- United States

- /

- Medical Equipment

- /

- NasdaqCM:BDMD

Undiscovered Gems in the United States Featuring 3 Promising Small Caps

Reviewed by Simply Wall St

Over the last 7 days, the United States market has dropped 2.6%, yet it has risen by an impressive 24% over the past year, with earnings forecasted to grow by 15% annually. In this dynamic environment, identifying promising small-cap stocks that offer strong growth potential and resilience can provide unique opportunities for investors seeking undiscovered gems.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Baird Medical Investment Holdings (NasdaqCM:BDMD)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Baird Medical Investment Holdings Limited, with a market cap of $271.92 million, develops and sells microwave ablation medical devices for minimally invasive tumor treatment in China.

Operations: Baird Medical Investment Holdings generates revenue primarily from the sale of microwave ablation medical devices, amounting to $33.05 million. The company experienced a negligible negative revenue from other medical devices.

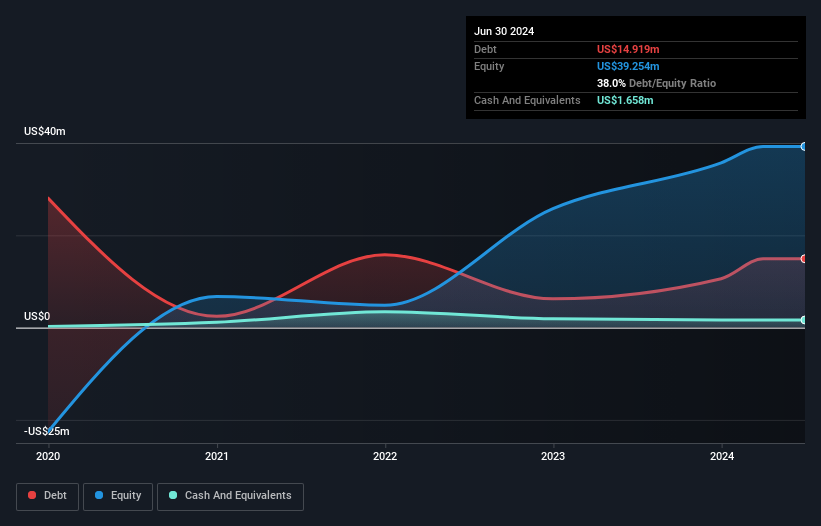

Baird Medical Investment Holdings, a smaller player in the medical equipment sector, has seen its earnings grow at 30.9% annually over the past five years, although recent growth of 8.5% lagged behind industry averages. The company's net debt to equity ratio stands at 33.8%, indicating satisfactory leverage levels with interest payments well covered by EBIT at 31.7 times coverage. Despite substantial shareholder dilution last year and a volatile share price recently, Baird's price-to-earnings ratio of 21.7x suggests it may offer value compared to the industry average of 34.5x, making it an intriguing prospect for investors seeking opportunities in this space.

Target Hospitality (NasdaqCM:TH)

Simply Wall St Value Rating: ★★★★★★

Overview: Target Hospitality Corp. operates as a specialty rental and hospitality services company in North America, with a market capitalization of approximately $956.27 million.

Operations: Target Hospitality generates revenue primarily from its Government segment, contributing $268.45 million, and the Hospitality & Facilities Services - South segment, which adds $149.42 million.

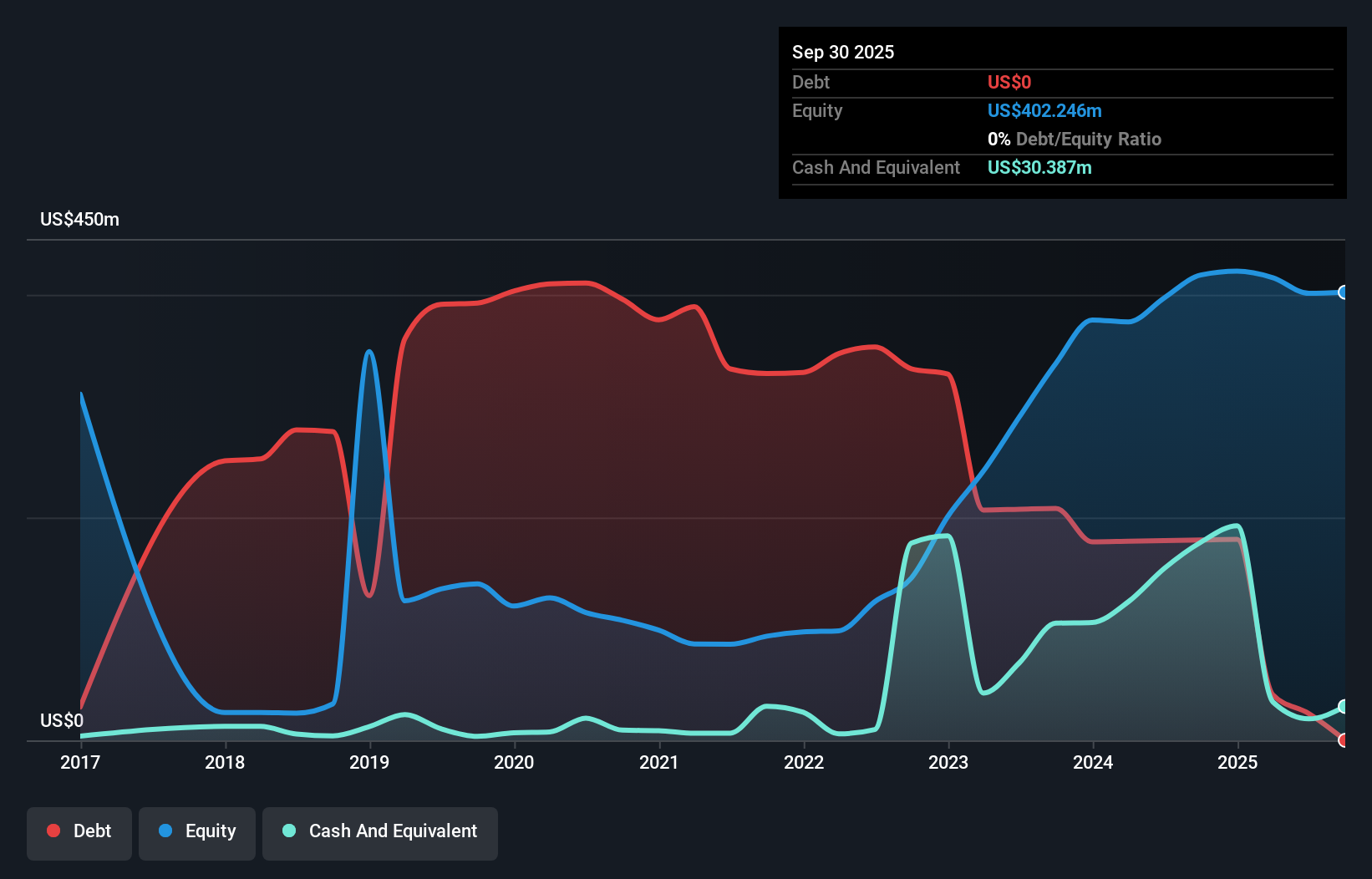

Target Hospitality, a player in the North American specialty rental and hospitality services sector, faces challenges with political uncertainties impacting its government contract-heavy portfolio. Recent earnings reports showed a revenue drop to US$302.58 million for the first nine months of 2024 from US$437.39 million the previous year, with net income falling to US$58.76 million from US$135.86 million. Despite these hurdles, their financial health is bolstered by a satisfactory net debt to equity ratio of 0.5% and strong interest coverage at 7.9 times EBIT, reflecting resilience amidst market fluctuations and strategic growth initiatives in progress.

Northeast Bank (NasdaqGM:NBN)

Simply Wall St Value Rating: ★★★★★★

Overview: Northeast Bank offers a range of banking services to individual and corporate clients in Maine, with a market cap of $752.76 million.

Operations: Northeast Bank generates revenue primarily from its banking segment, amounting to $157.67 million. The bank's financial performance is reflected in its market capitalization of approximately $752.76 million.

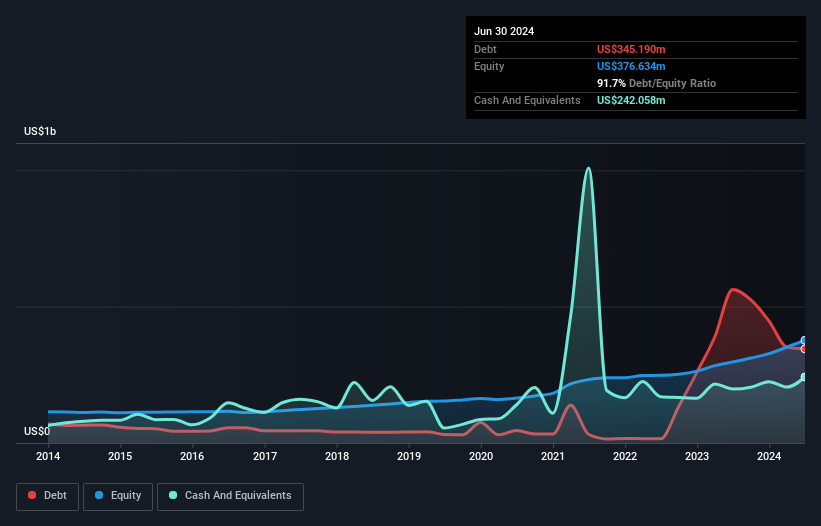

With total assets of US$3.9 billion and equity at US$392.6 million, Northeast Bank showcases a solid financial footing. Its loan portfolio stands at US$3.5 billion against deposits of US$3.1 billion, reflecting robust lending activity with a net interest margin of 5.2%. The bank's allowance for bad loans is well-covered at 117%, indicating prudent risk management, while its earnings grew by 17.8% last year, outpacing industry trends significantly by overcoming an -11.7% industry average growth rate decline in banks' earnings, showcasing its resilience and strategic prowess in the competitive banking landscape.

Seize The Opportunity

- Reveal the 244 hidden gems among our US Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baird Medical Investment Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BDMD

Baird Medical Investment Holdings

Together with its subsidiaries develops and sells microwave ablation medical devices for minimally invasive tumor treatment in China.

Adequate balance sheet with acceptable track record.