- United States

- /

- Hospitality

- /

- NasdaqGS:TCOM

What Trip.com Group (TCOM)'s Strong Q2 Results and $5 Billion Buyback Could Mean for Shareholders

Reviewed by Simply Wall St

- Trip.com Group Limited recently reported second quarter 2025 earnings showing solid year-over-year growth in both revenue and net income, while also announcing a new share repurchase program of up to US$5.0 billion in ordinary shares and/or ADSs.

- The combination of these robust financial results and a substantial new buyback program raises confidence in the company’s ongoing business momentum and management’s outlook on future value.

- We will explore how the introduction of a new US$5.0 billion share repurchase program could influence Trip.com Group’s investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Trip.com Group Investment Narrative Recap

Trip.com Group appeals to investors who believe in the long-term growth of digital travel across Asia-Pacific, driven by rising disposable incomes and mobile-first travel booking. The recently announced US$5.0 billion share repurchase program reflects management’s commitment to shareholder returns, but does not materially alter the near-term catalyst of cross-border travel recovery or alleviate the core risks from intensifying competition and geopolitical tensions affecting international travel demand.

Among recent announcements, Trip.com Group’s latest earnings release stands out most. With revenue and net income both showing solid year-over-year growth in the second quarter of 2025, this performance directly supports the bullish narrative around strong digital travel demand and the group’s operational efficiencies as key drivers of future results.

However, investors should also keep in mind the growing threat of disintermediation from direct hotel and airline booking platforms, as...

Read the full narrative on Trip.com Group (it's free!)

Trip.com Group's narrative projects CN¥83.3 billion revenue and CN¥23.2 billion earnings by 2028. This requires 13.3% yearly revenue growth and a CN¥5.2 billion earnings increase from current earnings of CN¥18.0 billion.

Uncover how Trip.com Group's forecasts yield a $82.62 fair value, a 14% upside to its current price.

Exploring Other Perspectives

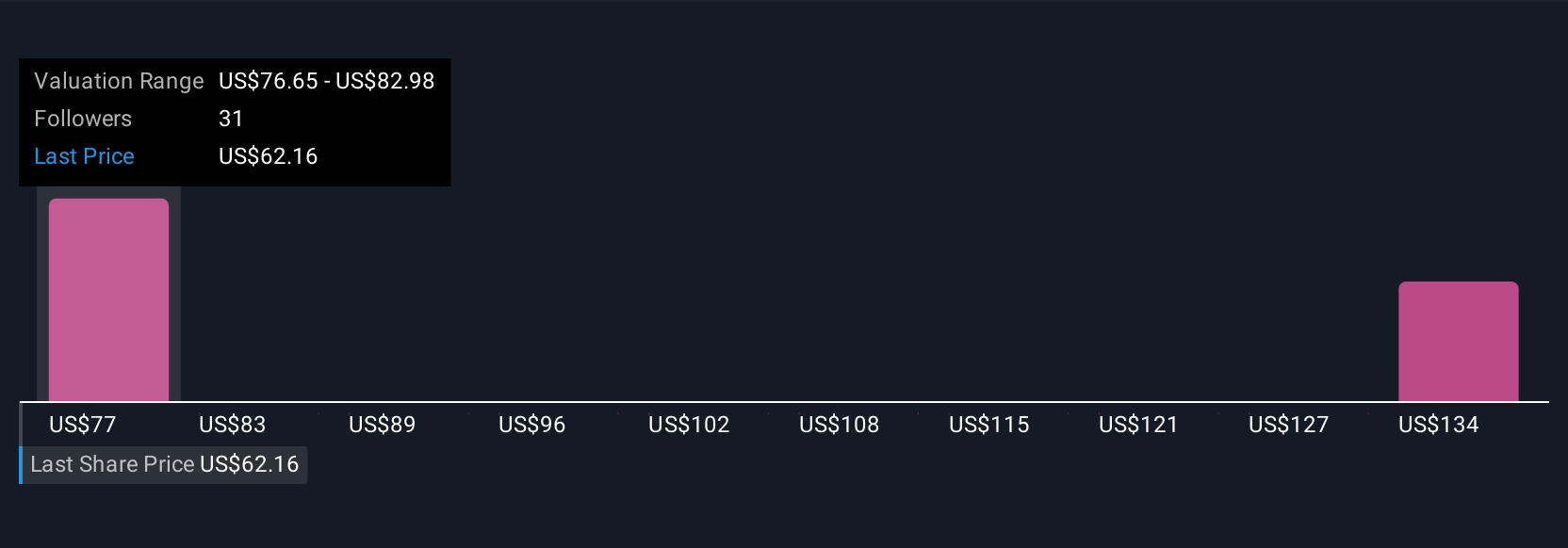

Simply Wall St Community members gave fair value estimates ranging from US$82.62 to US$126.90, reflecting a wide span of individual perspectives. While many see significant upside, the increasing adoption of direct booking tools by hotels and airlines could challenge Trip.com Group’s revenue model and earnings resilience; explore more viewpoints and decide where you stand.

Explore 2 other fair value estimates on Trip.com Group - why the stock might be worth as much as 74% more than the current price!

Build Your Own Trip.com Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Trip.com Group research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Trip.com Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Trip.com Group's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 30 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trip.com Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TCOM

Trip.com Group

Through its subsidiaries, operates as a travel service provider for accommodation reservation, transportation ticketing, packaged tours, in-destination, corporate travel management, and other travel-related services in China and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives