- United States

- /

- Hospitality

- /

- NasdaqGS:SBUX

Starbucks (SBUX): Assessing Valuation After Recent Share Price Dip

Reviewed by Simply Wall St

Starbucks (SBUX) has seen its share price edge lower recently, with a slight dip over the past day and a marginal change this month. Investors are watching how current trends could affect the company’s future value.

See our latest analysis for Starbucks.

Despite some underwhelming price action lately, Starbucks’ share price is down nearly 12% over the past 90 days and has posted a 1-year total shareholder return of -10.5%. Momentum appears to be fading from last year’s highs.

If you’re weighing your next move in an uneven market, this is a timely chance to explore fast growing stocks with high insider ownership.

This recent drop raises a key question for investors: is Starbucks stock currently undervalued compared to its long-term potential, or is the market accurately pricing in all possible future growth?

Most Popular Narrative: 13.4% Undervalued

Starbucks’ most widely followed narrative places its fair value at $97.63 per share, compared to a last close of $84.53. This perspective highlights optimism around major operations upgrades and long-term growth initiatives, setting the stage for debate on the company’s future prospects.

The Back to Starbucks strategy and Green Apron model aim to enhance customer experience and reduce service times. This is designed to increase transactions and potential revenue. Expanding in growth markets and focusing on local execution, particularly in China, is expected to boost global revenue and mitigate risks.

What is driving this optimistic valuation? The path to Starbucks’ fair value relies on transformative plans, with ambitious targets for margin expansion and profit growth. Want to see which assumptions underpin these numbers? Discover the powerful projections and global strategies that support this bullish price target.

Result: Fair Value of $97.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent U.S. store traffic challenges and fierce competition in China could threaten Starbucks’ turnaround story and test the confidence behind current valuations.

Find out about the key risks to this Starbucks narrative.

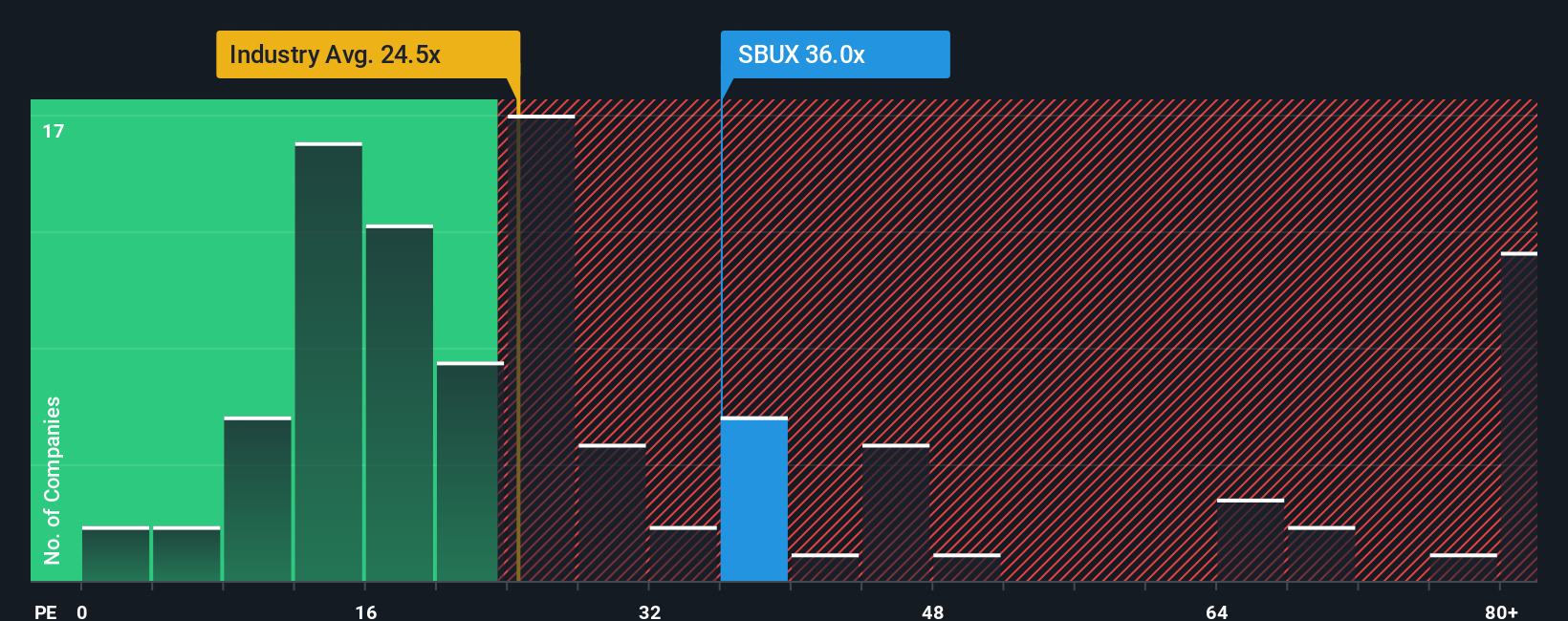

Another View: Earnings Ratio Signals Caution

Looking at Starbucks through the lens of its earnings ratio, a different picture emerges. The company’s price-to-earnings ratio stands at 36.5x, noticeably higher than both the US Hospitality industry average of 23.8x and the market’s fair ratio of 34.6x. This suggests the stock may be trading at a premium rather than a discount, raising questions about valuation risk if growth does not accelerate.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Starbucks Narrative

If you see things differently or have unique insights, you can quickly build your own view of Starbucks’ story and projections in just a few minutes. Do it your way

A great starting point for your Starbucks research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Seize the opportunity to uncover unique investment angles, spot undervalued stocks, and tap into emerging sectors that could set your portfolio apart this year.

- Power up your returns by checking out these 17 dividend stocks with yields > 3%, offering attractive yields above 3% for steady income.

- Tap into tomorrow’s breakthroughs by reviewing these 24 AI penny stocks, at the forefront of artificial intelligence innovation.

- Explore fresh opportunities with these 3596 penny stocks with strong financials, which boast strong financials and growth potential flying under the radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SBUX

Starbucks

Operates as a roaster, marketer, and retailer of coffee worldwide.

Slight risk second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives