- United States

- /

- Software

- /

- NasdaqCM:WULF

TeraWulf Inc. (NASDAQ:WULF) Stocks Shoot Up 37% But Its P/S Still Looks Reasonable

Despite an already strong run, TeraWulf Inc. (NASDAQ:WULF) shares have been powering on, with a gain of 37% in the last thirty days. The last 30 days were the cherry on top of the stock's 577% gain in the last year, which is nothing short of spectacular.

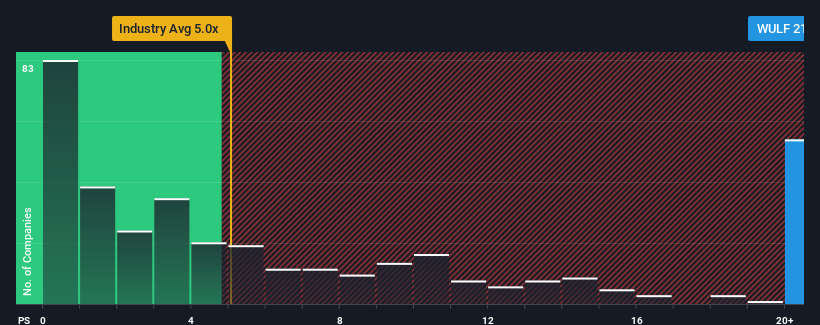

Following the firm bounce in price, TeraWulf's price-to-sales (or "P/S") ratio of 21.6x might make it look like a strong sell right now compared to other companies in the Software industry in the United States, where around half of the companies have P/S ratios below 5x and even P/S below 1.9x are quite common. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for TeraWulf

What Does TeraWulf's Recent Performance Look Like?

Recent times have been advantageous for TeraWulf as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on TeraWulf will help you uncover what's on the horizon.How Is TeraWulf's Revenue Growth Trending?

In order to justify its P/S ratio, TeraWulf would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an exceptional 131% gain to the company's top line. Although, its longer-term performance hasn't been as strong with three-year revenue growth being relatively non-existent overall. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next year should generate growth of 91% as estimated by the eight analysts watching the company. With the industry only predicted to deliver 26%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that TeraWulf's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does TeraWulf's P/S Mean For Investors?

Shares in TeraWulf have seen a strong upwards swing lately, which has really helped boost its P/S figure. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of TeraWulf's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with TeraWulf (at least 2 which don't sit too well with us), and understanding these should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if TeraWulf might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:WULF

TeraWulf

Operates as a digital asset technology company in the United States.

High growth potential with low risk.

Similar Companies

Market Insights

Community Narratives