- United States

- /

- Hospitality

- /

- NasdaqGS:SBUX

What Recent Union Negotiation News Means for Starbucks Shares in 2025

Reviewed by Bailey Pemberton

Thinking about what to do with Starbucks stock right now? You are not alone. With the shares recently closing at $85.36 and bouncing back 8.8% in the last week, momentum is starting to pick up after a challenging year. Over the past 12 months, the stock is still down 9.6%, but those paying close attention have seen hints of renewed optimism brewing just beneath the surface.

Let us be real, Starbucks has been through its fair share of headlines. Recent news included investor pressure to restart union negotiations, high-level executive shakeups with the CTO stepping down, and the CEO’s ambitious quest to deliver both unique drinks and fast service. Some news stirred worries, while other updates, such as a record-breaking week spurred by fall product launches, have injected fresh excitement into the mix. All of these factors are likely contributing to how the market is currently pricing risk and potential reward.

So, is Starbucks a buy at these levels? Our valuation score comes in at 1 out of 6, meaning Starbucks is only undervalued in 1 of the 6 key valuation checks we use. That score, paired with the stock’s recent price movement, suggests there is a little bit of a tug-of-war between bulls and bears here. If you want a deeper look at what drives the value beyond just headline numbers, stick around. The next section will break down the valuation approaches in detail, and later, we will discuss an even more insightful way to assess Starbucks’ true worth.

Starbucks scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Starbucks Discounted Cash Flow (DCF) Analysis

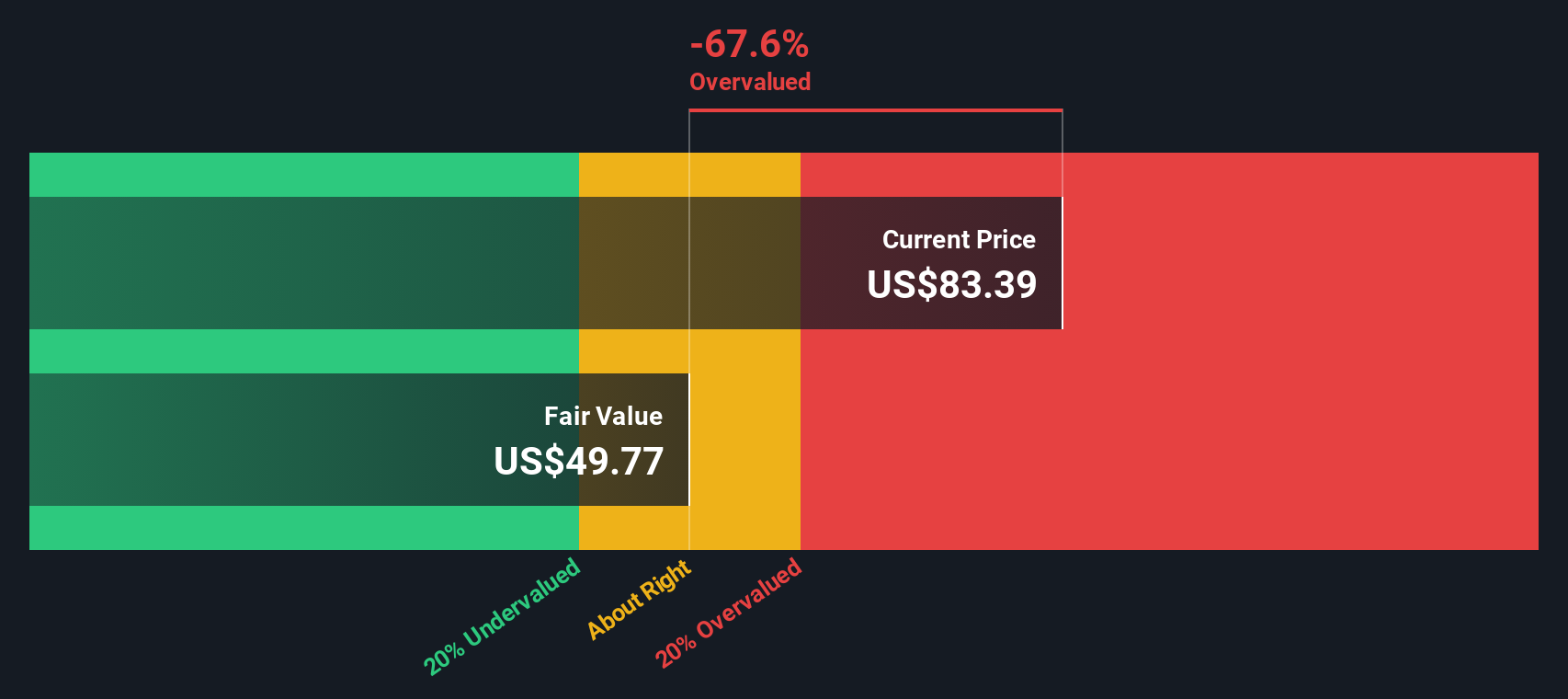

The Discounted Cash Flow (DCF) model estimates what a company is worth by projecting its future cash flows and discounting them back to today’s values. For Starbucks, the model uses recent and projected Free Cash Flow (FCF) to get a sense of the business's real value by factoring in both near-term estimates and long-term growth assumptions.

Currently, Starbucks has annual Free Cash Flow of $2.36 billion. According to analyst estimates, the FCF is expected to steadily increase, reaching approximately $3.65 billion by 2028. Projections going out another couple of years, based on trend extrapolation, suggest FCF could rise as high as $4.68 billion by 2035. For the DCF calculation, Simply Wall St uses both these analyst forecasts and its own long-term growth projections to capture the future potential.

The resulting intrinsic value from this model comes out to $51.31 per share. Compared to Starbucks’ recent closing price of $85.36, this suggests the stock is around 66.3% overvalued if we rely solely on the DCF model’s output. In other words, the market price looks much richer than what cash flow projections currently support.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Starbucks may be overvalued by 66.3%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Starbucks Price vs Earnings

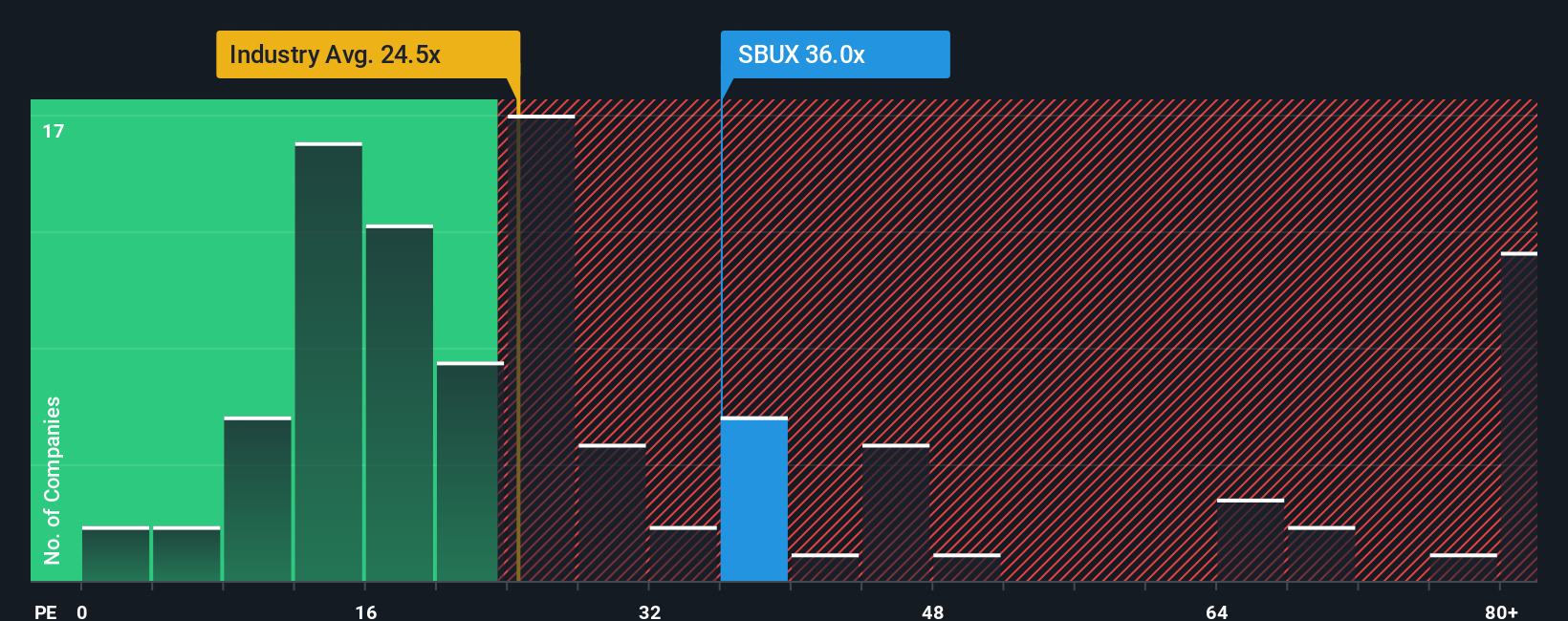

For strong, profit-generating companies like Starbucks, the Price-to-Earnings (PE) ratio is one of the most popular ways investors assess value. It helps show how much the market is willing to pay for each dollar of earnings. Growth expectations, profit stability, and risk all contribute to what investors consider a “fair” PE ratio. Higher growth or lower risk usually means a higher PE is justified, while slower growth or greater uncertainty should command a lower one.

Starbucks currently trades at a PE ratio of 36.9x. That is noticeably higher than both the hospitality industry average of 23.5x and the average of close peers, which sits at 58.7x. At first glance, Starbucks carries a significant premium to the industry. However, its PE is actually well below its direct peer group.

This is where Simply Wall St’s “Fair Ratio” comes in. The Fair Ratio for Starbucks, incorporating factors like company-specific earnings growth, profit margin, risk profile, industry features, and market cap, sits at 34.5x. Unlike a simple comparison to industry or peer benchmarks, this calculation aims to provide a more tailored and holistic view. It offers a more informed check on the stock’s value given Starbucks’ unique situation.

Comparing Starbucks' actual PE of 36.9x to the Fair Ratio of 34.5x suggests the shares are only slightly above what would usually be expected based on fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Starbucks Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, an innovative tool that connects a company’s story, your personal outlook, and detailed financial forecasts into a single, actionable fair value estimate.

A Narrative is more than just numbers; it lets you map out your own investment perspective by blending your assumptions about Starbucks’ future, such as revenue growth, margins, risks, and opportunities, with the real data, then see how your view stacks up against the current price and other investors’ expectations.

This approach is both simple and powerful and is now available to everyone on the Simply Wall St Community page, where millions of investors collaborate and update their Narratives as fresh news, earnings, or market-shifting events come in.

Narratives make it easier than ever to decide when to buy, hold, or sell. You can compare your Fair Value to the latest share price and see exactly which assumptions drive your result.

For example, recent Starbucks Narratives show some bulls see a fair value above $115 per share based on aggressive global expansion and margin improvements, while more cautious investors peg fair value closer to $73 per share, citing ongoing cost and competitive risks.

Do you think there's more to the story for Starbucks? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SBUX

Starbucks

Operates as a roaster, marketer, and retailer of coffee worldwide.

Slight risk second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives