- United States

- /

- Hospitality

- /

- NasdaqGS:SRAD

US Growth Companies With High Insider Ownership August 2024

Reviewed by Simply Wall St

The U.S. stock market has shown significant gains recently, with major indexes rising sharply following favorable inflation data and the anticipation of potential interest rate cuts by the Federal Reserve. Amid this positive backdrop, investors often look for growth companies with high insider ownership, as these stocks can indicate strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.6% |

| PDD Holdings (NasdaqGS:PDD) | 32.1% | 21.8% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 24.1% |

| Hims & Hers Health (NYSE:HIMS) | 13.7% | 40.9% |

| Duolingo (NasdaqGS:DUOL) | 14.9% | 42.5% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 31.3% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.4% | 60.9% |

| Carlyle Group (NasdaqGS:CG) | 29.5% | 22.8% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

| BBB Foods (NYSE:TBBB) | 22.9% | 70.7% |

We're going to check out a few of the best picks from our screener tool.

Pangaea Logistics Solutions (NasdaqCM:PANL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pangaea Logistics Solutions, Ltd. (NasdaqCM:PANL) provides seaborne dry bulk logistics and transportation services to industrial customers globally, with a market cap of $302.99 million.

Operations: Pangaea Logistics Solutions generates $503.74 million from its transportation and shipping services.

Insider Ownership: 26.4%

Revenue Growth Forecast: 10.9% p.a.

Pangaea Logistics Solutions demonstrates strong growth potential with earnings forecasted to grow at 20.8% annually, outpacing the US market's 14.8%. Recent Q2 results showed net income rising to US$3.68 million from US$2.84 million year-over-year, and revenue increasing to US$131.5 million from US$118.08 million. The company trades below its estimated fair value and analysts expect a 58.5% stock price rise, though it has an unstable dividend track record and no recent substantial insider trading activity.

- Navigate through the intricacies of Pangaea Logistics Solutions with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, Pangaea Logistics Solutions' share price might be too pessimistic.

LGI Homes (NasdaqGS:LGIH)

Simply Wall St Growth Rating: ★★★★★☆

Overview: LGI Homes, Inc. designs, constructs, and sells homes with a market cap of approximately $2.33 billion.

Operations: The company generates $2.22 billion from its homebuilding business segment.

Insider Ownership: 12.2%

Revenue Growth Forecast: 21.6% p.a.

LGI Homes exhibits robust growth potential with earnings expected to grow 20.8% annually, surpassing the US market's 14.8%. The company’s revenue is forecasted to increase by 21.6% per year, outpacing the broader market. LGI Homes recently reported Q2 net income of US$58.57 million, up from US$53.13 million a year ago, and has been actively repurchasing shares under its buyback program, enhancing shareholder value while maintaining a lower-than-market P/E ratio of 11.9x.

- Get an in-depth perspective on LGI Homes' performance by reading our analyst estimates report here.

- Our valuation report here indicates LGI Homes may be overvalued.

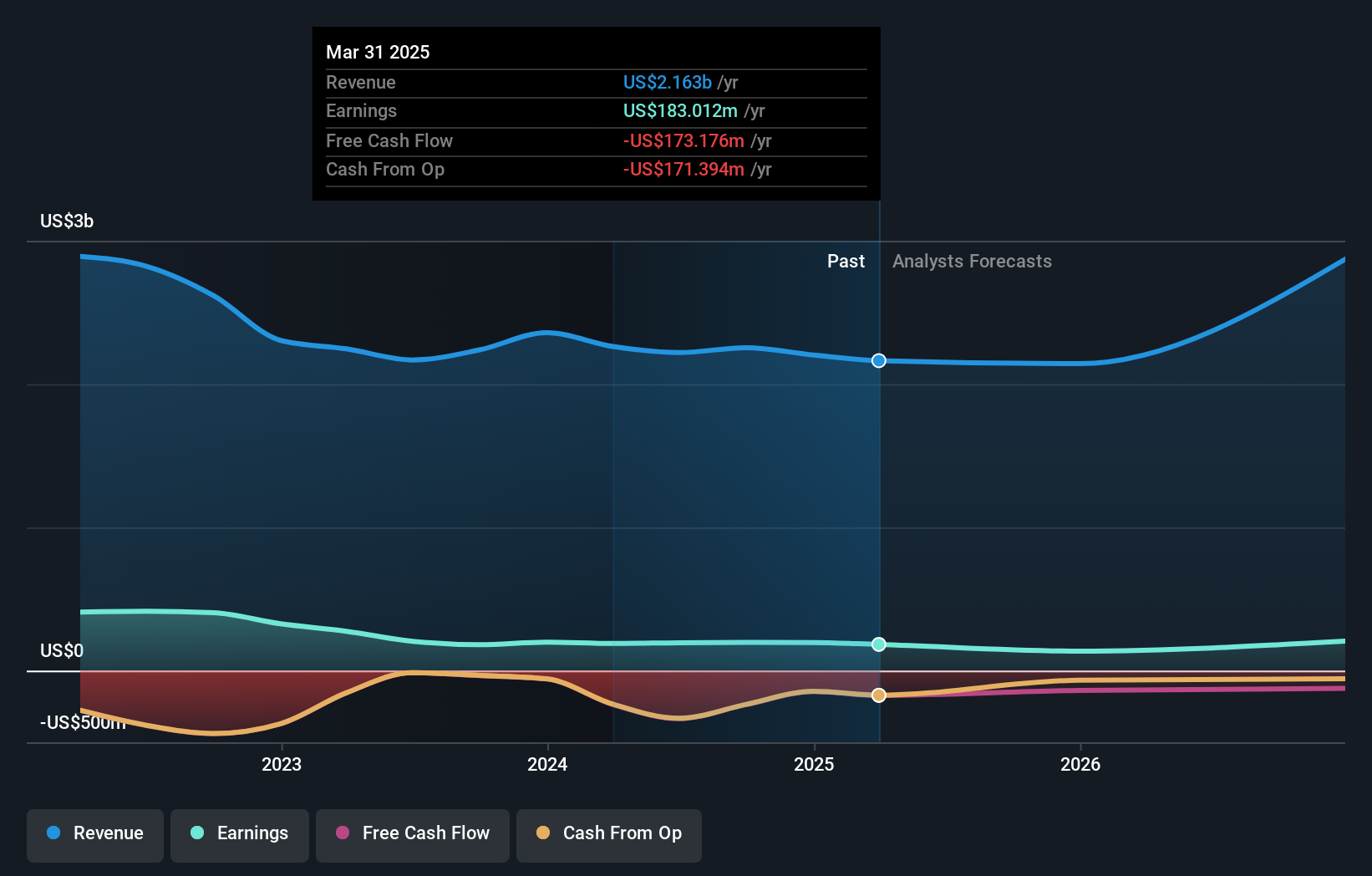

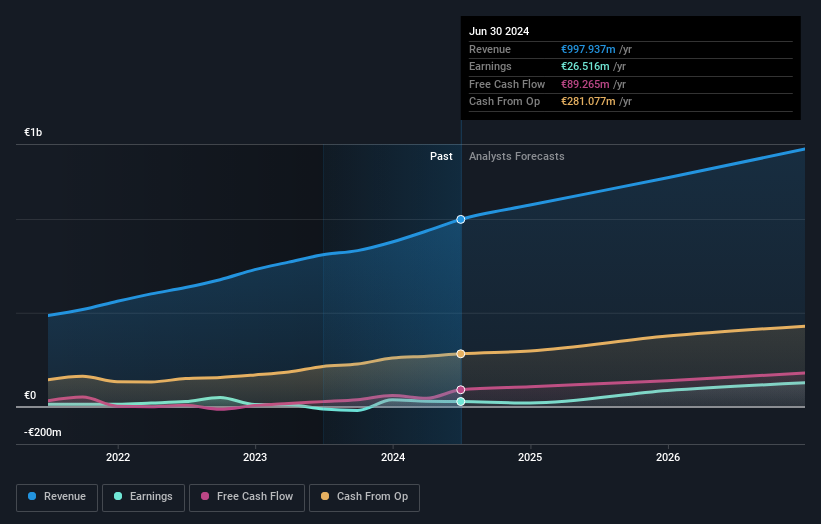

Sportradar Group (NasdaqGS:SRAD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sportradar Group AG, with a market cap of $3.32 billion, provides sports data services for the sports betting and media industries across various regions including the United Kingdom, the United States, Malta, Switzerland, and internationally.

Operations: Sportradar Group AG generates revenue through its sports data services for the sports betting and media industries across multiple regions, including the United Kingdom, the United States, Malta, Switzerland, and internationally.

Insider Ownership: 31.9%

Revenue Growth Forecast: 12.3% p.a.

Sportradar Group is poised for significant earnings growth, forecasted at 34.5% annually, outpacing the US market's 14.8%. Despite a recent net loss of EUR 1.45 million in Q2 2024, revenue grew to EUR 278.42 million from EUR 216.43 million year-over-year. The company trades at a substantial discount to its estimated fair value and insiders maintain high ownership levels, indicating confidence in its long-term prospects despite short-term financial setbacks.

- Take a closer look at Sportradar Group's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, Sportradar Group's share price might be too optimistic.

Key Takeaways

- Access the full spectrum of 174 Fast Growing US Companies With High Insider Ownership by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SRAD

Sportradar Group

Provides sports data services for the sports betting and media industries in the United Kingdom, the United States, Malta, Switzerland, and internationally.

Reasonable growth potential with proven track record.