- United States

- /

- Hospitality

- /

- NasdaqGS:SRAD

Three US Growth Companies With Insider Ownership As High As 31%

Reviewed by Simply Wall St

As the Dow Jones Industrial Average approaches a record closing high, reflecting robust investor confidence amid a vibrant U.S. stock market, it's an opportune time to consider the potential benefits of growth companies with significant insider ownership. High insider ownership often aligns management’s interests with those of shareholders, particularly in a buoyant market environment where strategic decisions can significantly impact company performance and investor returns.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.3% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 22.1% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 12% | 31.4% |

| Duolingo (NasdaqGS:DUOL) | 15% | 48.1% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.7% | 60.9% |

| Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

| BBB Foods (NYSE:TBBB) | 22.9% | 94.7% |

Let's explore several standout options from the results in the screener.

CarGurus (NasdaqGS:CARG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CarGurus, Inc. operates an online automotive marketplace facilitating the buying and selling of vehicles, both in the United States and internationally, with a market capitalization of approximately $2.64 billion.

Operations: The company generates revenue primarily through two segments: the U.S. Marketplace, which brought in $664.65 million, and Digital Wholesale, contributing $179.75 million.

Insider Ownership: 16.7%

CarGurus is poised for robust growth with earnings expected to increase significantly, outpacing the US market's average. However, despite high insider ownership, recent months have seen more insider selling than buying, suggesting mixed confidence from those closest to the company. Additionally, CarGurus' profit margins have declined from the previous year. Recent shareholder approvals and active participation in industry conferences highlight strategic initiatives aimed at bolstering its market stance amidst these challenges.

- Click here to discover the nuances of CarGurus with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that CarGurus is trading beyond its estimated value.

Sportradar Group (NasdaqGS:SRAD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sportradar Group AG operates globally, offering sports data services to the sports betting and media industries, with a market capitalization of approximately $3.43 billion.

Operations: Sportradar Group AG generates its revenue by providing sports data services internationally, primarily to the sports betting and media sectors.

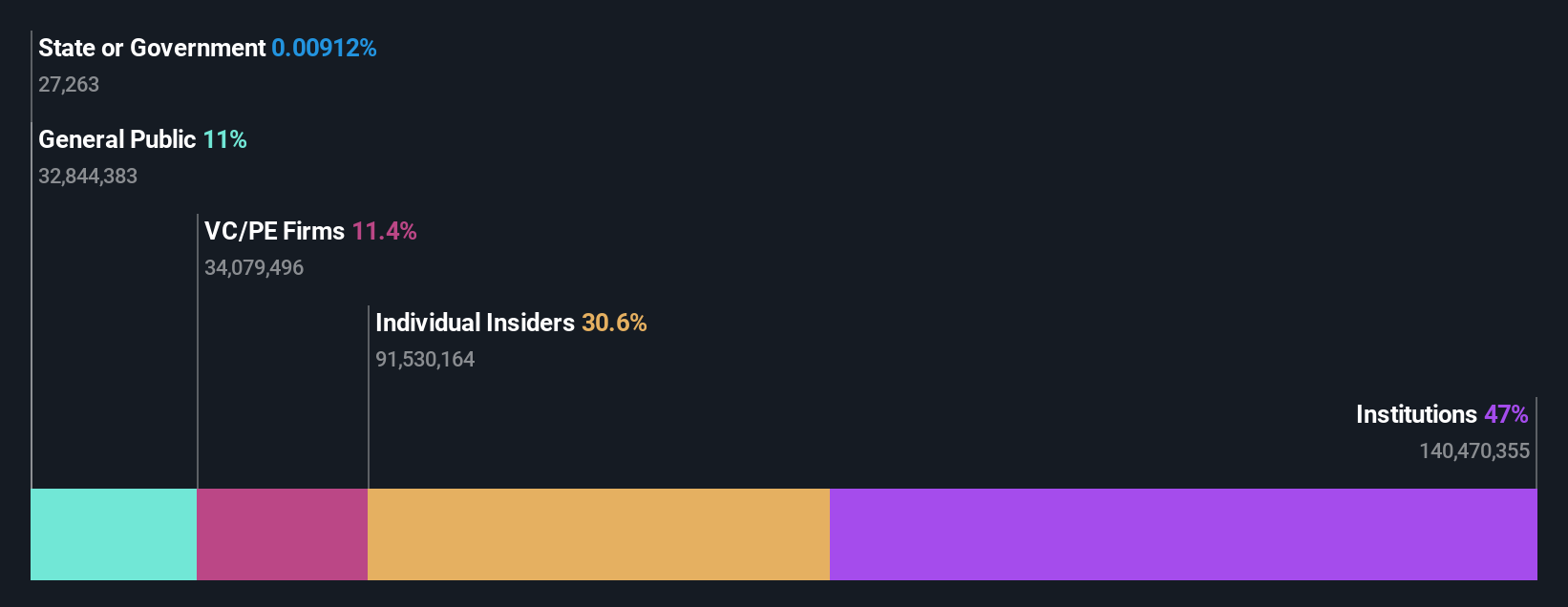

Insider Ownership: 31.9%

Sportradar Group, a data and content provider for the sports betting industry, reported a shift from net income to a net loss in Q1 2024 despite increasing sales significantly. The company's earnings are expected to grow faster than the US market average, with substantial revenue growth forecasted. Recent strategic hires and technological enhancements underline its commitment to innovation and market expansion. However, its return on equity is projected to remain low, reflecting potential challenges in achieving profitable growth.

- Take a closer look at Sportradar Group's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Sportradar Group is priced higher than what may be justified by its financials.

Contango Ore (NYSEAM:CTGO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Contango Ore, Inc. is an exploration stage company focused on the exploration and development of mineral properties in Alaska, United States, with a market capitalization of approximately $262.36 million.

Operations: The company is primarily involved in mineral exploration and development activities in Alaska.

Insider Ownership: 30.9%

Contango Ore, a growth-focused mining company with significant insider ownership, recently celebrated the first gold pour at its Manh Choh mine, marking a major operational milestone. This achievement follows strategic expansions and leadership enhancements, including the acquisition of HighGold Mining and the appointment of its CEO to Contango's board. Despite facing a substantial net loss in Q1 2024 and shareholder dilution over the past year, Contango is anticipated to reach profitability within three years, supported by an impressive forecasted annual revenue growth rate of 92.6%. The company’s stock is currently trading well below its estimated fair value, suggesting potential for appreciation as it progresses towards profitability and stabilizes operations.

- Dive into the specifics of Contango Ore here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, Contango Ore's share price might be too pessimistic.

Make It Happen

- Reveal the 181 hidden gems among our Fast Growing US Companies With High Insider Ownership screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SRAD

Sportradar Group

Provides sports data services for the sports betting and media industries in the United Kingdom, the United States, Malta, Switzerland, and internationally.

Reasonable growth potential with acceptable track record.