- United States

- /

- Hospitality

- /

- NasdaqGS:TXRH

Is Texas Roadhouse Attractively Priced After Its Recent 5.7% Weekly Rally?

Reviewed by Bailey Pemberton

- Wondering if Texas Roadhouse is a bargain or already priced to perfection? You are not alone. Many investors are looking for an edge in sizing up its true value.

- Lately, Texas Roadhouse stock has caught attention for its recent moves, bouncing up 5.7% in the past week despite being down 11.8% over the last year.

- Market headlines have focused on the company's operational expansion and strong consumer demand, with several news outlets noting how these factors may be shifting investor sentiment. This has fueled debates about whether the recent price movements represent momentum or increased risk.

- Our valuation check score for Texas Roadhouse currently stands at 3 out of 6, meaning there are both positives and areas for caution. Let us break down what this score really means using different valuation approaches. We will also reveal a fresh perspective on valuation at the end of this article.

Find out why Texas Roadhouse's -11.8% return over the last year is lagging behind its peers.

Approach 1: Texas Roadhouse Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by forecasting its future cash flows and then discounting those projections back to today's value. This approach helps investors separate the business's underlying worth from its current market sentiment by focusing on fundamentals.

For Texas Roadhouse, the latest reported Free Cash Flow stands at $341.3 million. Analyst consensus offers projections up to five years out, estimating the company could generate up to $587.4 million in free cash flow by the end of 2028. Beyond analyst coverage, Simply Wall St extrapolates these numbers by applying reasonable growth rates and projecting $1.14 billion in annual free cash flow by 2035. All cash flows are reported in US dollars.

The DCF model currently estimates Texas Roadhouse's fair value at $227.72 per share. This represents a 22.4% discount to the current trading price, suggesting there could be meaningful upside for long-term investors if these projections hold true. In short, the present market price appears to undervalue the business.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Texas Roadhouse is undervalued by 22.4%. Track this in your watchlist or portfolio, or discover 926 more undervalued stocks based on cash flows.

Approach 2: Texas Roadhouse Price vs Earnings (PE)

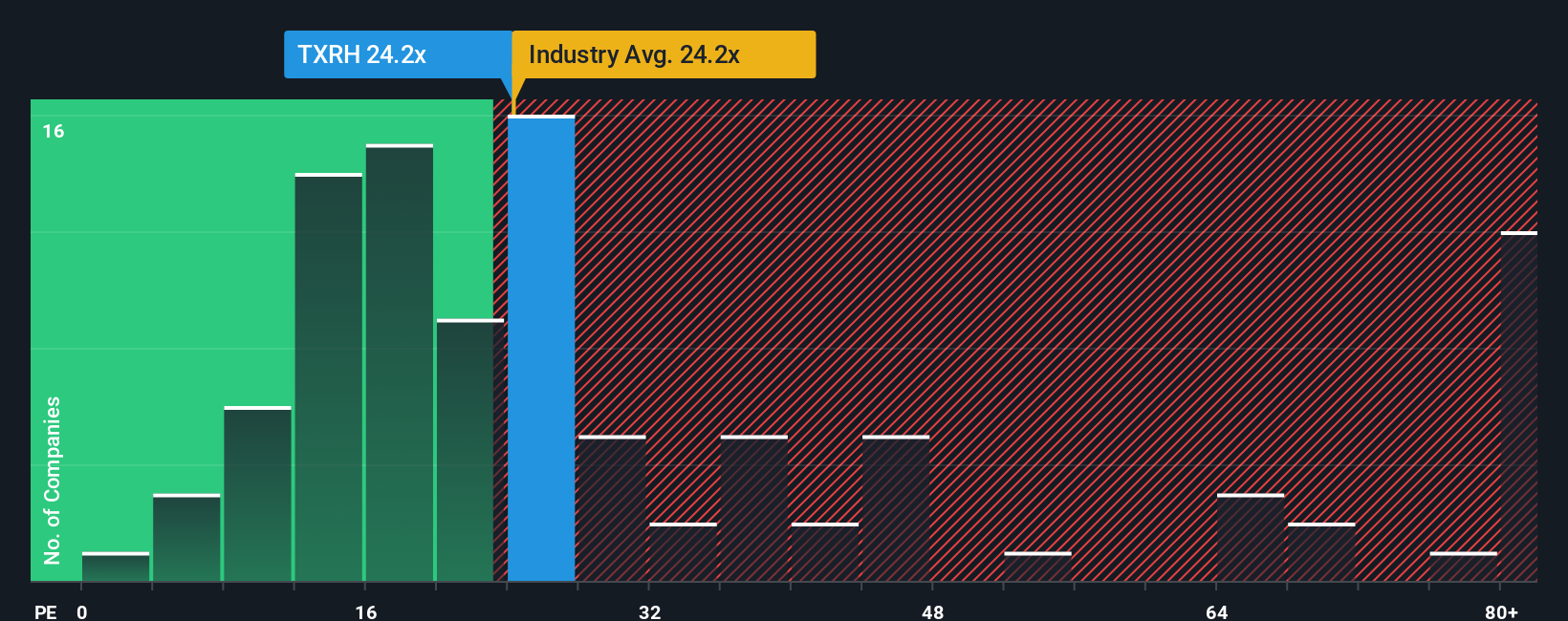

The Price-to-Earnings (PE) ratio is one of the most widely used valuation metrics for profitable companies like Texas Roadhouse. It enables investors to gauge how much they are paying for each dollar of the company's earnings, making it especially useful for businesses with consistent, positive profits.

Growth prospects and perceived risks play an important role in shaping a company’s “normal” or “fair” PE ratio. In general, companies expected to grow earnings faster or those viewed as lower risk command higher PE ratios. Slower-growing or riskier businesses often see lower multiples.

Texas Roadhouse currently trades at a PE ratio of 26.8x. This compares to a Hospitality industry average of 21.4x and a peer group average of 48.1x. At first glance, the stock appears more expensive than most industry peers, though less so than some direct competitors.

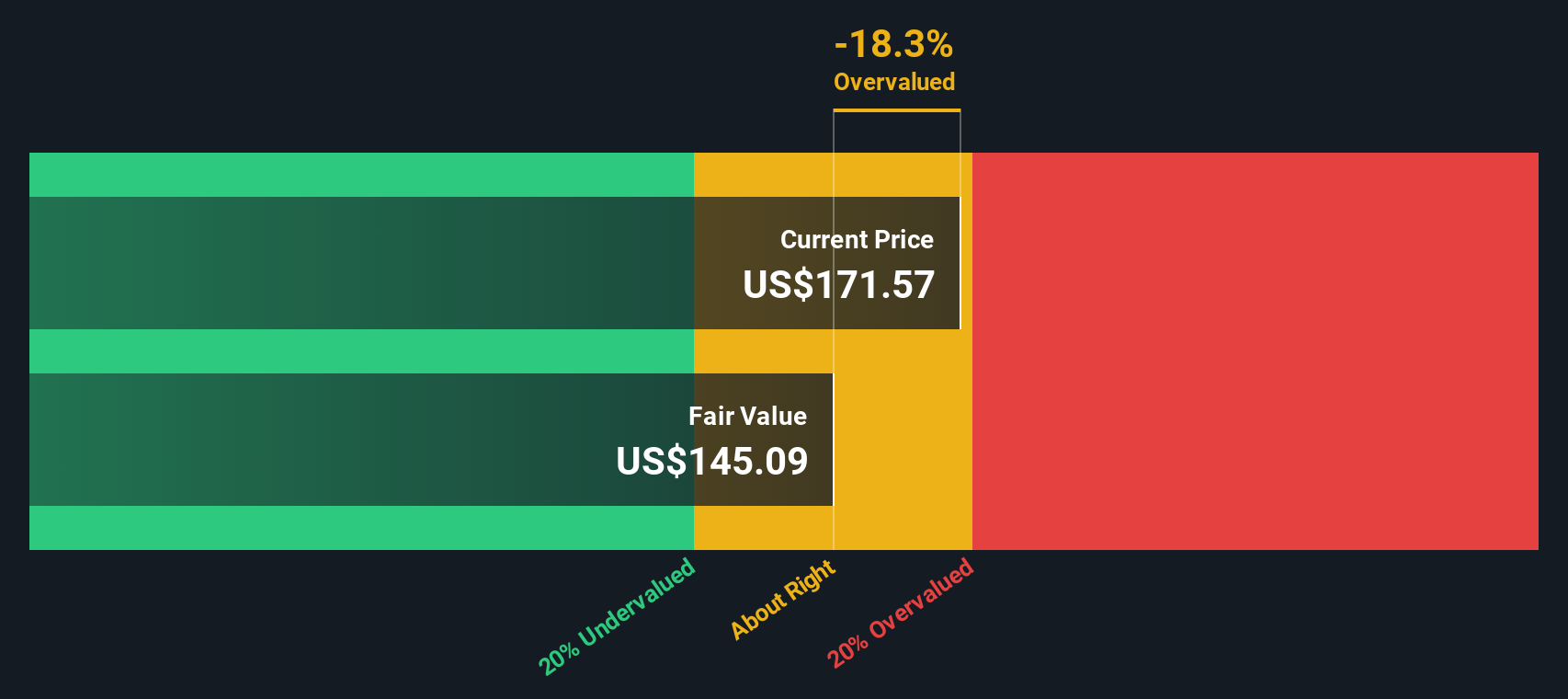

Simply Wall St’s “Fair Ratio” for Texas Roadhouse is 21.8x. This proprietary figure does more than simply compare the company to others. It takes into account Texas Roadhouse’s earnings growth outlook, profit margins, market cap, underlying risks, and its position within the Hospitality industry, offering a holistic and tailored valuation benchmark for the business.

When we line up Texas Roadhouse’s current PE of 26.8x with its Fair Ratio of 21.8x, the stock looks slightly overvalued on this measure. The market appears to be pricing in either stronger near-term growth or less risk than our model expects.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1434 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Texas Roadhouse Narrative

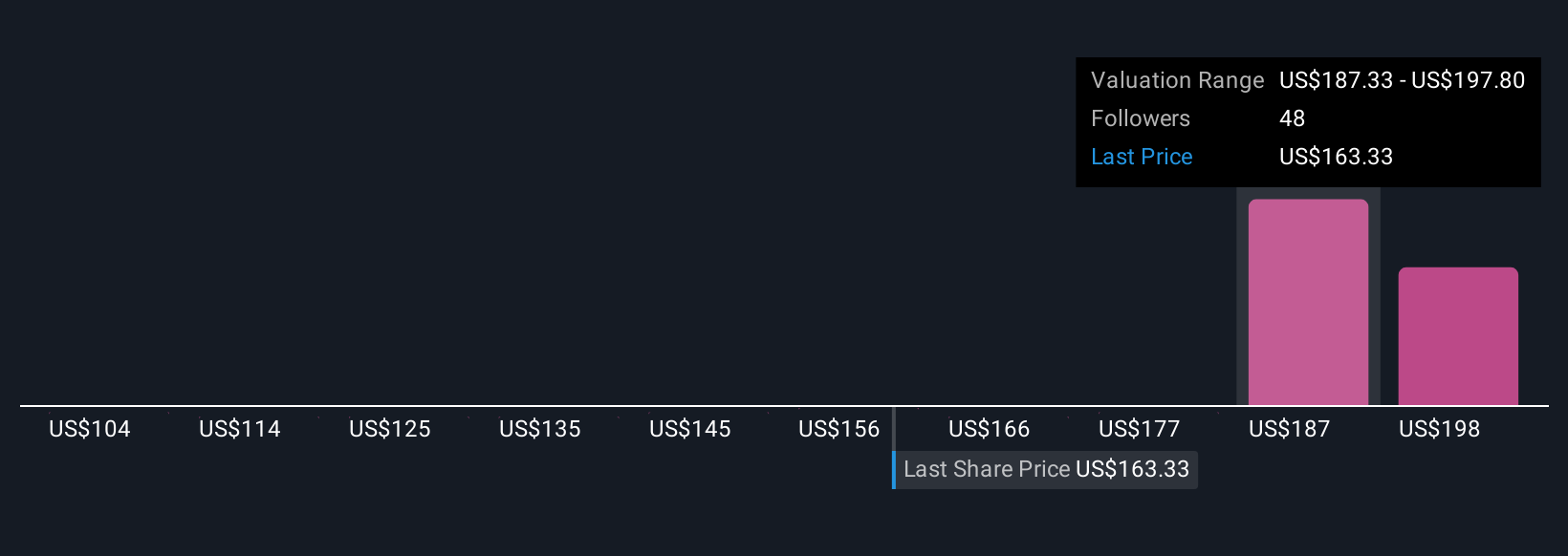

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story about a company. It connects your assumptions about its future revenue, earnings, and margins with your view of fair value, making the investment process feel both personal and logical.

Instead of only relying on analyst estimates or generic ratios, Narratives let you build, adjust, and share your own perspective based on what you believe will drive Texas Roadhouse’s success or present challenges. On Simply Wall St’s Community page, millions of investors use Narratives as an accessible, step-by-step tool, linking their foresight about a company to an up-to-date, scenario-driven valuation.

The biggest advantage is responsiveness: your Narrative’s fair value updates dynamically with new news, earnings releases, or operational changes. This helps you decide when the price deserves your attention, and when to stay patient. For example, some investors expect strong revenue growth and margin expansion, leading them to set a Narrative-based price target as high as $227.0, while more cautious users, noting commodity and labor cost pressures, lean towards the lower end at $170.0. Narratives empower you to make more informed investment decisions by always comparing your estimated fair value to the current market price.

Do you think there's more to the story for Texas Roadhouse? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Texas Roadhouse might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TXRH

Texas Roadhouse

Operates casual dining restaurants in the United States and internationally.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success