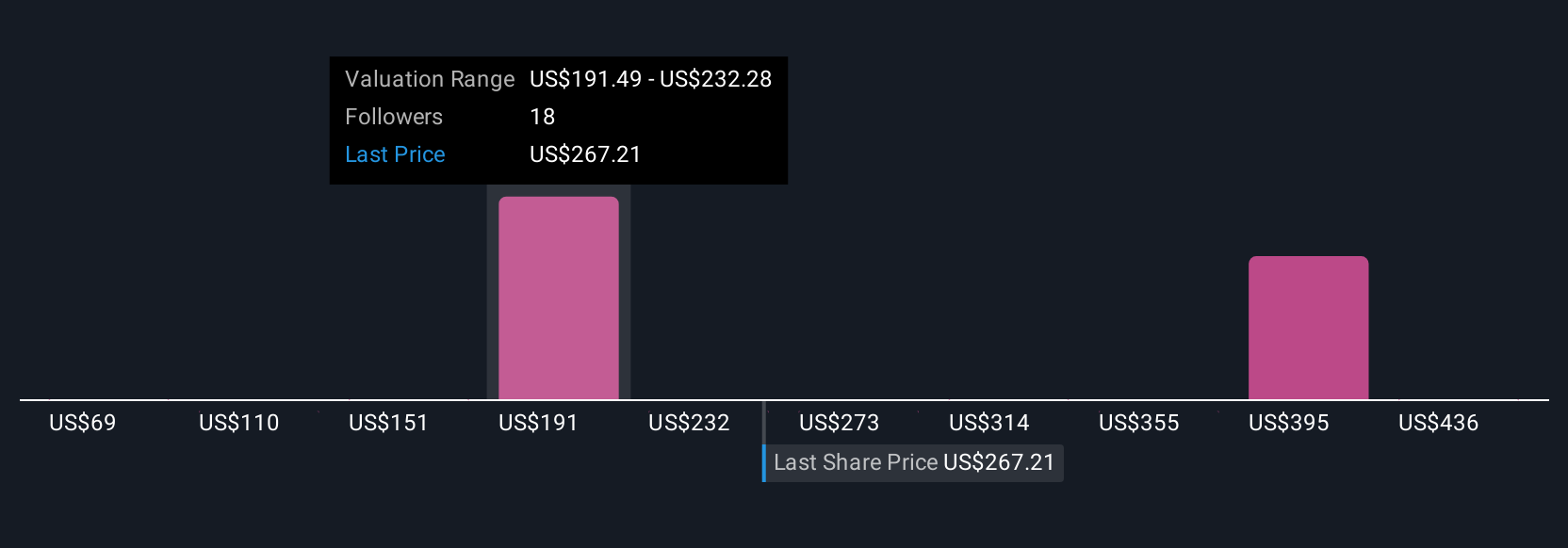

Seven different Simply Wall St Community fair value estimates for Wingstop range from US$69 to US$477 per share, reflecting wide disagreement. With consumer demand now flagged as a critical risk, these diverging views highlight just how much future performance expectations can differ.

Explore 7 other fair value estimates on Wingstop - why the stock might be worth less than half the current price!

Build Your Own Wingstop Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Wingstop research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Wingstop research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Wingstop's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wingstop might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WING

Wingstop

Wingstop Inc., together with its subsidiaries, franchises and operates restaurants under the Wingstop brand.

Proven track record with low risk.

Market Insights

Community Narratives