- United States

- /

- Hospitality

- /

- NasdaqGS:WING

Is Wingstop’s 15% Drop in 2025 a Buying Opportunity or Cause for Caution?

Reviewed by Bailey Pemberton

If you’re looking at Wingstop’s stock chart and wondering “what next?”, you’re definitely not alone. It’s been a rollercoaster year for this fast-growing restaurant chain, with shares closing recently at $247.36. Over the last week, the stock took a 7.3% hit, capping off a year-to-date drop of 15.3%. That might sound rough, but if you step back a bit, the story changes. Wingstop’s shares have surged 61.4% over the past three years and an impressive 130.0% over five.

So what’s behind the recent swings? While there hasn’t been a single headline grabbing the spotlight, several factors are in play. Shifting consumer trends and increased competition have weighed on the restaurant sector. On the flip side, Wingstop has been steadily rolling out new locations and experimenting with menu items, fueling some long-term optimism among investors. These shifts are important to keep in mind as we turn our focus to valuation. Is the current share price justified, or are there more shake-ups to come?

If you look at the company’s value score, Wingstop lands at 1 out of 6, meaning it’s considered undervalued by only one of the six valuation checks we use. That may signal caution for some investors, but it’s just one lens through which to view the story. Next, we’ll break down each key valuation method in detail, and stay tuned for an even better approach to make sense of what Wingstop is really worth.

Wingstop scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Wingstop Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) approach projects a company’s future free cash flows and then discounts those cash flows back to today to estimate the company's true value. In other words, it is a way to look ahead at what Wingstop could earn and figure out how much that is worth right now.

Wingstop’s latest reported Free Cash Flow stands at $56.7 million. Analysts expect a sharp growth trajectory, with Free Cash Flow projected to reach $307.6 million by 2029. It is important to note that around five years of FCF estimates are provided by analysts, and the following five years are calculated by extrapolation.

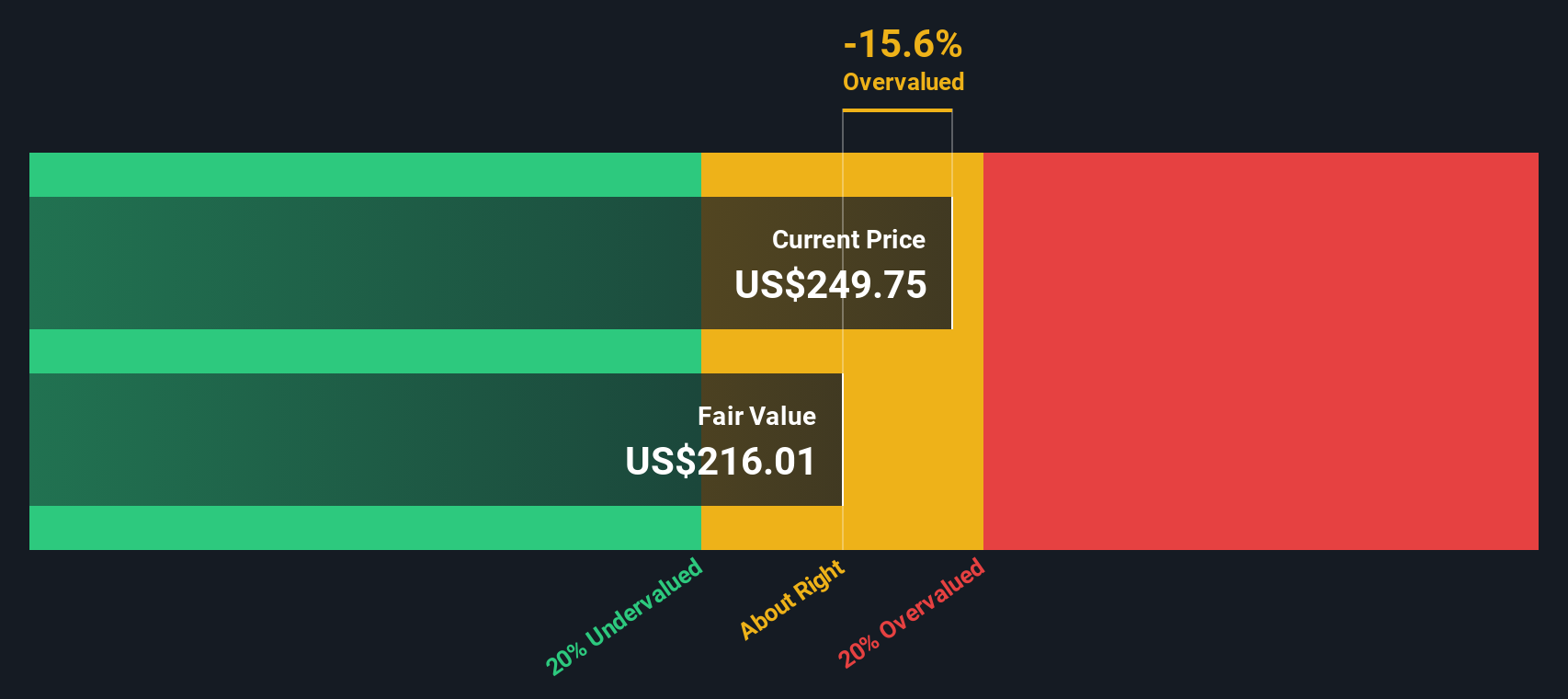

After crunching the numbers, the DCF model calculates an intrinsic value for Wingstop of $215.96 per share. With the current market price at $247.36, this implies the stock is trading at a 14.5% premium to its DCF-based fair value.

Bottom line, according to the DCF analysis, Wingstop appears to be overvalued at current levels because investors are pricing in more growth than the model projects.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Wingstop may be overvalued by 14.5%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Wingstop Price vs Earnings

The price-to-earnings (PE) ratio is widely used for valuing profitable companies because it measures how much investors are willing to pay for each dollar of a company's earnings. It is particularly useful for comparing companies within the same industry, as it factors in both profitability and market expectations.

Growth expectations and risk play an important role in what a fair PE ratio should be. Companies with higher expected earnings growth or lower perceived risk typically trade at higher PE multiples, while those with slower growth or greater risk trade lower. This helps set a baseline for identifying potential market mispricings.

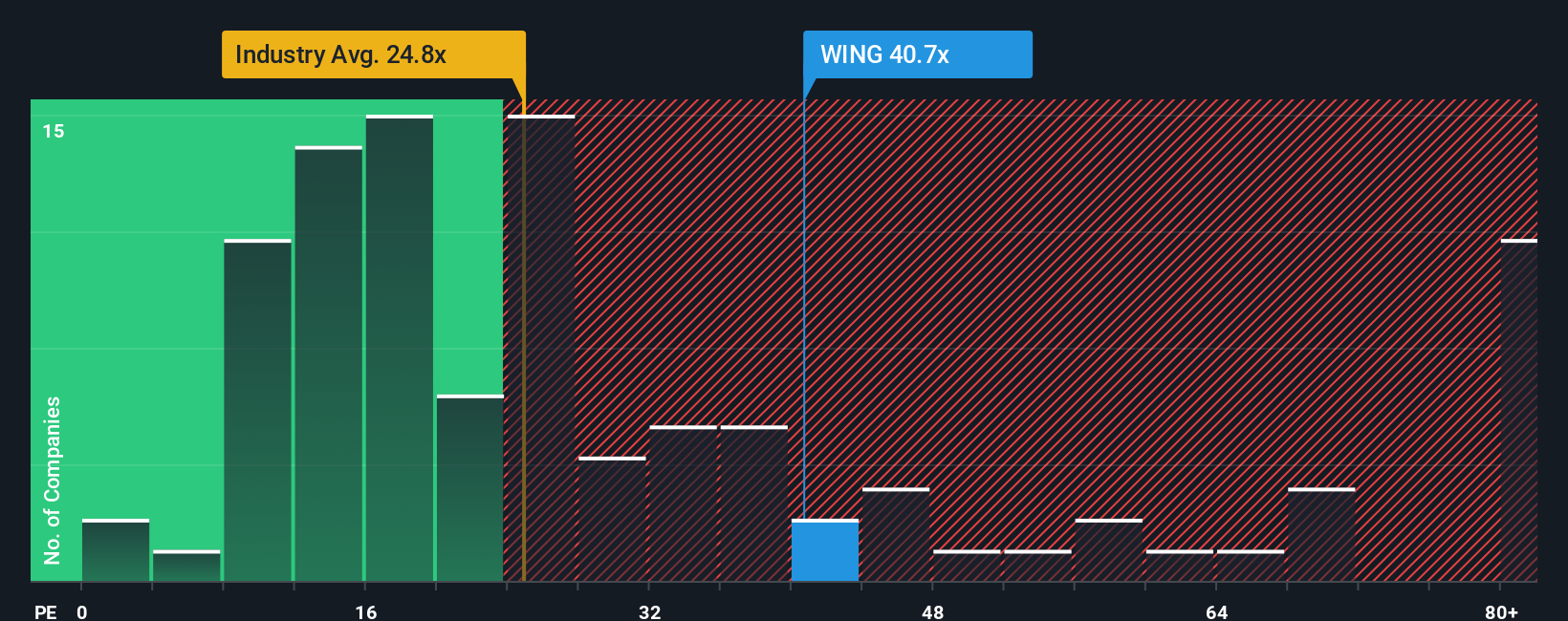

As of now, Wingstop is trading at a PE ratio of 40.3x. That’s well above the hospitality industry average of 23.9x, and also higher than its peers at 55.9x. These numbers might make the stock seem expensive at first glance, but raw comparisons often miss the nuances of a company’s growth prospects, profitability, risk profile, and scale.

This is where Simply Wall St’s “Fair Ratio” comes in, currently set at 20.1x for Wingstop. Unlike broad industry or peer benchmarks, the Fair Ratio accounts for company-specific factors such as Wingstop’s earnings growth, profit margins, risks, and its position in the market. This provides a more tailored view of value. By blending these inputs, the Fair Ratio offers a more rounded perspective than raw peer or industry comparisons.

Comparing the Fair Ratio of 20.1x to Wingstop’s actual PE of 40.3x suggests the stock is valued well above what would be considered “fair” based on its fundamentals and risk profile.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Wingstop Narrative

Earlier, we mentioned there is an even better way to approach valuation, so let's introduce you to Narratives. A Narrative is simply your personal story or perspective about a company, linking the real-world journey you believe a business is on with the numbers behind its financial forecasts and, ultimately, what you think is a fair value for its shares.

Narratives go beyond basic ratios by letting you factor in assumptions about future revenue, earnings, and margins directly. This ties your view of the company's future to a clear valuation. They make valuation approachable for anyone, and you’ll find them already in use by millions of investors on Simply Wall St’s Community page.

With Narratives, you can easily compare your own fair value to the current price, giving you a practical tool for deciding when it makes sense to buy or sell. In addition, Narratives are kept up-to-date in real time as new data, earnings, or news emerges about the business, keeping your investment thesis relevant.

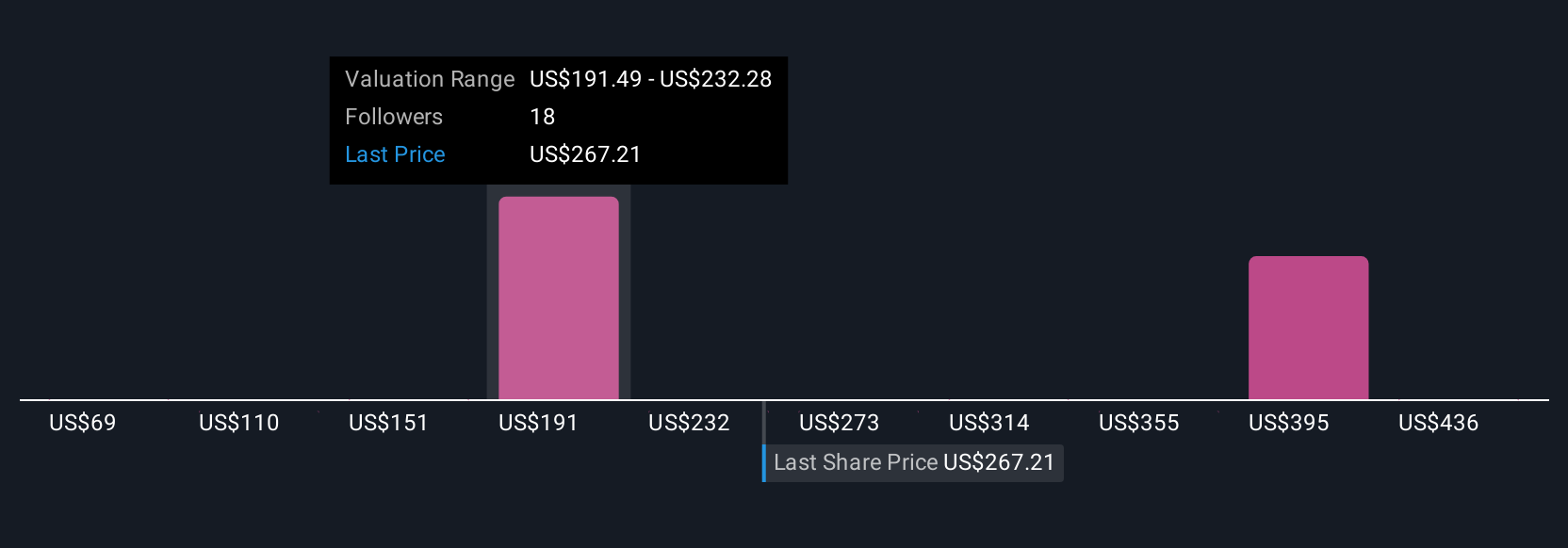

For example, on Wingstop, some investors believe its digital innovation and international expansion can drive shares up to $477, while others are more cautious and see fair value closer to $185. This shows how Narratives help capture all sides of the story in one place.

Do you think there's more to the story for Wingstop? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wingstop might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WING

Wingstop

Wingstop Inc., together with its subsidiaries, franchises and operates restaurants under the Wingstop brand.

Proven track record with slight risk.

Market Insights

Community Narratives